The Brazilian Real continues to be very choppy and noisy against the US dollar as we try to figure out what the situation is in Latin America. We already know that the coronavirus has decimated various parts of Latin America and seems to be running around with absolutely nothing stopping it from getting worse. The favelas in places like Rio de Janeiro and São Paulo have been hit hard, and the sanitary conditions in those areas are like breeding grounds for these diseases.

With that being said, it should not be a big surprise that people are concerned about the Brazilian economy. The US dollar had previously gone straight up in the air against the Real, but the Federal Reserve has stepped in and tried to kill the US dollar through the flooding of the markets. After all, there are going to be major issues in emerging markets due to debt loads that are getting exacerbated and the historically strong US dollar makes that a much more difficult situation as most if those debts are priced in US dollars.

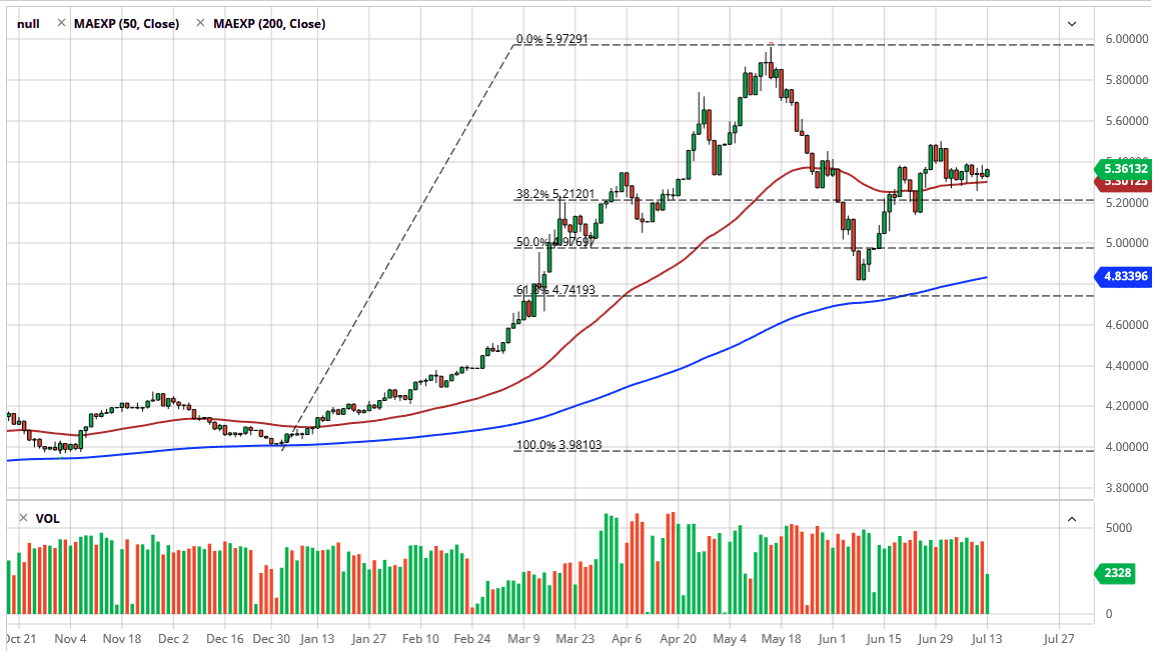

The 50 day EMA sits just below the current trading level, as we dance around trying to build up the necessary momentum to reach towards the 5.5 level again. If we do break down below the 50 day EMA the 5.20 level and then the 5.00 level both should be rather supportive, followed by the 200 day EMA. In other words, it is probably much easier to buy short-term pullbacks in this pair than it is to try to short it, because in order for this pair to break down significantly you would need to see the emerging markets get a bit of a boost through risk appetite. Yes, the Federal Reserve is trying to liquefy the markets but there are so many problems out there right now that demand that traders are cautious about their trading capital, that it is difficult to imagine a scenario where a Latin currency takes off the way that a serious break down here would suggest. We are seeing the same thing in the Mexican peso as well, so both of the biggest Latin American currencies are sending signals of potential weakness against the US dollar going forward. Ultimately, if we can break above the 5.5 level, then we could be looking at a move towards the 6.0 level again.