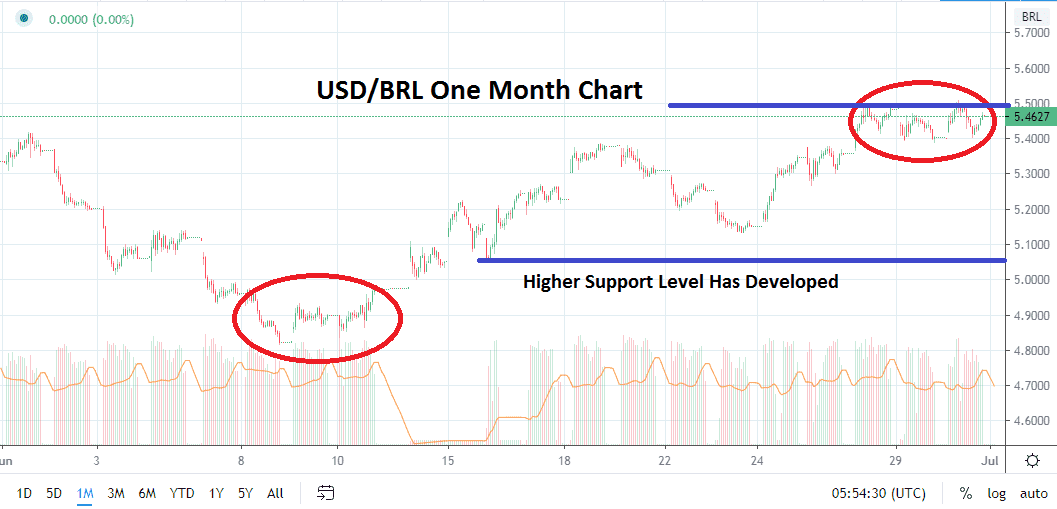

After achieving a flurry of added value from mid-May until the first week of June concluded, the Brazilian Real has reversed and begun to lose ground to the US Dollar. The past three weeks of trading has seen the USD/BRL consistently vanquish short term resistance levels and the current price level near the 5.4600 juncture has not created a flash of selling.

Speculators who believe the Brazilian Real will suddenly achieve better values and the USD/BRL will see increased selling may have room to position themselves too and test ranges. However, the higher support levels for the Brazilian Real which have developed the past two weeks may signify to speculators USD/BRL may continue to find a surge of interested buyers.

The past two weeks of trading for the USD/BRL has seen a rather tight range of 5.1000 to 5.5000 emerge, but the past five days of action have seen the Brazilian Real begin to bang up against resistance on a consistent basis. Current resistance of 5.5000 is an inflection point and traders will see the last time the USD/BRL traded at this level was in late May. If the 5.5000 juncture is broken upwards, the Brazilian Real may face a sudden burst of volatility with a target in mind of 5.5300.

The Brazilian government continues to face criticism from world health organizations that not enough has been done to contain the coronavirus pandemic in the nation. Infection and death statistics from Brazil are certainly creating a negative impact on sentiment for the Brazilian Real. While the government has managed to keep its economy open in many respects, the underlying fear grows that the impact from the pandemic will create hardships economically for businesses that rely on domestic consumption, and international commerce will suffer too.

Trading sentiment generated globally certainly will affect underlying movement for the USD/BRL and while criticism of the Brazil government is strong, it should also be noted that if risk appetite remains active and hungry the Brazilian Real will have the opportunity to reverse from its current trend. Speculators who sell the USD/BRL may believe the current resistance levels will provide a strong amount of reversal potential for the Brazilian Real. Technical traders who look at three month chart may believe resistance at the 5.5200 level could be a dynamic. However, for the 5.5200 level to be tested it means the 5.5000 resistance mark will have to collapse first. Choppy trading for the USD/BRL may be common in July and traders need to see if the higher support levels between 5.1000 and 5.2000 can hold.

The trading range for the Brazilian Real will prove opportunistic for speculators in July. The current range between 5.1000 and 5.5500 appears to be vulnerable in many respects. Resistance is certainly being tested under present market conditions, but June also saw plenty of trading for the USD/BRL which tested support levels. However, the USD/BRL has shown a bullish trend for the US Dollar since the 10th of June and it might prove unwise to step in front of the buying surge until the Brazilian Real can display signs of a true reversal for a duration that lasts a few days, this before attempting to become a seller under present market conditions.

Brazilian Real Outlook for July:

Speculative price range for USD/BRL is 5.000 to 5.6000

Support at 5.2000 is important and if broken the USD/BRL may test additional support at 5.000

Resistance at 5.5200 is important, if broken a move to 5.6000 may occur