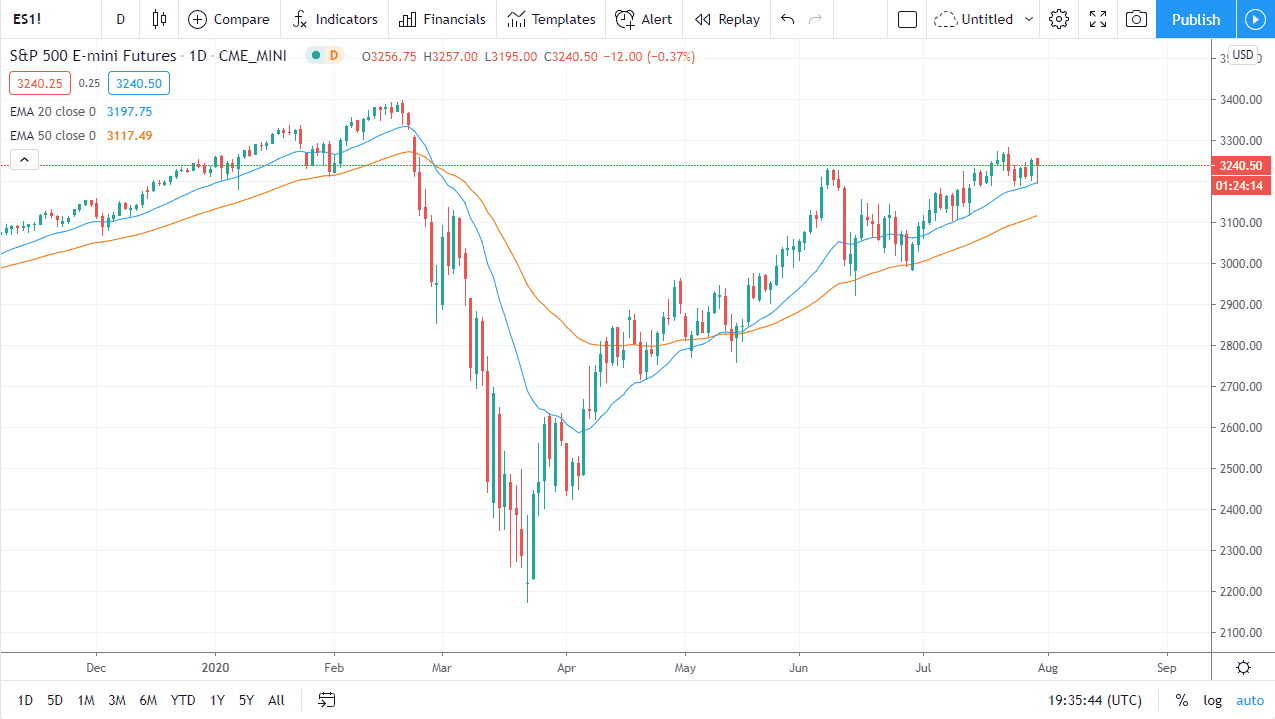

The S&P 500 has fallen a bit during the trading session on Thursday but found a significant amount of support at the 20 day EMA. That moving average has held up for the last couple of weeks, and it looks like we are going to continue to see buyers on these dips. After all, the Federal Reserve is trying to devalue that currency and therefore force people into buying “things.” Without being said, the market continues to offer value every time it dips, and I do think that there is a “zone of support” between the 20 day EMA and the 50 day EMA. The 50 day EMA currently sits at the 3100 level, so that gives it a bit of “double importance.”

It is not until we break down below the 3000 level that I would be concerned about this market, because that is a major figure to give up. At this point in time I think it is more likely that we find buyers every time we dip, thereby offering an opportunity to reach towards the highs again. Ultimately, I think we not only reach the 3400 level, but I think we go much higher. This is based upon liquidity issues by the Federal Reserve, and that is not going to end anytime soon. That being said, the market is likely to continue to find plenty of buyers but if we see a break down below the 3000 level, it is likely that the market will eventually find buyers, but I would be on the sidelines until we see some type of support.

The candlestick shape for the day of course is a hammer, which of course is a bullish sign. If the market does break down below the bottom of the candlestick during the trading session on Thursday, then I will simply wait for a daily trade signal to go long. I believe at this point there is absolutely no way to short this market, and if the last 12 years have told us anything, it is obvious that shorting is a fool’s errand, as there has been plenty of traders that I know personally that have been wiped out after trying to do so. Until the Federal Reserve changes its tune, it is almost impossible to imagine a scenario where this market stays down for an extended amount of time. As coronavirus numbers get worse, the market still continues to go higher.