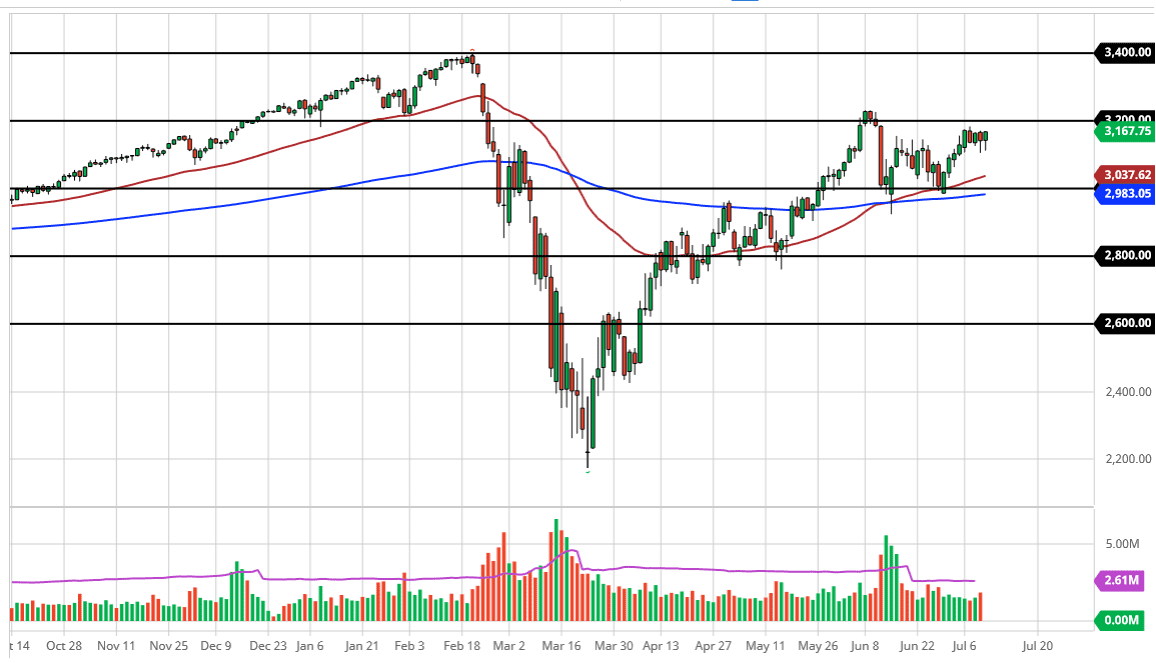

At this point, it should be obvious that the S&P 500 can only go up under most circumstances. Even though we sold off rather hard of the last couple of days you can see that we continue to see buyers underneath. Even if we were to break down below the bottom of the candlestick for the last couple of days, then I would simply look for a cheaper price to buy the S&P 500 from. Quite frankly, I hope that this market breaks down a couple of hundred points, closer to the 3000 level where I would be more than willing to pick it up.

Near the 3000 level there is also the 50 day EMA, and that is an area that I think would increase the odds of a bit of a bounce. Underneath there we have the 200 day EMA that should also offer longer-term support. Ultimately, I think this is a market that continues to see a lot of value hunters, and with the earnings season coming, we may get the occasional short-term blast lower. That blast lower should be an opportunity to take advantage of value, as the market continues to see plenty of reasons to go higher. The biggest reason is the fact that the Federal Reserve is flooding the market with liquidity, which is what Wall Street likes. In other words, they “have Wall Street’s back.”

On the other hand, if we turn around a break above the 3230 level, the market is ready to go looking towards the highs again, reaching towards the 3400 level. That is an area where we have seen a massive pullback from previously and it makes sense that a lot of people will cause a lot of attention. If we can break through there, then the S&P 500 will eventually go looking towards the 3500 level. In general, though I think that we are in a roughly 200 point range, and that will continue to be the way this market behaves, simply going back and forth. The noise in this market continues to be pretty intense but selling has only led to pain during most of the session so I do not think that it is possible to do anytime soon. Furthermore, we have recently had the “golden cross” when the 50 day EMA broke above the 200 day EMA.