Paulo Guedes, the Brazilian Minister of the Economy, proposed changes to the tax system. It includes lowering the overall tax rate and granting informal workers up to a 20% reduction on their taxable income, as an incentive to file returns. Under his proposal, the government would deposit the 20% bonus into a bank account, comparable to a savings account. Successful implementation of the tax reforms will boost revenue in Latin America’s largest economy. President Jair Bolsonaro made reforms a key pillar of his election campaign. Bearish pressures in the USD/BRL are expanding following the most recent breakdown.

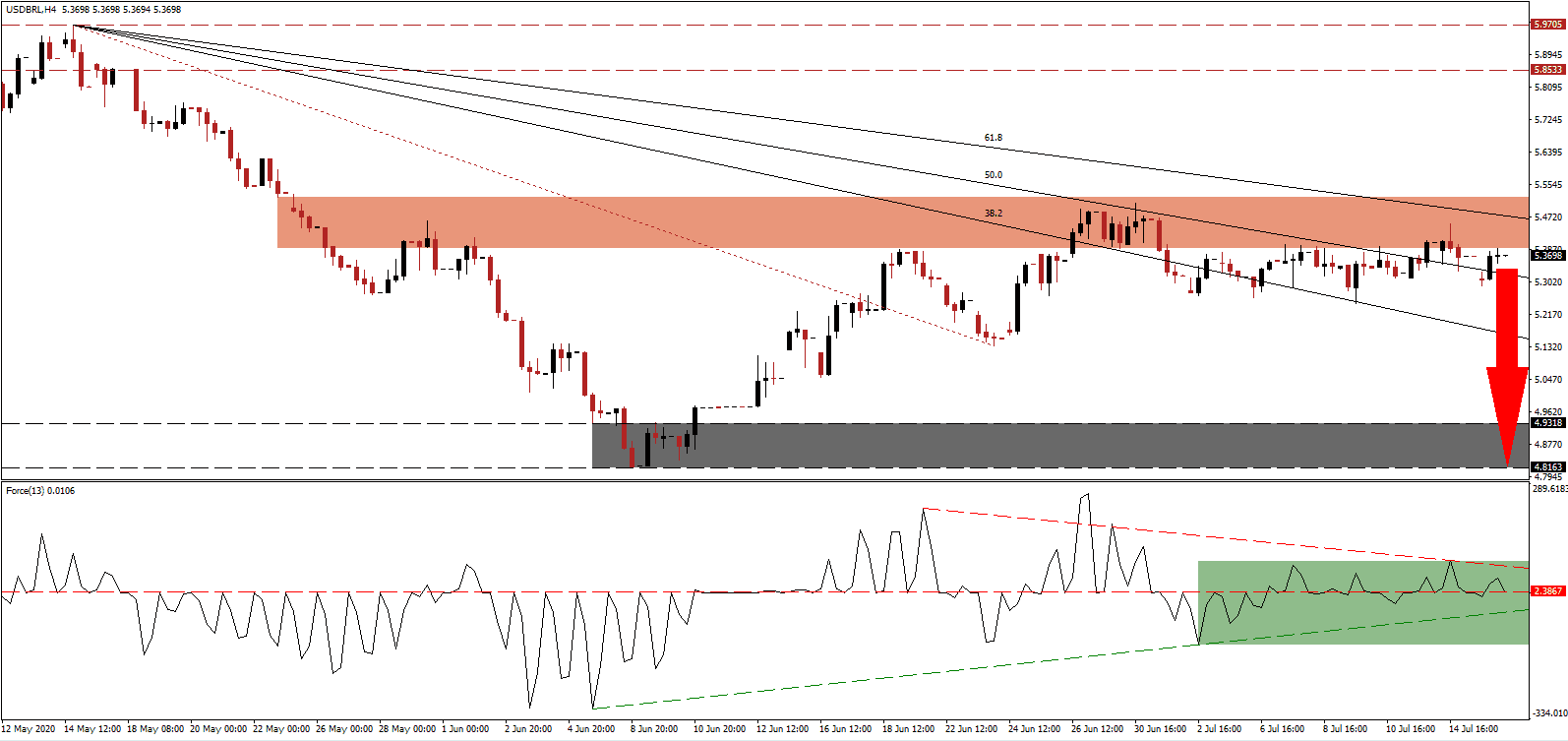

The Force Index, a next-generation technical indicator, was unable to eclipse its descending resistance level, as marked by the green rectangle. It is now in the process of moving below its horizontal resistance level from where an accelerated contraction is anticipated to take it through its ascending support level. Bears wait for this technical indicator to slide below the 0 center-line to regain complete control over the USD/BRL.

Adding a bullish catalyst to this currency pair is the upward revised GDP forecast released by the Banco Central do Brasil. The central bank now expects a 2020 contraction of 6.1%, an improvement over the previously forecast 6.5% plunge. No change was made to the 2021 predictions for a 3.5% GDP expansion. Inflation expectations were marginally increased from 1.63% to 1.72% and remained unchanged at 3.0% for 2020 and 2021, respectively. After the USD/BRL completed a breakdown below its short-term resistance zone located between 5.3900 and 5.5222, as identified by the red rectangle, more downside is likely to emerge.

Brazil continues to benefit from the Chinese demand for agricultural exports. A drought in the south of the country and elevated appetite for soy has caused Brazil, one of the largest producers, to import it from neighboring countries at the fastest pace in four years. Sugar, another major agricultural commodity, is unlikely to follow the same trajectory as soy. The Covid-19 pandemic has created what many refer to a golden opportunity if proper steps are implemented, and the outlook remains cautiously optimistic. A breakdown in the USD/BRL below its descending 50.0 Fibonacci Retracement Fan Support Level is pending. It will clear the path for a sell-off into its support zone located between 4.8163 and 4.9318, as marked by the grey rectangle.

USD/BRL Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 5.3700

Take Profit @ 4.8000

Stop Loss @ 5.4700

Downside Potential: 5,700 pips

Upside Risk: 1,000 pips

Risk/Reward Ratio: 5.70

A breakout in the Force Index above its descending resistance level is likely to pressure the USD/BRL to the upside, temporarily. The upside potential is confined to its downward revised resistance zone located between 5.8533 and 5.9705. With the US struggling with an out-of-control pandemic, and government subsidies to the unemployed set to expire in less than two weeks, the US Dollar is under expanding bearish pressures. Forex traders should take advantage of any advance with new net short positions.

USD/BRL Technical Trading Set-Up - Confined Breakout Scenario

Long Entry @ 5.6300

Take Profit @ 5.8700

Stop Loss @ 5.4700

Upside Potential: 2,400 pips

Downside Risk: 1,600 pips

Risk/Reward Ratio: 1.50