The music stays the same from Argentina. Last week it became clear Argentina and its debt creditors had reached an impasse. No agreement was going to be made, so Argentina announced it now has a new deadline to find acceptable repayment terms with financial institutions that have loaned money to the beleaguered nation. You have heard this song before people, and by now you should be accustomed to the rhythm of the melody. Argentina borrows money, shows that it is about to go broke, and then threatens not to repay those who entrusted the country.

Fool me once, shame on you. Fool me twice shame on me. Fool me ten times and both sides show there is something to the equation that many observers do not understand. Argentina has presented potential new amendments to its debt restructuring as an overture to creditors to entice them to agree to a new repayment strategy at an acceptable interest rate.

The deadline now imposed for an agreement is the end of July, but will anyone be satisfied when the calendar hits midnight? The answer is maybe. This because many creditors upon purchasing Argentina debt years ago, probably realized the interest rate would always have to be renegotiated down the road when things went sour economically again in the troubled nation.

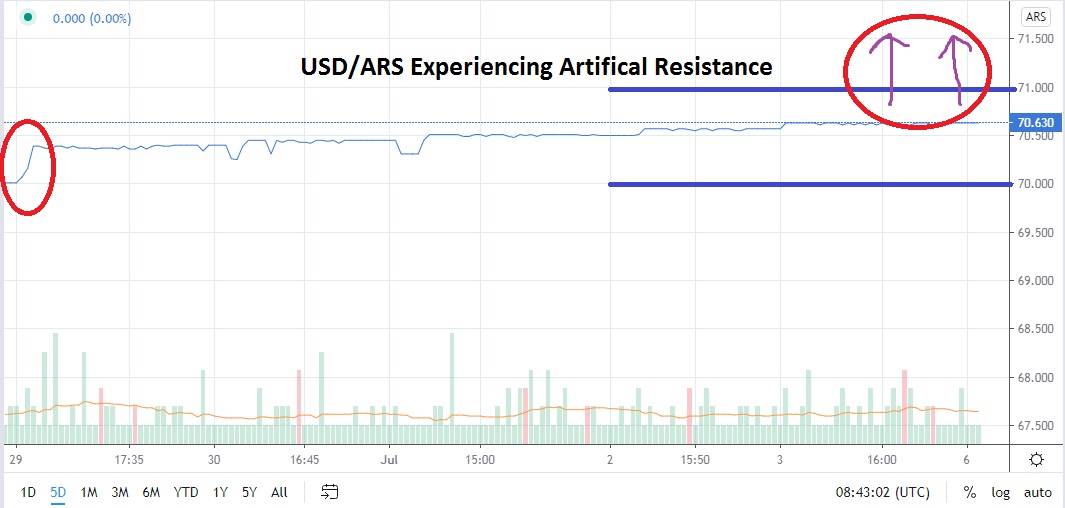

In the meantime, the USD/ARS is trading per the official Argentine government rate within a very worrisome range. If you believe the current exchange rate of the USD/ARS is really matching the 70.000 or 71.000 values on the street where the black market operates and takes US Dollars from Argentine citizens lucky enough to still have some greenbacks stashed away you are not paying attention. The exchange rate on the streets of Buenos Aires is much higher than the ‘printed and official’ values the Argentine government tries to convince its business partners to conduct transactions.

A five-day chart shows a bizarrely flat technical chart in which the USD/ARS appears stable. However, the value from the chart shows support near 71.000 and the potential for resistance as imaginary ‘sketched’ arrows pointing upwards has no reality except on forex trading platforms. Meaning if a speculator wants to dip their toes into the water and buy the USD/ARS because they have no faith in the Argentine government, they may be fighting against an artificial rate which is effectively published and can kill them per the whims of the not so transparent nation with some bizarre downward move which tests support junctures.

Economics in Argentina have become a tragic joke and the Argentina government needs to find a way out of the abyss. An acceptable restructured payment plan regarding money that is owed on bonds would help the Argentina Peso. However, until the music changes, the reality is the USD/ARS remains a buying opportunity.

Argentine Peso Short Term Outlook:

Current Resistance: 71.000

Current Support: 70.200

High Target: 71.500

Low Target: 70.000