South Africa, Africa’s most infected Covid-19 country, received $4.3 billion in emergency financial assistance under the Rapid Financing Instrument of the US-based International Monetary Fund (IMF). The IMF confirmed its GDP outlook for Africa’s most industrialized nation for a contraction of 7.2%. The New Development Bank will extend a $1 billion loan, and the African Development Bank will add another $300 million. South Africa is also negotiating a loan from the World Bank. The new debt pile has pressured the South African Rand lower, allowing the USD/ZAR to enter a breakout sequence.

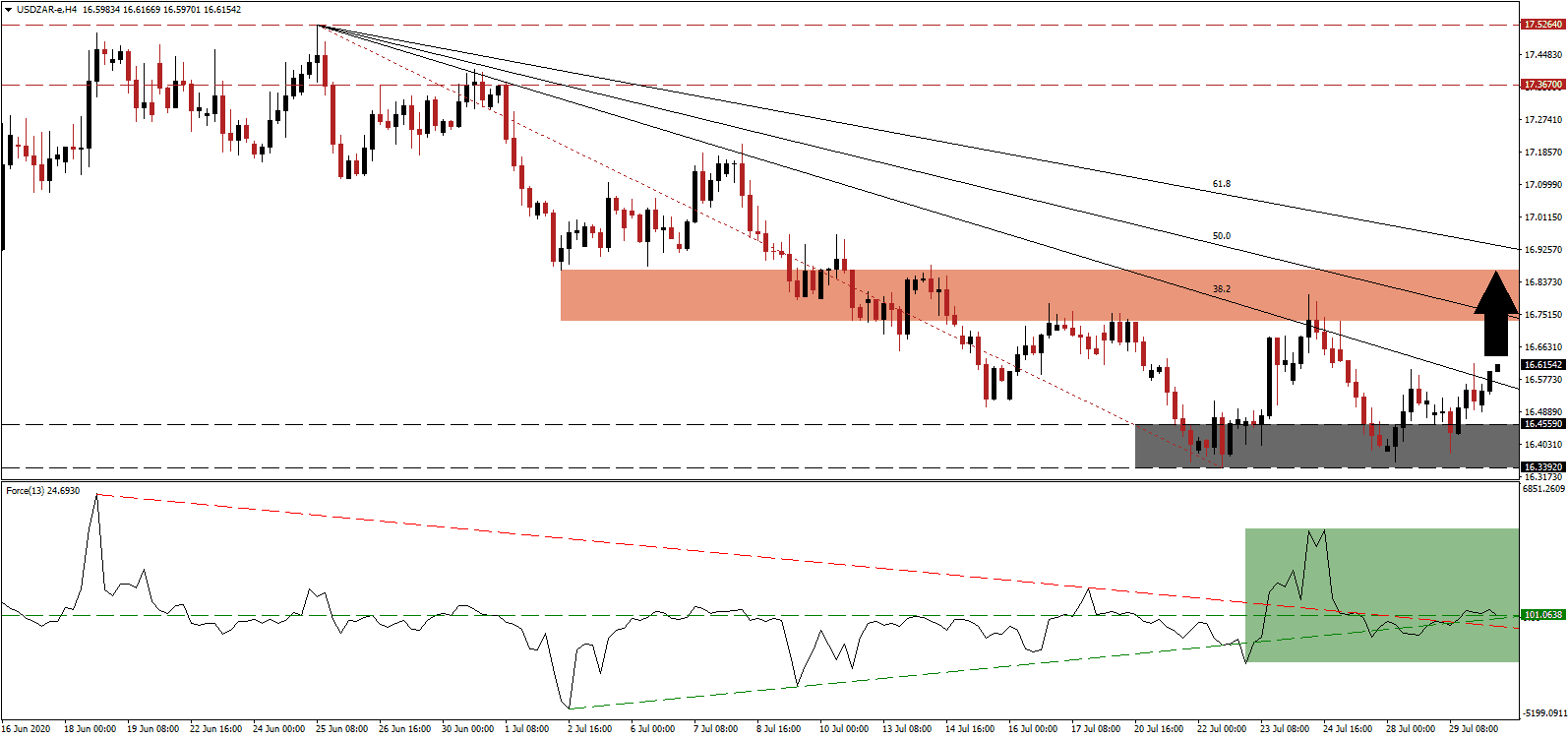

The Force Index, a next-generation technical indicator, confirms short-term bullishness after pushing through its descending resistance level. It was followed by a conversion of its horizontal resistance level into support, as marked by the green rectangle. Adding to upside pressure is the ascending support level, together with the move by this technical indicator above the 0 center-line. Bulls are currently in control of price action in the USD/ZAR.

Global debt, unsustainable before the Covid-19 pandemic, has increased considerably, led by the US. It creates a long-term problem for growth and inflation, which could dwarf the present issues from the virus-related supply chain disruptions and demand destruction. An increase in the South African 2020 budget deficit to 16.0% is forecast, while the debt-to-GDP ratio is expected to reach 78.1% before expanding to 82.4% in 2021. The USD/ZAR accelerated out of its support zone located between 16.3392 and 16.4559, as identified by the grey rectangle, with more temporary upside potential.

Jacques Celliers, the CEO of First National Bank (FNB), one of the Big Five banks in South Africa, warned against a significant cutback in consumer spending. He cautioned that saving into an economic recovery is not a realistic option, and stressed the need to revive domestic trade. The Bureau for Economic Research (BER) added that poor government response to the Covid-19 pandemic harmed economic output. After the USD/ZAR eclipsed its descending 38.2 Fibonacci Retracement Fan Resistance Level, it is clear to extend the advance into its short-term resistance zone located between 16.7315 and 16.8689, as marked by the red rectangle. A resumption of the long-term correction is favored from there, enforced by its 61.8 Fibonacci Retracement Fan Resistance Level.

USD/ZAR Technical Trading Set-Up - Limited Breakout Extension Scenario

- Long Entry @ 16.6200

- Take Profit @ 16.8200

- Stop Loss @ 16.5200

- Upside Potential: 2,000 pips

- Downside Risk: 1,000 pips

- Risk/Reward Ratio: 2.00

In case the Force Index collapses below its descending resistance level, the USD/ZAR is favored to resume its long-term downtrend, partially fueled by expanding bearish pressures in the US Dollar. Congress is debating a fifth stimulus of approximately $1 trillion, less than the $3 trillion Democrats outlined, with an economy in crisis and an out-of-control Covid-19 pandemic. Forex traders should consider any advance as a selling opportunity. The next support zone awaits between 15.4522 and 15.7482.

USD/ZAR Technical Trading Set-Up - Breakdown Resumption Scenario

- Short Entry @ 16.3200

- Take Profit @ 15.4700

- Stop Loss @ 16.5200

- Downside Potential: 9,500 pips

- Upside Risk: 2,000 pips

- Risk/Reward Ratio: 4.75