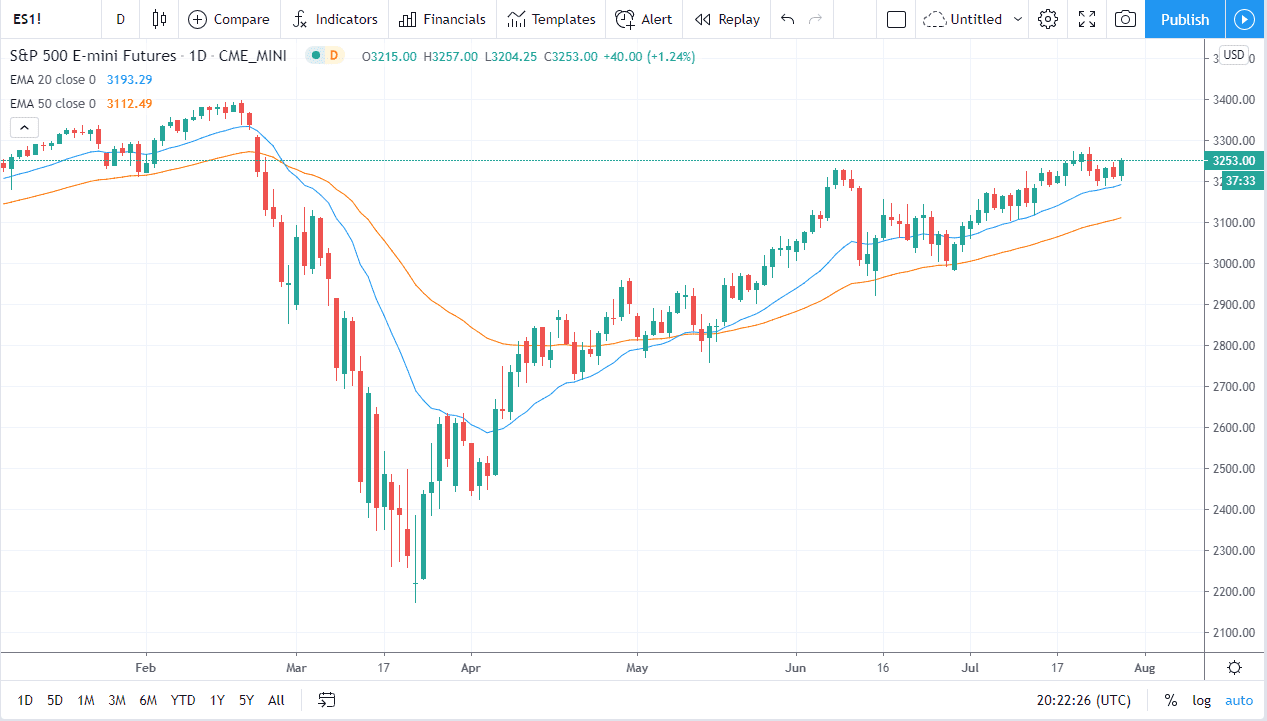

The S&P 500 has initially pulled back against the backdrop of a FOMC meeting coming out on Wednesday. However, we have turned around completely the show signs of strength again as the market has bounced from the 20 day EMA. This is a market that should continue to grant higher, closing at the 3250 level was certainly a win for the buyers. Pullbacks at this point should continue to offer plenty of buying opportunities as we are in an uptrend and I do think that it is only a matter of time before we break even higher.

Underneath the 20 day EMA there is the 50 day EMA at the 3100 level. That is an area that is going to offer support as well, as it is most certainly a large, round, psychologically significant area. Overall, I think that this is a market that continues to offer plenty of value at times, and with the Federal Reserve reiterating their desire to flood the market with US dollars and liquidity, it is very likely that we continue to see the stock indices in the United States rally. After all, stock market participants are looking for any reason to own something, and they continue to flood money into the same handful of stocks that drive the indices overall. The S&P 500 is driven by a handful of stocks, just as the NASDAQ 100 is, so at this point it is likely that we will see buyers.

To the upside, I think we go chasing the all-time highs at the 3400 level, and perhaps even break above there. Short-term volatility continues to be a mainstay of this market, but it is only a matter of time before we see value opportunities to buy on short-term charts. Buying and holding will be one way to play this market, but it is difficult to imagine a scenario where that would be easy to hang onto. Little bits and pieces along the way probably will be the best way, but if you have the ability to trade the CFD markets, then you might be able to hang on through the volatility a little easier, because the position size will necessarily have to be that. In this scenario, I have no reason whatsoever to look for shorting opportunities, that something that I will lead to those who try to “outthink the market.”