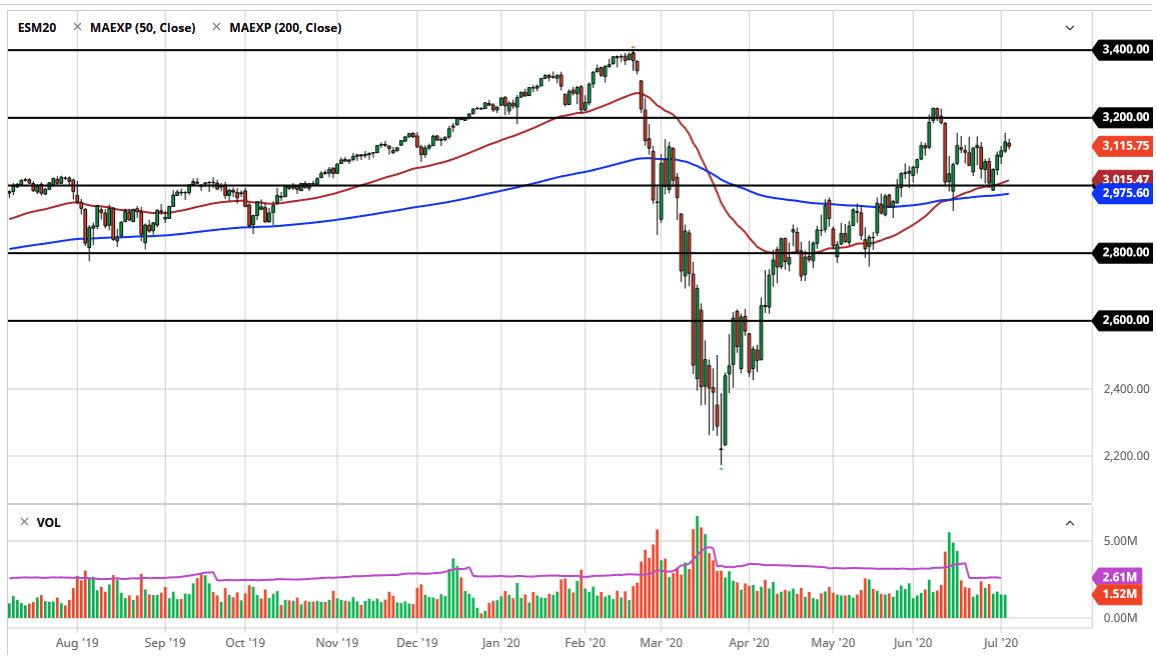

The S&P 500 did little during the trading session on Friday, which makes quite a bit of sense considering that the Independence Day holiday was observed during the session. This means that the underlying index was not actually open but the Globex was opened for trading. The market sat in the same area that is closed in during the Thursday session, sitting just underneath a major resistance barrier in the form of the 3150 area. We pierced that area during trading on Thursday but gave back quite a bit of the gains to show that we are quite ready to break out.

With that in mind, if we can clear the Thursday candlestick to the upside, then I think it opens up the move to the 3200 level that the market has been trying to take. Pullbacks at this point should be thought of as buying opportunities all the way down to the 3000 level, and therefore I think we are in a bit of a trading range at the moment. The 50 day EMA has just crossed above the 3000 level, just as the 200 day EMA is starting to slope towards it. In other words, I think that if we get a pull back to the 3000 level there will be plenty of traders to start jumping in and push this market to the upside. If we were to break down below there it would be a rather significant move, but even then, I think there is probably even more support at the 2800 level. This market is going to go higher given enough time, mainly due to the fact that the Federal Reserve is putting as much money as they possibly can.

As we have just had a major shift in attitude of the last couple of months, it looks like this is more of a grind higher than anything else. The market is starting to act somewhat normal again, as we are not overly aggressive to the upside, but are not in a state of panic either. The biggest fear right now is that the United States locks back down due to the coronavirus issues, but we are not close to that quite yet and therefore it is likely that we are going to see this market reached towards the highs given enough time. I do believe that the 3200 level is going to be difficult to crack to the upside but once we get above there the path to the upside opens up quite drastically.