The silver markets initially gapped higher to kick off the trading session on Wednesday but drifted a bit lower as we filled the gap rather quickly. Later in the day we saw quite a bit of volatility in general, and that is good for precious metals as people go running towards safety. That being said, silver has to deal with the fact that it is also an industrial metal, so it does cause it to lag a little bit a lot of the time. However, that did not seem to be the case during the trading session on Wednesday as it actually outperformed gold for once.

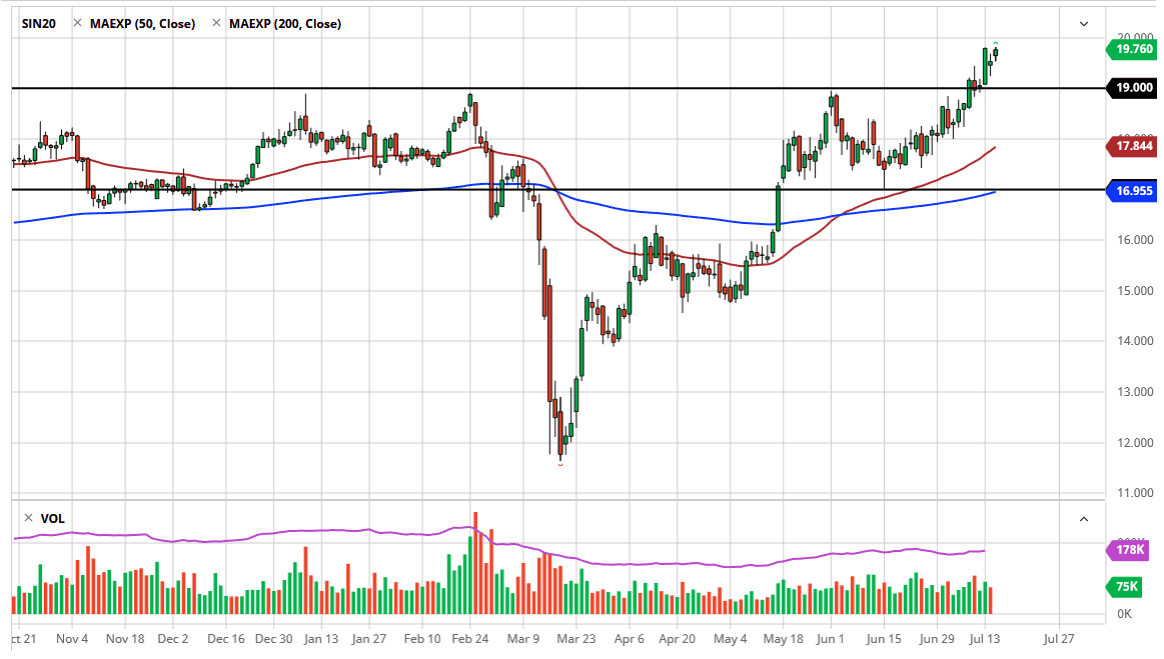

To the downside, I see the $19 level as being rather important, so I would anticipate that there should be a certain amount of pressure in this market to the upside at that level. I would be a buyer of a supportive candle or of bounce in that general vicinity, as it would represent a certain amount of value. To the upside, the most obvious problem right now is the $20 level which will attract significant attention. Because of this, it is worth noting that the market is going to be paying attention to that big significant figure, but also, we should pay attention to the fact that we might be a little bit stretched at this point.

It is probably worth noting that the US dollar looks like it could have a slightly positive session on Thursday, and that will work against the value of silver, at least in theory. If that is the case, then we could see a bit of a pullback, but I look at that pullback as offering a nice buying opportunity. I have no scenario in which I’m willing to sell the precious metals right now, but I do recognize that timing is part of the trick. With all that being said, I do believe that there is only one direction that you can trade and as a result, I will simply ignore negativity until we break down below the 50 day EMA which is currently trading at $17.84. It would take quite a bit to send the market back down to that level, so it is simply a matter of looking for some type of bounce or supportive looking candle on the short-term charts to take advantage of this strong and obvious trend.