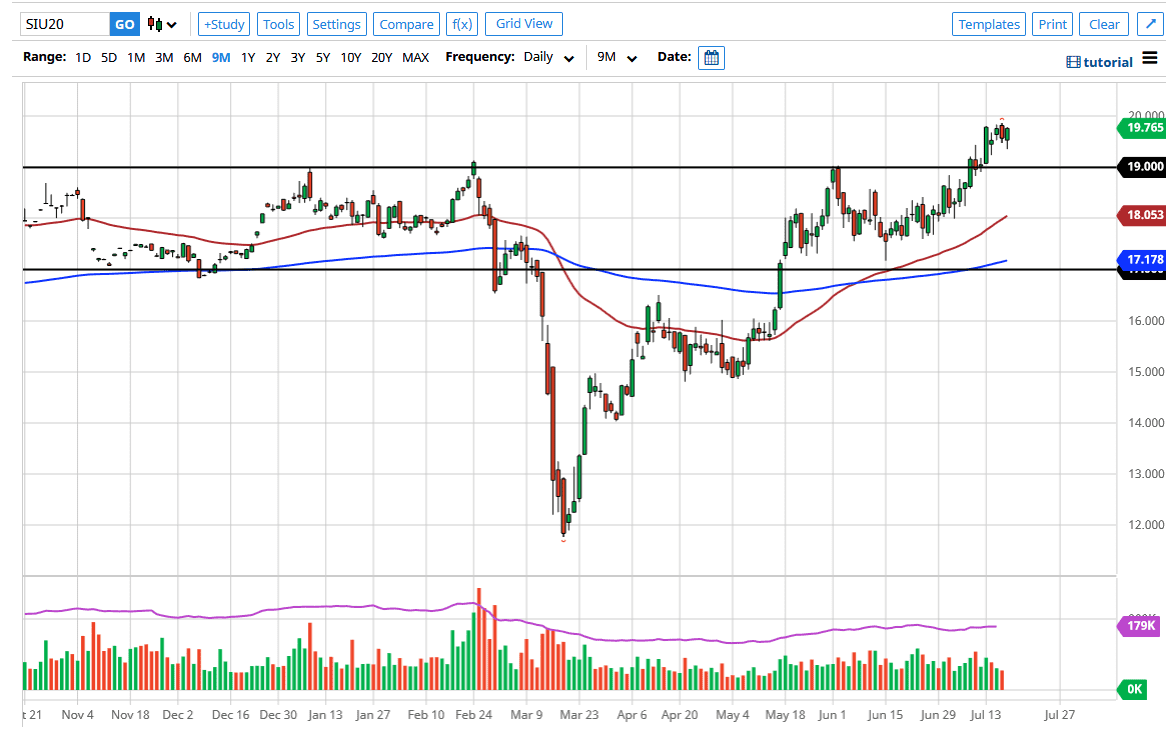

Silver markets have initially pulled back a bit during the trading session on Friday but found plenty of buyers near the $19.35 level as we see value on these dips. Silver of course continues to rally due to the US dollar falling so heavily, and that will send precious metals higher in general. Looking at this candlestick, it is not quite a hammer, but it is most certainly a bullish candlestick to say the least.

To the downside, even if we were to break down below the $19.35 level it is likely that we will then go looking towards the $19 level for support. That is an area that was previously resistant so it would make quite a bit of sense to see a reaction in that area. Quite frankly, any bounce from there should be a nice buying opportunity as well. The $20 level above is an area that should continue to attract a lot of attention, but if we were to break above there it is likely that the silver market should go much higher, kicking off the next leg higher overall. Looking at this chart, it is obvious that the market has been very bullish, but it might be a little bit overextended in the short term.

To the downside, the $18 level is where we see the 50 day EMA, which is going to be crucial. All things being equal, I am looking for some type of value to get involved, and although I would be a buyer as soon as we break above the $20 level on a daily close, I prefer buying these dips in short increments in order to take advantage of the volatility of the market, and I do not have any interest whatsoever in trying to short silver because it has been so bullish for so long. Furthermore, the Federal Reserve is likely to continue pressuring the US dollar as the quantitative easing is not going to let out. That being said though, central banks around the world are doing the same thing so I think that if you have the opportunity to buy silver in other currencies, then that might even work out as well. At this point, the US dollar is on its back foot so that should continue to be the main driver.