The US Dollar Went back and forth during the trading session on Friday, initially breaking to the upside towards the 97 level before pulling back again. Because of this, it shows that we have a lot of indecision when it comes to the greenback, and that is not a huge surprise considering everything going on.

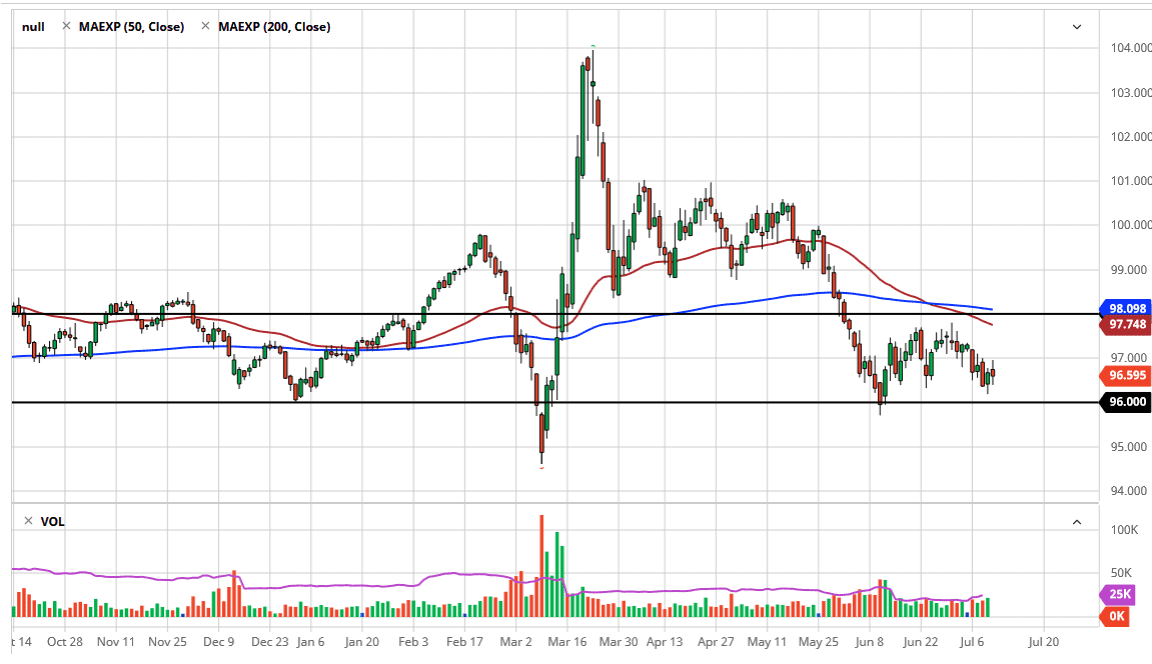

On one end of the spectrum, you have the Federal Reserve out there pumping as much liquidity into the market is possible, and that weighs upon the value of the US dollar. However, there are a lot of US-denominated debts out there that will need to be paid relatively soon so we have a bit of a built-in demand for the greenback overall. The 96 level has offered significant support as of late, and now we have to wonder whether or not we are going to form a bit of a “double bottom.” This is an area that has offered support and resistance more than once, going back over the longer term. If we break down below the 96 handle, then it opens up a quick move down to the 95 handle which has also been supportive.

To the upside, the 50 day EMA is currently sitting at the 97.75 handle and drifting much lower. This is why I think that short-term rallies will continue to run into trouble. Yesterday, I had spoken about the likelihood of a significant pop, and we did get that early in the session on Friday but turned right back around at the 97 handle. The 97 handle is essentially the “fair value level” in the current trading range that we find the market in. We will continue to see a lot of noise because there are a lot of moving pieces right now that will continue to throw the FX markets around. The liquidity issues will continue to show major volatility, and therefore I think that we will see a lot of choppiness. This makes sense when you look at the Euro and the British pound, but if we get a move below the 96 handle, we will see bigger moves in other currencies, perhaps most specifically the British pound and the Australian dollar. The Euro will also be a major beneficiary of that but may not be as resilient as those other two currencies.