The Argentinian economy is expected to decline by a significant amount during 2020. The estimated plunge being presented by various analysts suggests a mind-blowing contraction of close to minus -12% for the calendar year. This number is not a misprint and while the effects of coronavirus can be blamed, the government of the nation needs to be held accountable too. The USD/ARS value continues to produce a one-way trend in the wrong direction for the citizens of Argentina.

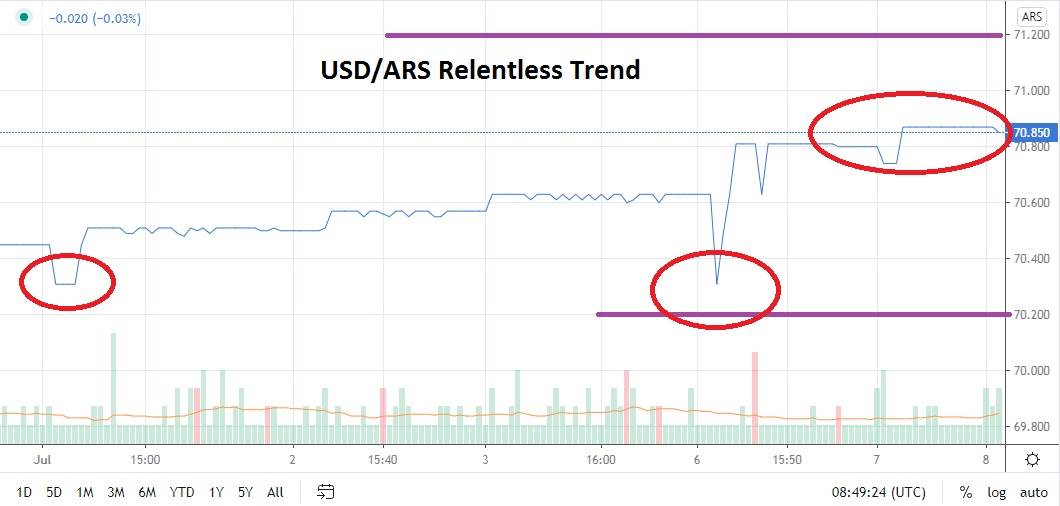

The official value of the USD/ARS currency pair is near 70.850, but this exchange rate is essentially an illusion. The black market (or blue market as it is referred to in Argentina by many) is far above this artificial number decreed by the government. Traders who are buying the USD/ARS on trading platforms need to abide by the official numbers mandated by Argentina. Traders also should keep in mind price fluctuations are rampant because there is little transparency and volume is often less than full.

So what do you do if you are a speculator of the USD/ARS and believe the actual value of the forex pair will continue to pursue its bullish trend with rampant buying of the USD against the Argentine Peso? You must practice patience and have the stamina to withstand days in which there appears to be no movement, or worse sudden unexplainable spikes downward that tests support.

The USD/ARS is a currency pair best left to experienced speculators and adventure-seeking traders. The amount of leverage you use within your trading position is crucial, this so a sudden downturn doesn’t wipe your account out with a violent move. Meaning you have to choose your trading amount carefully and be able to also withstand the costs of holding a position overnight. Carrying charges for overnight trading on forex pairs can be a thorn in the side of unsuspecting and new traders. These transaction charges must be considered when you are trading the USD/ARS.

It is not really a question if the Argentine Peso will continue to lose value to the US Dollar; it is a question about timeframes. The Argentine government is not about to arise and declare that it will be light onto nations as a capitalistic free-market economy and inspire a new wave of investment. What Argentina is going to do is to postpone its pain as long as it can. Traders who want to take advantage of the weak Argentine Peso should keep on buying the USD/ARS forex pair, but they need to understand the realities which can cause havoc too in their trading accounts.

Argentine Peso Short Term Outlook:

Current Resistance: 71.000

Current Support: 70.200

High Target: 71.500

Low Target: 70.000