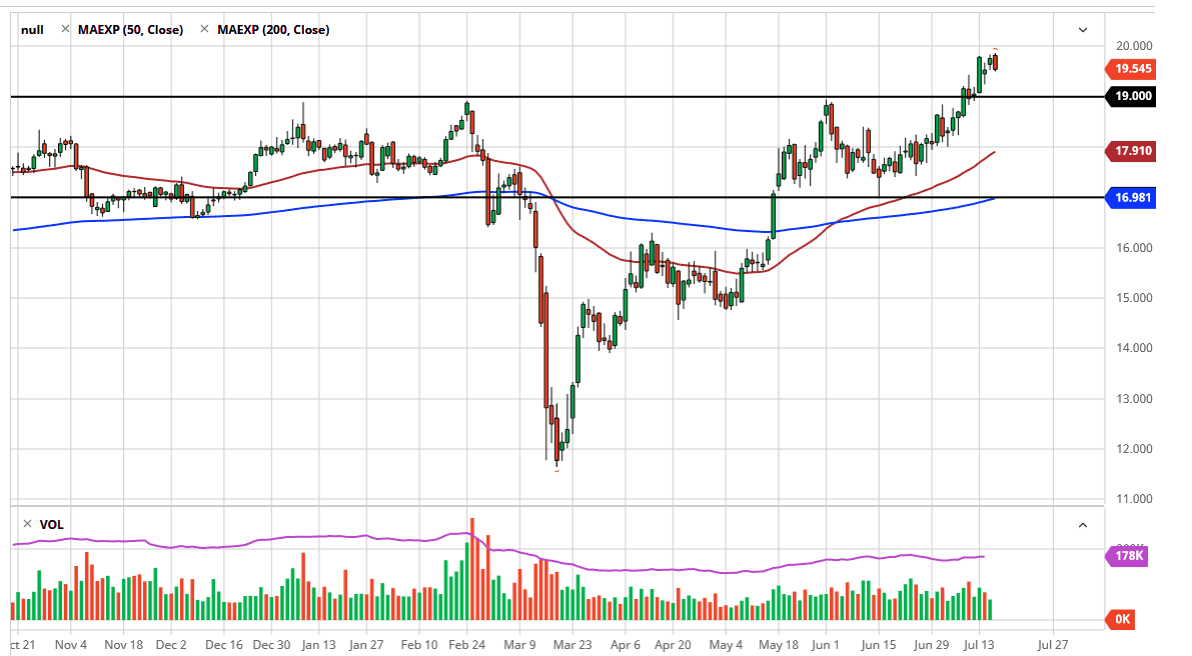

Silver markets continue to struggle with the $20 level above, an area that a lot of traders are desperately trying to take out. This is an area that has kicked off major moves in the past, so I think it will be followed with great interest. With that being the case, it is likely that what we are going to see is a lot of noise, followed by a significant break out. Central banks around the world continue to do everything they can to bring down the value of the currency, so it should not be a surprise that all that precious metals may do fairly well. Granted, silver is “less precious” than gold, but at the end of the day it does tend to follow the same general direction.

As a general rule, I think you should be buying metals on dips, as the central bank actions continue to be negative for their respective currencies. With this, I think we are probably looking at a scenario where we can take advantage of value every time it offers itself, as we will more than likely see value hunters return. The $19 level underneath should be massive support from everything I see, so a move below there would probably kick off a little bit more selling. At that point though I believe that the 50 day EMA probably comes into the picture near the $18 area, and that will more than likely attract a lot of attention. Longer-term, I do believe that we break above the $20 level and continue going much higher, perhaps as high as $50. It is obviously a longer-term target, but every time in the past where we have had a significant break above the $20 level, that is exactly what happened over the longer term. Granted, that has only been a couple of times, but we certainly have enough monetary uncertainty out there right now to justify that type of thinking. Looking forward, I will be especially interested near $19 as far as finding some type of bounce or support of candle that I can get involved in. Because of this, the market is likely to see a lot of volatility, but in the end, I think the longer term uptrend will prevail, as the Federal Reserve is jumping all over the dollar and crushing it. Industrial demand is probably the one thing that is working against this metal.