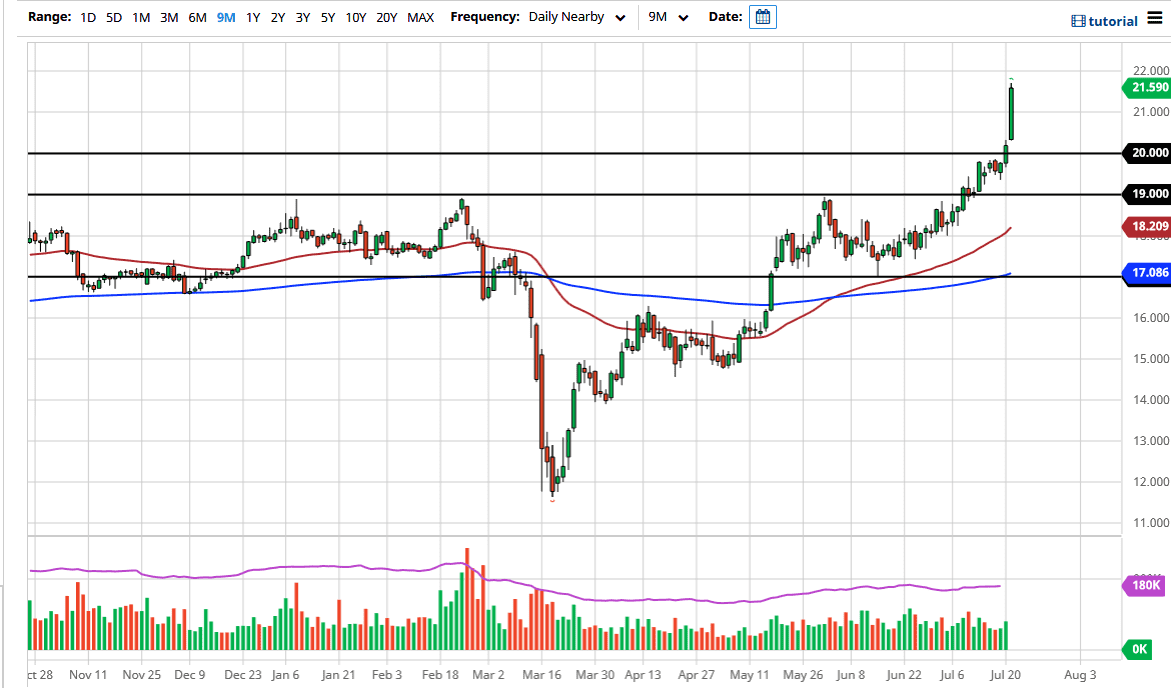

The silver market rallied significantly during the trading session on Tuesday, breaking above the $21 level rather handily. At this point, the market is likely to continue to see buyers on dips and therefore I think we are going to continue to reach towards the $25 level. I think it is only a matter of time before we pull back and go looking for support underneath, perhaps near the $20 level. I think there is a massive amount of support there extending down to the $19 level.

This has been a bullish sign, and the explosive move that we have seen in the silver market suggests that the trend should continue to go much higher over the longer term. The last time we saw a breakout like this the silver market went all the way to the $50 level. Obviously, we have no idea when that is going to happen or even if it is going to happen. Short-term pullback should continue to be buying opportunities as long as the US dollar is on its back foot, which it clearly is right now. In fact, the US dollar has been absolutely pummeled against almost everything else, so it makes sense that people are running towards the silver market. After all, it is priced in US dollars so it makes sense that we would continue to see a lot of upward pressure. This does not mean that you can simply jump in and start buying here, what you are looking for is an opportunity to pick up silver “on the cheap.”

I find it almost impossible to short the silver market and to think that the silver market is certainly going to turn around and start showing selling opportunities. This is a market that will see plenty of buyers every time it dips, so if it does pull back simply be cautious. In order to pick up a bounce here and there, some type of supportive candle is being made, especially near the $20 level, which was previous structural and psychological resistance. I have a suspicion that we are about to see a lot of volatility, but this is going to be a longer-term cyclical trade from what I see. I have been saying for some time that you cannot short silver, and that is especially true now that we have done this.