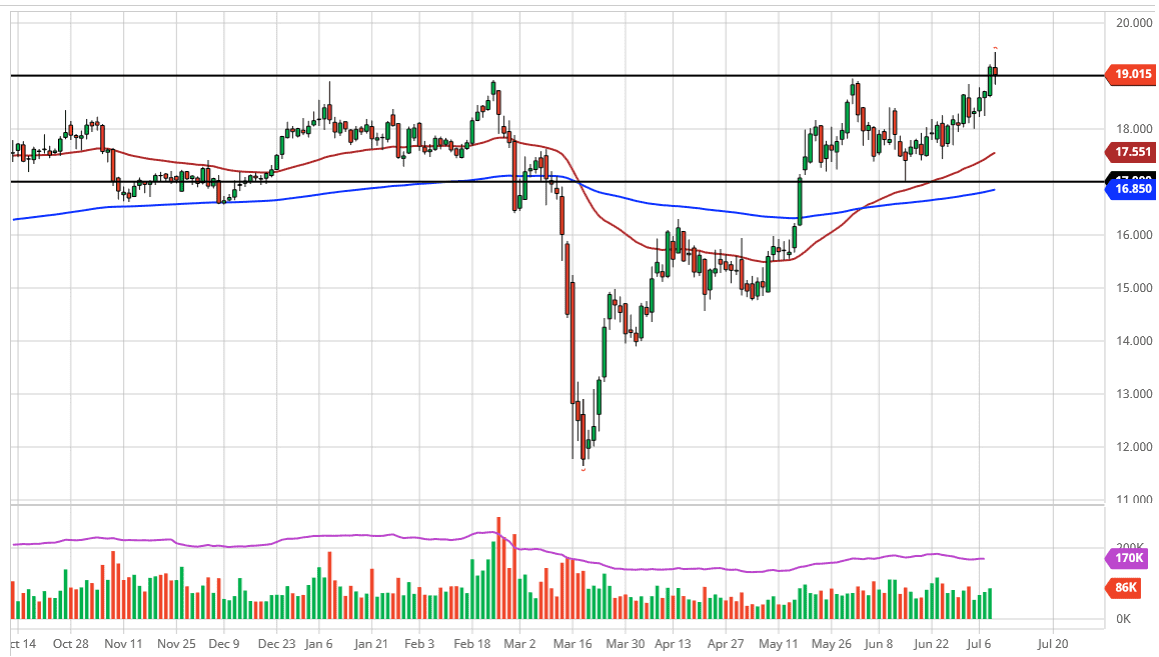

The silver markets have struggled a bit during the trading session on Thursday, initially shooting towards the $19.50 level before pulling back. We did end up forming a shooting star and that of course is a negative candlestick. However, I do not necessarily think that you can be a seller of the silver market, this just simply shows that breaking above the $19 level is going to take some momentum. After all, there is a lot of noise between $19 and $20, so I think it is only a matter of time before we see the market challenge that area again. Do not get me wrong, I think that there are still plenty of reasons to buy this market, but it is obvious that we are going to need several attempts I think to break out above the $20 handle. Once we do, that could send this market much higher as it would open the door for another move like we had seen during the Great Financial Crisis.

In the meantime, I think that this silver market may be struggling a bit due to the fact that the US dollar looks poised to gain a bit. If that is going to be the case, then I would look for a move down towards the $18.75 level, followed by the $18.50 level. In that general vicinity I would anticipate seeing a lot of choppiness but ultimately, we should see a buying opportunity. The alternate scenario of course would be that we simply turn around a break above the top of the candlestick for the Thursday session. Again, I think that would be another run towards the $20 level but $20 is going to be difficult to break. Do not get me wrong, I fully anticipate that we will eventually, but it is going to take a lot of effort and effort is expressed by the occasional pullback that gives you the ability to finally build up the pressure needed to break out.

Even if we break down below the areas mentioned, I believe that the $18 level will cause significant support, just as the $17.50 level will be. I have no scenario in which I am willing to sell precious metals right now, unless of course for some reason the central banks around the world stop liquefying the markets and with suddenly tight monetary policy. I just do not see that happening anytime soon.