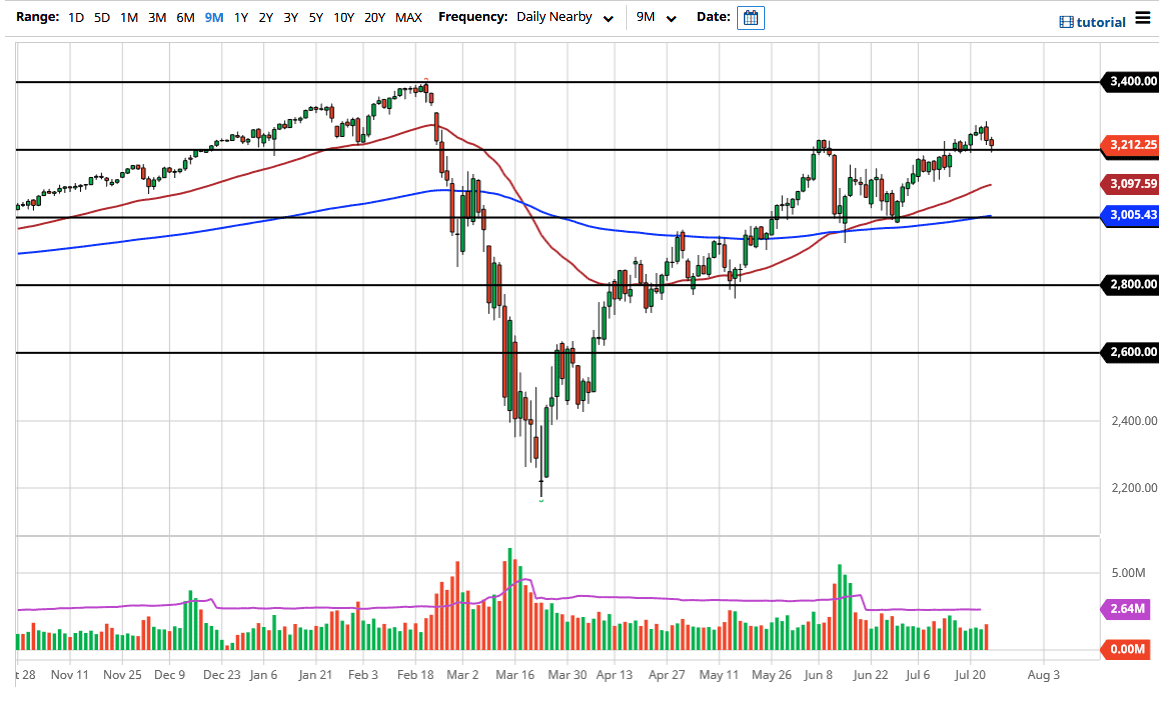

The S&P 500 has fallen a bit during the trading session on Friday, to bring down the market towards the 3200 level. That is an area that will continue to cause a bit of attention, but I think at this point it is more than likely going to be a scenario where we just have buyers sooner rather than later. At this point, the 3200 level will continue to be important, but even if we break down below there, I think that the markets will find plenty of support underneath.

The 3100 level is likely to be supportive as well, just as the 3150 level will be. The 50 day EMA underneath should offer support, so I think that given enough time we will see this market find some buyers based upon value. After all, this is a market that continues to grind its way higher, and the Federal Reserve is likely to continue flooding the market with greenbacks, which will have people jumping into other assets in order to take advantage of a highly liquefied market. To the upside, the market is likely to go looking towards the 3350 handle, where there is a bit of a gap. If we were to break above there, the 3400 level is likely to be targeted as it was the all-time high.

At this point, I believe that the “floor the market” is closer to the 3000 level, and that is where I determined that we would see a trend change. I do not think we get there, and even though we are in the midst of the earnings season, any pullback will simply be an excuse to start buying again for most traders. We have recently made a “higher high”, and this of course is half of the equation for an uptrend. As long as we make a “higher low”, then we have not violated the most basic of definitions of an uptrend. We will see a lot of volatility, but that should provide us with a lot of opportunities. I still believe that we eventually go looking towards the all-time highs, but it will probably be after the earnings season is done. We have had a couple of negative days, but quite frankly that was very healthy and something that was needed.