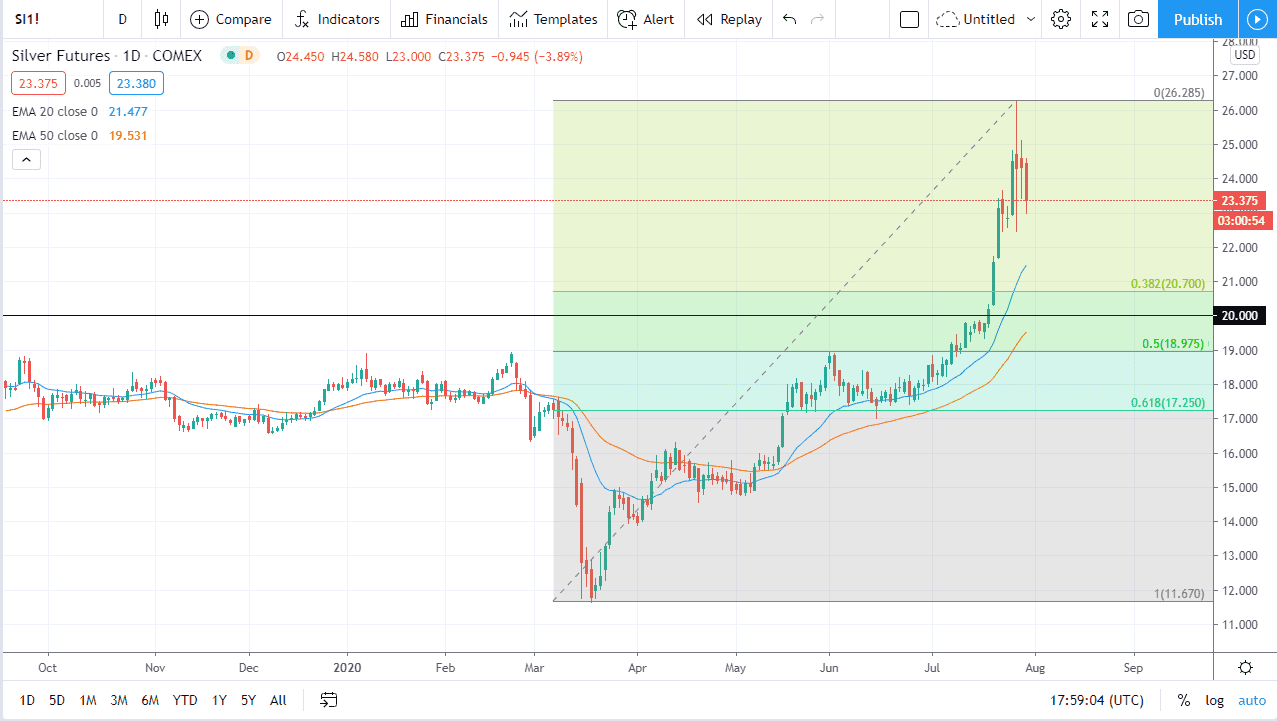

Silver markets pulled back a bit during the trading session on Thursday to test the $23 level. If we can break down below the $23 level, then it is likely we go looking towards the 20 day EMA closer to the $22 level, perhaps even down to the $21 level. At this point in time, the market should continue to see a lot of support underneath regardless, as the US dollar continues to fall, so that of course drives up the value of precious metals in general. Silver is especially volatile, as it is a much smaller market then the gold market, so it will move much quicker. Nonetheless, this is a market that has gotten far ahead of itself, and somewhere near the $21 level we should see the 38.2% Fibonacci retracement level come into play.

The candlestick for the trading session on Thursday is rather negative, but we are still within the long legged doji from the Tuesday session, and that of course suggests that we are still within the trading range that could be setting up. If we break down below the Tuesday session, the market then goes looking towards the $21 level.

I believe that there is a massive floor underneath at the $20 level, and the 50 day EMA underneath will also offer support which is raising its way towards that $20 level. With this being the case, we continue to see plenty of support from a structural standpoint and of course the US dollar will continue to lose value as the Federal Reserve is becoming so aggressive with its loose monetary policy. Even if we rally from here, I believe that the top of the candlestick from Tuesday should cause some major issues as well. If we were to break above it, then it would be a bit of a “blow off top” and that is a very negative sign as those almost always lead to massive pullbacks. I think at this point at the very least we need to do is kill time in order to keep the trend going to the upside, but we will be much better off if we can find the market pulling back enough to offer value, then of course it is time to start buying.