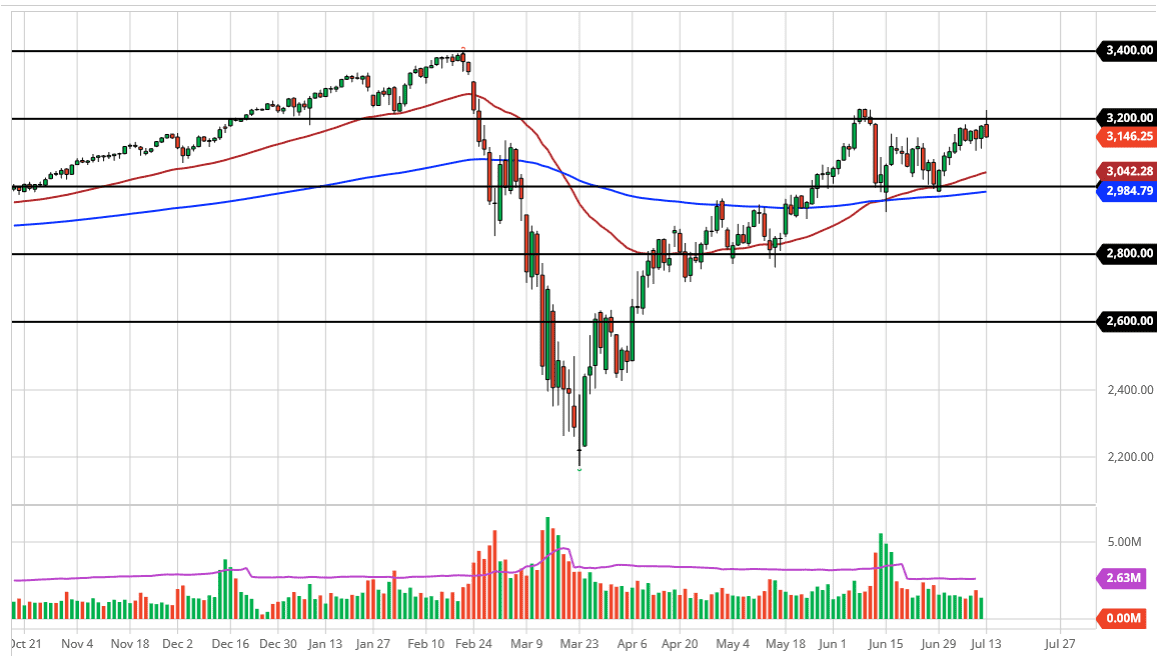

The S&P 500 initially rallied during the trading session on Monday to kick off the week but as you can see has given up quite a bit of the gains above the 3200 level to crash into the 3150 level. This was an extraordinarily volatile session, as the market gave up a ton of gains. With this, it is likely that the market will probably drift a bit lower from here in a bid to try to pick up a bit of value. Stock markets aren't things you sell anymore because the Federal Reserve has manipulated the market to the point where it only goes in one direction. Yes, we could have a major meltdown again, but look how quickly that meltdown was forgotten back in February. What makes you think this one would be any different, assuming it happens?

Underneath, the 50 day EMA is currently at the 3042 level, so I think that’s the next major support level if we were to break down below the 3100 level. Even with the nasty candlestick that we have seen, not much has changed on this chart. We are at the beginning of her earnings season, but again this is a Federal Reserve manipulated market, so earnings season only means so much. If we were to turn around and break above the top of the candlestick for the trading session on Monday, that would be an extraordinarily bullish sign and send this market looking towards the gap at the 3330 area. After that, it is the all-time highs at the 3400 level which I think we do try to get to at least. After all, the Federal Reserve is more than willing to throw plenty of money Wall Street in order to make this happen, and after all, it is an election season.

The 3000 level underneath will be massive support, as it is a large, round, psychologically significant figure that has already shown itself to be important. Beyond that, we also have the 200 day EMA slithering around the same neighborhood, so I think that if we did have a significant break down that is about where it would end. It does not look like much on the chart but it would be a garden-variety 5% pullback or so. Either way, I am not selling and waiting to start buying again.