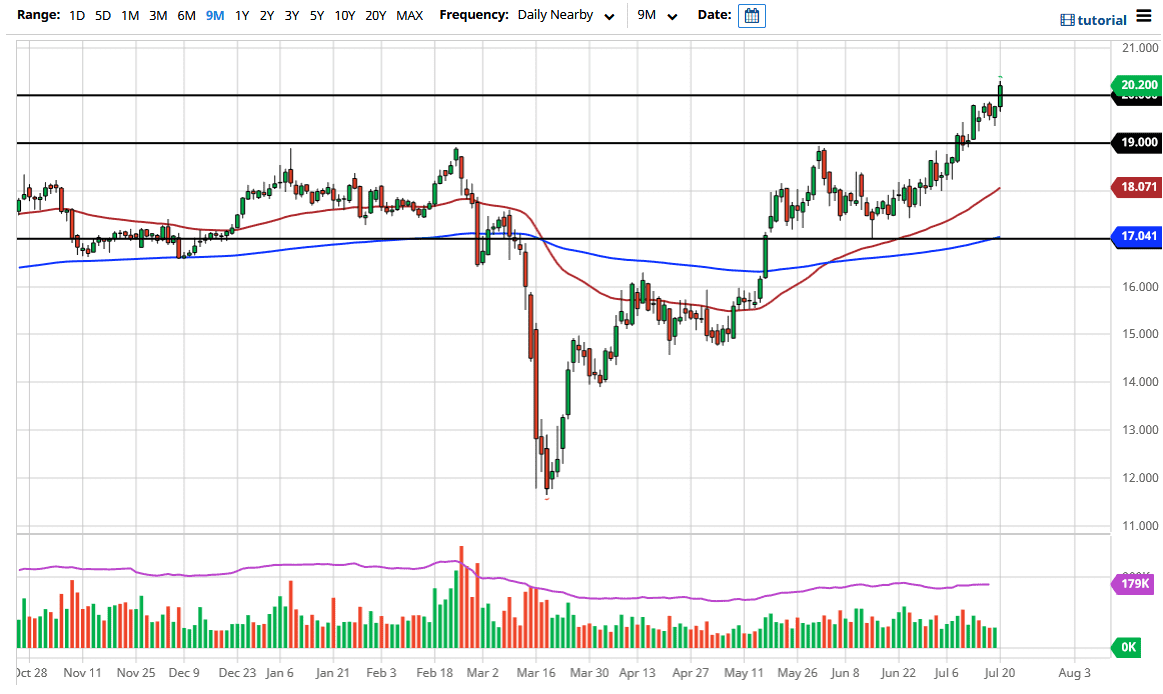

The silver markets have broken above the $20 level during the trading session on Monday, as this signals a major shift in attitude, or perhaps a better way to put it: That we are ready to continue the next leg higher. Granted, we have been trying everything we can do to break out, and the fact that we have finally done so and are closing above there at the end of the session tells me that we are ready to go much higher. This does not mean that you jump in with both feet right now and start buying hand over fist, but short-term pullbacks would probably be the best way to play this market.

To the downside, there seems to be a lot of support that extends all the way down to at least the $19 level, so I would look at this as a value play more than anything else. The $19 level was the scene of a major breakout, but we have been piddling around for a couple of weeks since then. By breaking above the $20 level, we have a clearly major psychological barrier and it should be noted that this was a level that the last major bullish move in the silver market started at. In fact, the last time we have seen the market break above there was during the Great Financial Crisis, at least for a sustained time. At that point, the market rose all the way towards the $49/$50 region. With that in mind, we could be at the very precipice of a major move. Do not misunderstand me though, I do not think it happens overnight, just that it could be a huge move just waiting to happen.

To the downside, if we were to break down below the $19 level, it is likely that we could go down towards the 50 day EMA underneath, which is at the $18 level. I still think that we would be in a strong uptrend even if that happened then you would have to look at this as a major value opportunity. Overall, this is a market that continues to see a lot of buyers based upon the central bank actions coming out of the Federal Reserve, and many other ones around the world. As the market continues to see quantitative easing, it makes sense that precious metals get a boost.