India continues to report nearly 50,000 new Covid-19 infections daily and remains the most-infected country in Asia. Testing capabilities are relatively limited, suggesting the actual toll is considerably more elevated. Expectations for the GDP for the first quarter of the 2022 fiscal year (April through June) and the second quarter (July through September) call for a contraction due to the nationwide lockdown followed by a more localized one. Economists continue to predict a V-shaped recovery in the following two quarters but a full-year contraction. The USD/INR ended its minor counter-trend advance following the rejection by its short-term resistance zone.

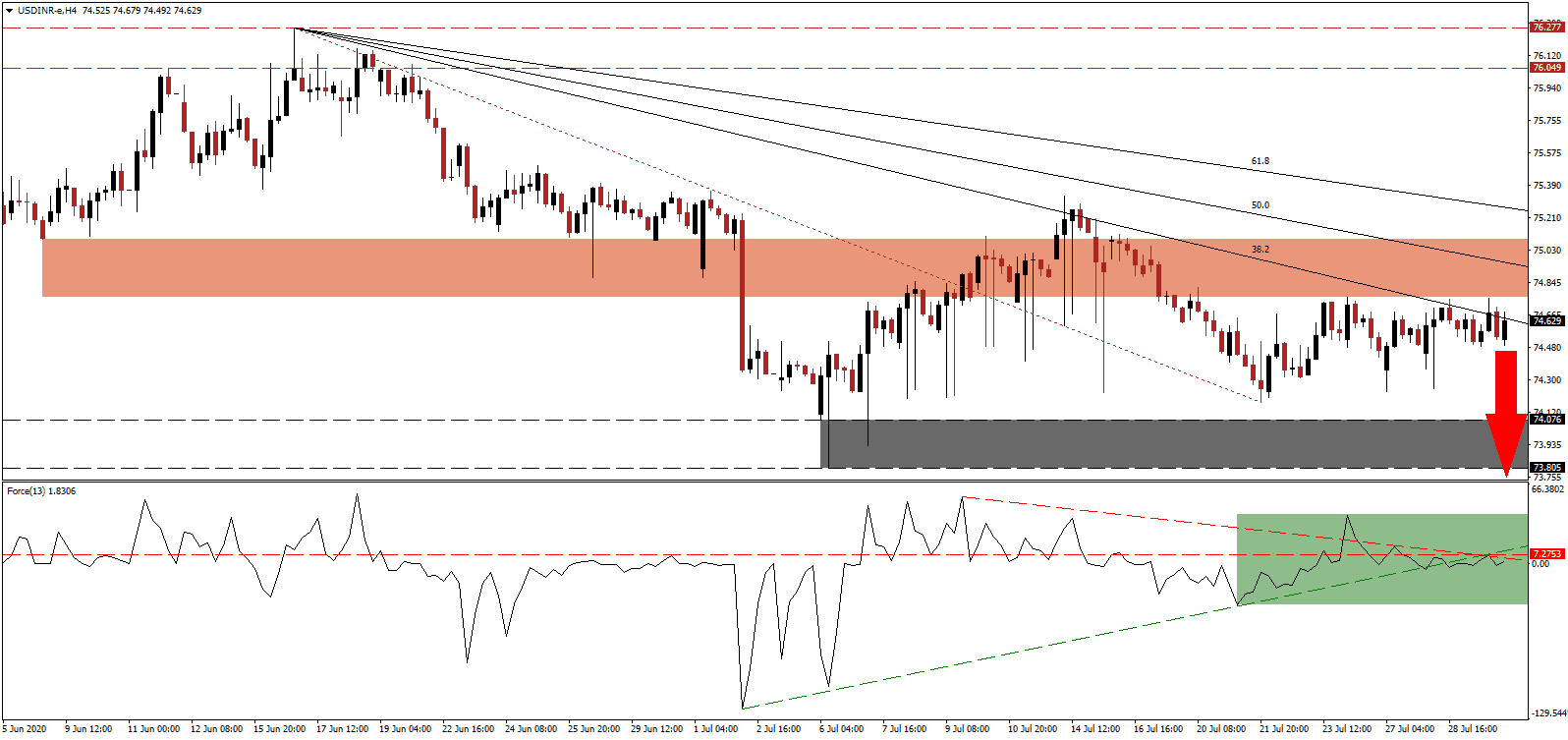

The Force Index, a next-generation technical indicator, remains below its horizontal resistance level with an expansion in bearish momentum after the breakdown below its ascending support level. Adding to downside pressure is the descending resistance level, as marked by the green rectangle. Bears now wait for this technical indicator to slide below the 0 center-line to regain complete control over the USD/INR.

Prime Minister Narendra Modi tried to reassure Chief Ministers of various states that the economic fundamentals are strong, and urged them not to worry. He also attempts to lure foreign investors, which is likely to require a complete overhaul of the registration process. The government’s Invest India division identified 767 pre-operation licenses from 35 ministries before operating a business. After the short-term resistance zone located between 74.763 and 75.088, as marked by the rectangle, breakdown pressures in the USD/INR have increased, partially driven by ongoing US Dollar weakness.

Jerome Powell, the Chairman of the US Federal Reserve, confirmed that the US economy is operating well-below pre-Covid-19 levels. The central bank left interest rates unchanged, which was expected by market participants, and no change is forecast until at least the end of 2022. According to the median Fed estimates, 2020 GDP will plunge by 6.5%, followed by a 5.5% recovery in 2021. The descending Fibonacci Retracement Fan sequence is favored to pressure the USD/INR into its support zone located between 73.805 and 74.076, as identified by the grey rectangle. More downside is likely to lead price action into its next support zone between 72.433 and 73.214.

USD/INR Technical Trading Set-Up - Breakdown Extension Scenario

- Short Entry @ 74.625

- Take Profit @ 73.225

- Stop Loss @ 74.925

- Downside Potential: 14,000 pips

- Upside Risk: 3,000 pips

- Risk/Reward Ratio: 4.67

Should the Force Index reclaim its ascending support level, serving as resistance, the USD/INR may temporarily push higher. With the US government subsidy to the unemployed facing a reduction from $600 to $200 weekly and the Covid-19 pandemic out of control, Forex traders are advised to sell any rallies. The upside potential is limited to its 61.8 Fibonacci Retracement Fan Resistance Level.

USD/INR Technical Trading Set-Up - Limited Breakout Scenario

- Long Entry @ 75.025

- Take Profit @ 75.225

- Stop Loss @ 74.925

- Upside Potential: 2,000 pips

- Downside Risk: 1,000 pips

- Risk/Reward Ratio: 2.00