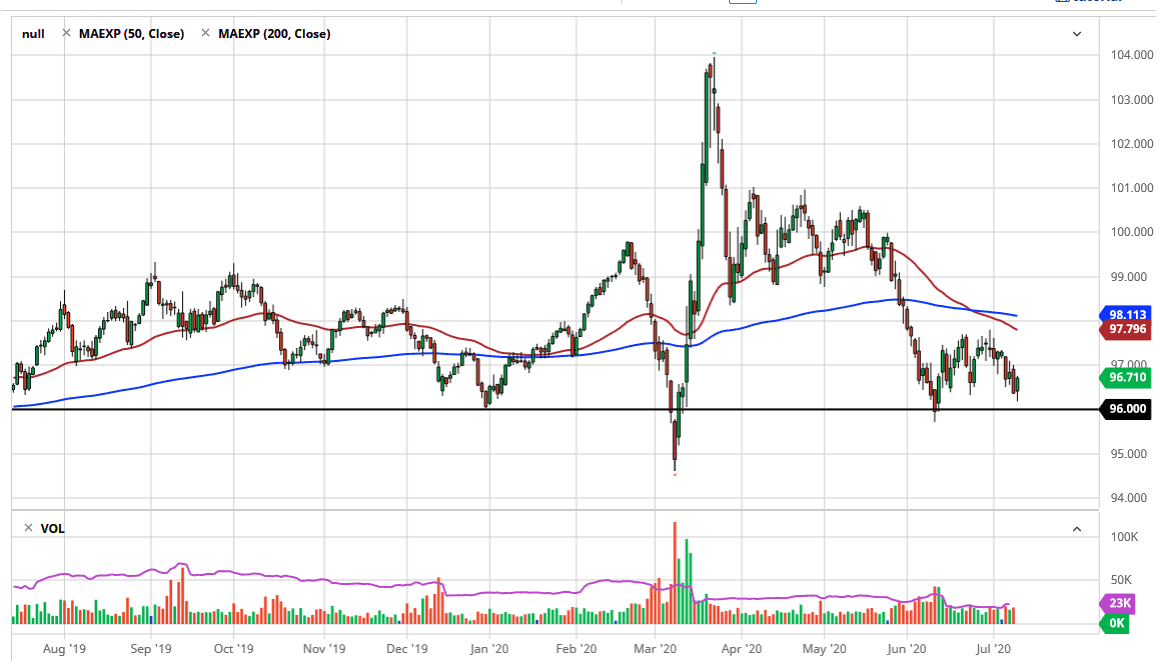

The US Dollar Index has fallen initially during the trading session on Thursday but continues to find support at the critical 96 handle. This of course is an area that has been supportive more than once and when you look at the longer-term charts you can see that this is an area that continues to find value hunters. The question now is whether or not this will continue to favor a rally in the US dollar? I do think that eventually that happens, but it is possibly just a short-term bounce. When you look at this chart, you can clearly see that the 50 day EMA is sitting just below the 98 handle, an area that is the top of recent consolidation. However, one thing to pay attention to on this market chart is that if we break above the 200 day EMA, currently trading at 98.113, that could open up a much bigger move towards the 100 level again, because we will have formed a “W bottom.”

The US dollar has taken on the chin due to the Federal Reserve flooding the market with greenbacks, but there are bigger issues at play than just liquidity as far as the stock markets are concerned. After all, one thing the need to keep in mind is that most debt around the world is denominated in US dollars, which at one point in time were abundant, but now people are trying to pay off their debts which demand those US dollars, and by “people” I mean emerging markets.

On the other hand, if we break down below the 96 level, then it opens up a move down to the 95 level. This is a market that retail traders need to pay attention to, because the US Dollar Index futures market or the “Dixie”, is an amalgamation of the US dollar against the Euro, Pound, Canadian dollar, Swedish Corona, Japanese yen, Swiss franc, etc. In other words, if you know where the US dollar is going to go overall, that can influence your trades and other currency markets. It is not weighted equally, it is much like the S&P 500, where there are some that are more important than others, the most obvious one be in the Euro as it is almost half of this index. I urge you to pay attention to this chart before placing trades that involve the USD. It makes truly little sense to trade against this currency chart. Another thing that is worth paying attention to is that if we do break to the upside in this market, it is very likely that some of the exotic and emerging market currencies are going to get absolutely hammered, perhaps the Mexican peso, South African Rand, Brazilian real, and many others.