The silver markets dropped a bit during the trading session in early hours Globex trading on Thursday, as traders waited for the jobs figure to come out of the United States. As the announcement came out, and it was of course better than expected, people started to bet on the idea of silver being needed for industrial use. That being said, it really does not matter the reason because we were in an uptrend to begin with due to central bank liquidity measures which of course have been working against the value of fiat currencies in general. The Federal Reserve has been extraordinarily guilty about this, so that something that you should pay attention to as it pummels the value of the US dollar, at least in contrast to hard assets such as silver and other metals.

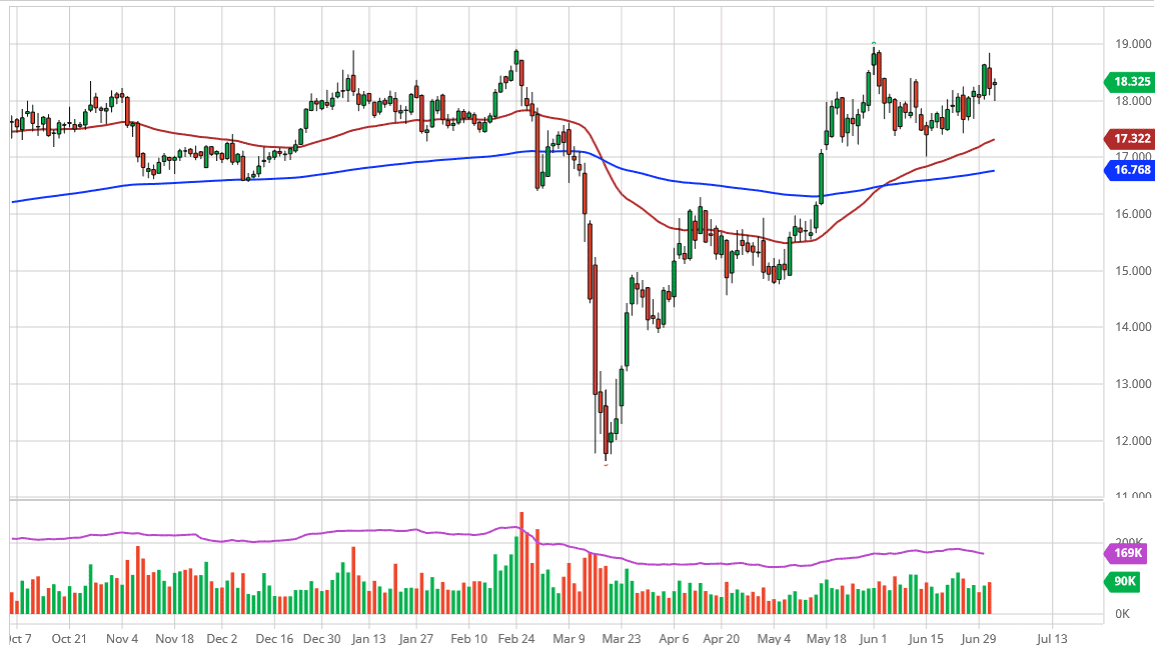

Looking at this chart, it is interesting that we found support right at the $18 level, which proves that the large, round, psychologically significant figure will more than likely continue to attract a certain amount of attention. If we were to break down below there, then it is likely that the market could unwind towards the 50 day EMA which coincides quite nicely with the lows over the last couple of weeks. That would be at roughly $17.50 or so by the time we get there, and then I think we would have a lot of value hunters in the market trying to take advantage of that.

To the upside, I believe that the $19 level is probably the first target for traders to aim for, and once they do it is likely that we will see a bit of selling pressure up there as well. If we can break through there, then the market is likely to go reaching towards the $20 level. That being said, I think it is going to take a significant amount of momentum to make that happen, so I am not overly surprised if it takes quite a while to get there. That in mind, I think that it is only a matter of time before dips are bought into, meaning that this continues to be more of the same type of trading, simply looking for value as it occurs. Once that value occurs, then you have the ability to jump into the market and pick up silver “on the cheap.” With the current environment was central banks, I have no interest in shorting precious metals.