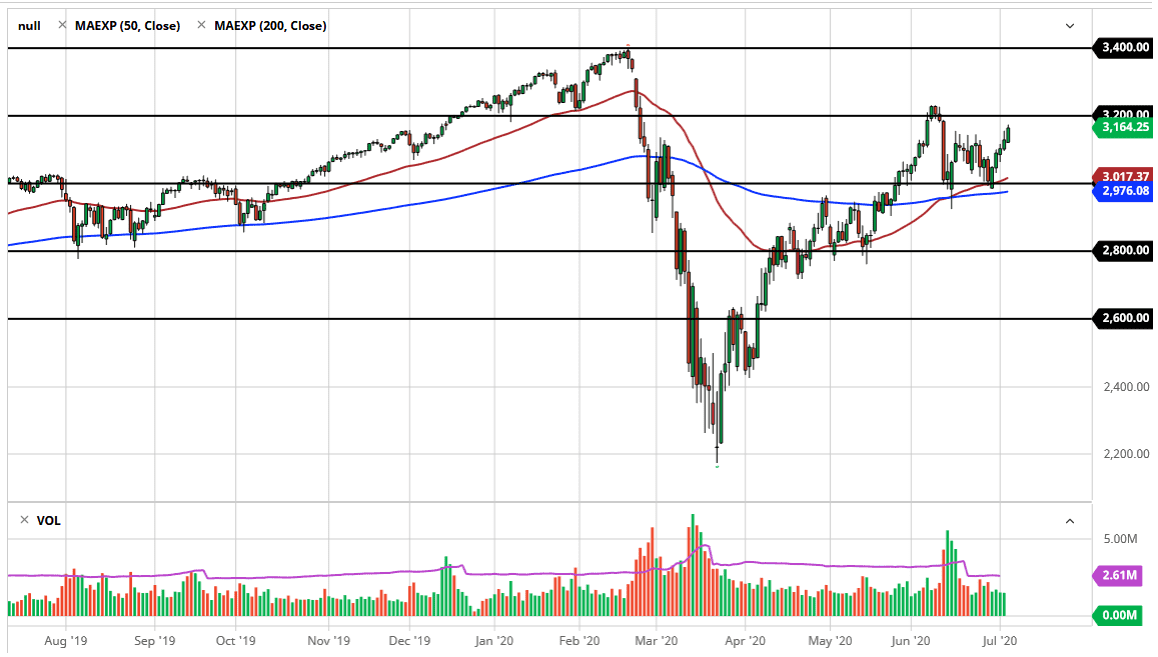

The S&P 500 rallied significantly during the trading session on Monday, as it got a bit of a bid during the Asian Globex trading. While it should be noted that the market still had a positive New York session, most of the gains actually occurred before we even got to that part of the session. In fact, the RTH, or “Regular Trading Hours” had little in the way of momentum. The market essentially just sat there as we are breaking free of the 3150 handle. That being said, there is a lot of noise above that is likely to be seen at the 3200 level.

Later in the day, we did start to see a little bit of a volume swell but at the end of the session, I am left believing that we will eventually go looking towards the 3200 level. That is an area that has seen a lot of selling pressure in the past, so I do think that it is only a matter of time before seeing some type of pullback from that level. Ultimately, the market is likely to see a big fight on our hands near the 3200 level during that timeframe, but if we can break above there it is likely that we will break much higher and see massive moves to the upside, perhaps reaching towards the all-time high again.

Longer-term, that is exactly what I expect to see, as the market has shown itself to be extraordinarily resilient and willing to look past just about any negative headlines that is out there. With this, I like the idea of taking advantage of short-term dips, as we continue to see buyers come in for one reason or another. Quite frankly, the biggest reason to be involved in this market is to play the Federal Reserve liquidity issues, which of course continues to flood the market with greenbacks. As long as the Federal Reserve is flooding the markets, it is likely that we will continue to see assets such as the stock market show signs of strength. In fact, I think that we have massive support all the way down to the 3000 level, so it is not until we break down below there that I even start to think about the idea of shorting this market, and even then I would have to have a whole host of other things line up in order to get me bearish.