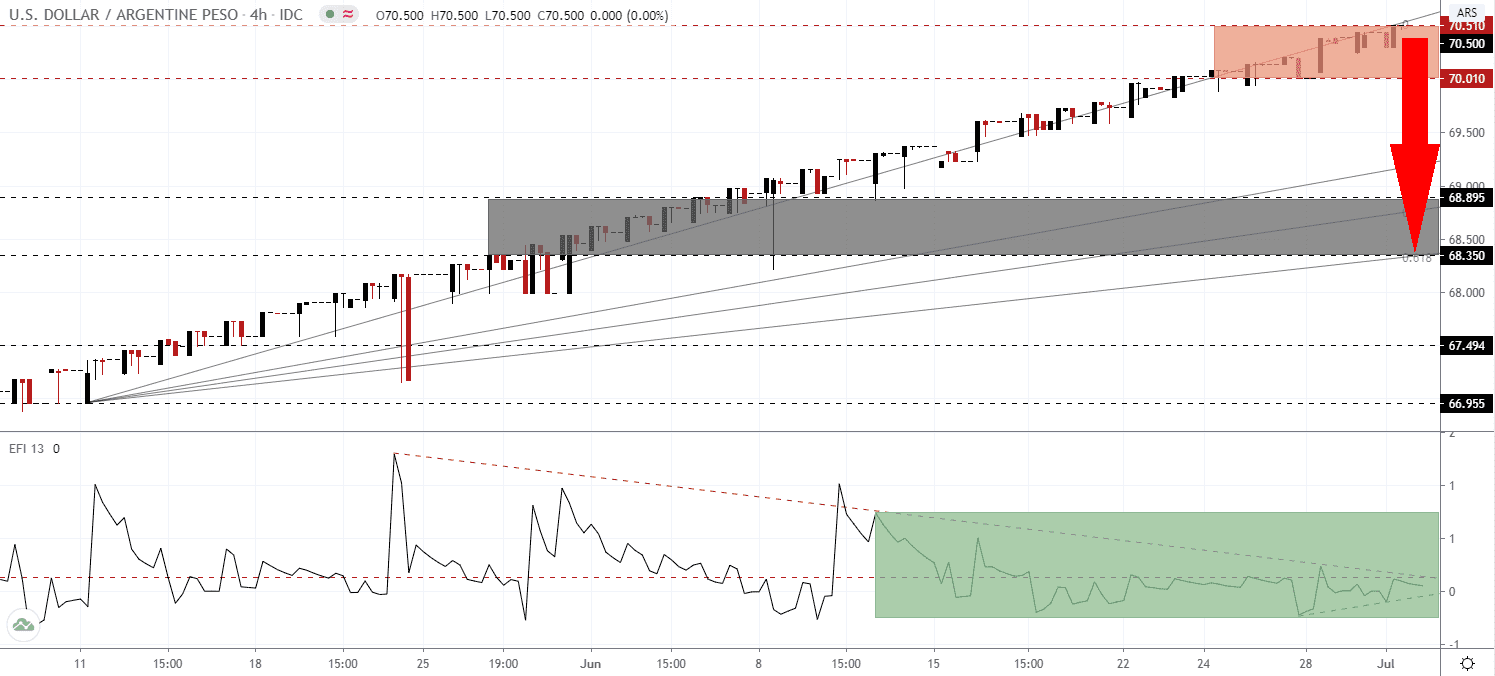

Argentina’s economy collapsed 17.5% in April as compared to March, and 26.4% year-over-year. It represents the steepest contraction since the government’s Instituto Nacional de Estadística y Censos (INDEC) started to publish data in 1993. The economy fared worse than during the 2001 economic crisis, leading to Argentina defaulting on $95 billion in debt. Private companies shed 91,000 jobs in April, the most massive loss since 2003. President Alberto Fernández extended the nationwide lockdown until June 17th. The USD/ARS continued its advance into its resistance zone, enveloping the essential 70.000 psychological resistance level, while debt negotiations are ongoing.

The Force Index, a next-generation technical indicator, flashes an early warning that price action is vulnerable to a reversal. This currency pair drifted higher, but the Force Index created a series of lower highs, resulting in the emergence of a negative divergence. The descending resistance level is expanding downside pressures on the Force Index below its horizontal resistance level, as marked by the green rectangle. A breakdown below its ascending support level is favored to take this technical indicator below the 0 center-line, granting bears full control over the USD/ARS.

President Fernández attempts to settle with debtors, including an expedited interest payment as soon as January and July of 2021. It represents the latest concession from the previous proposal of making a coupon payment in May and November. Argentina seeks to restructure $65 billion worth of foreign debt, after entering its ninth default in May, while the deadline extended for a fifth time to July 24th. With a deal likely, the Argentine Peso is positioned for a profit-taking sell-off. It will follow a breakdown below its resistance zone located between 70.010 and 70.0510, as marked by the red rectangle.

Today’s US initial and continuing jobless claims, together with the June NFP report, release don day earlier due to the July 4th weekend, could deliver a disappointment, sparking a sell-off in the USD/ARS. US economic reports are mixed, but employment components remained universally disappointing. More stress is expected with the Covid-19 pandemic out of control across significant parts of the US. Price action is anticipated to collapse into its short-term support zone located between 68.350 and 68.895, as identified by the grey rectangle, and enforced by its ascending 61.8 Fibonacci Retracement Fan Support Level. A breakdown extension into its next support zone is expected to follow.

USD/ARS Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 70.500

Take Profit @ 68.350

Stop Loss @ 71.200

Downside Potential: 2,150 pips

Upside Risk: 700 pips

Risk/Reward Ratio: 3.07

Should the Force Index move above its descending resistance level, the USD/ARS may attempt a breakout. The next resistance zone awaits price action between 71.920 and 72.625. While Argentina is in the process to restructure its debt, the US is on the verge of adding to the world’s most excessive one. Interest payments exceed $1 trillion annually, poised to increase, while the economy is shrinking. Forex traders are advised to take advantage of any breakout with new short positions.

USD/ARS Technical Trading Set-Up - Breakout Scenario

Long Entry @ 71.600

Take Profit @ 72.600

Stop Loss @ 71.200

Upside Potential: 1,000 pips

Downside Risk: 400 pips

Risk/Reward Ratio: 2.50