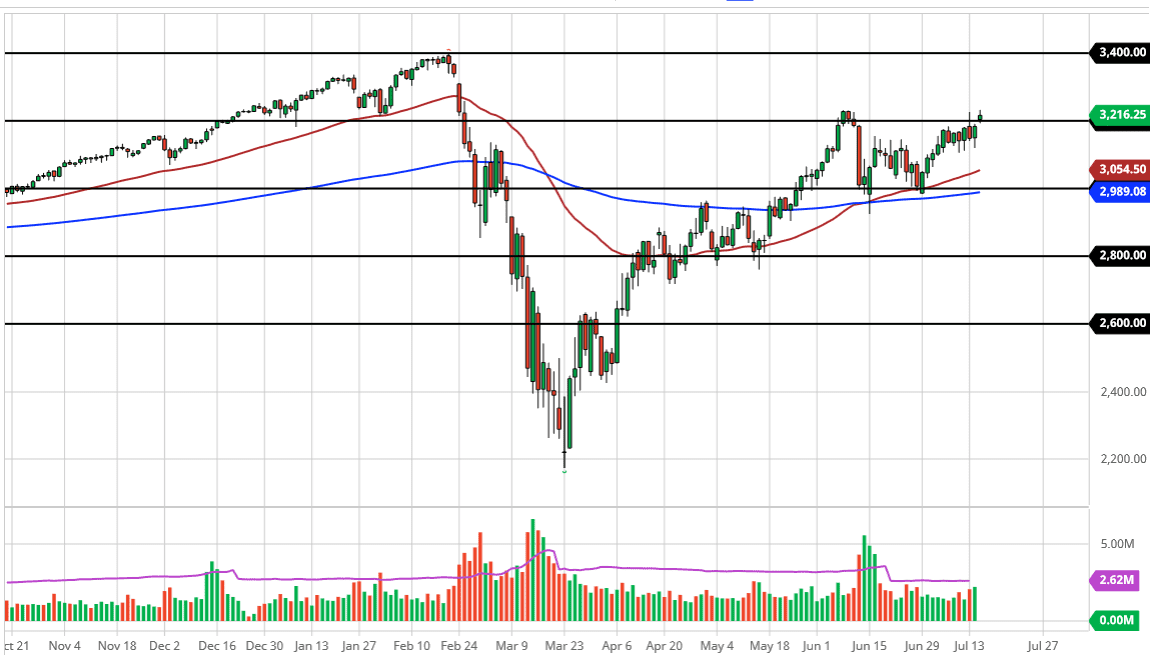

The S&P 500 gapped higher to kick off the trading session on Wednesday but then rallied after that only to find sellers. This has been a very volatile session but it is clear that the buyers are still very invested in the idea of this market going higher, mainly due to Federal Reserve liquidity and the fact that we did get a little bit better business numbers out of the United States as far as confidence is concerned. That helps but at the end of the day, it is not everything.

There are concerns about states in the United States adding more restrictions after loosening up the original lockdown, but at this point, the market is focused on where we are going, not where we have been. Furthermore, the Federal Reserve is adding liquidity to the system in a manner that almost certainly will force more money into stock markets. Bonds pay nothing as far as a yield is concerned now, so passive investors find themselves being forced into the stock market, which of course is by design. With that being said, it is likely that we will continue to see a lot of volatility, but at the end of the day I think this market will eventually break above the 3240 handle, and then go ripping towards the 3400 level. At this point, one would think that it only takes one or two good headlines to make that happen.

Another thing that has been throwing the markets around has been coronavirus treatment headlines, something that is a bit up in the air. However, earlier in the day we did get word that there was a successful phase 1 clinical trial that produced anti-bodies for the coronavirus, which of course is something that a lot of people are keeping a close eye on. This market is going to continue to be extraordinarily volatile and there is not a lot you can do about it. Because of this, you will need to be overly cautious about your position size but at the end of the day, it is obvious that this still remains a “buy on the dips” type of scenario. This does not mean we cannot pull back, I expect to, but the gap getting filled will probably be about as low as we get without some type of negative catalysts causing chaos.