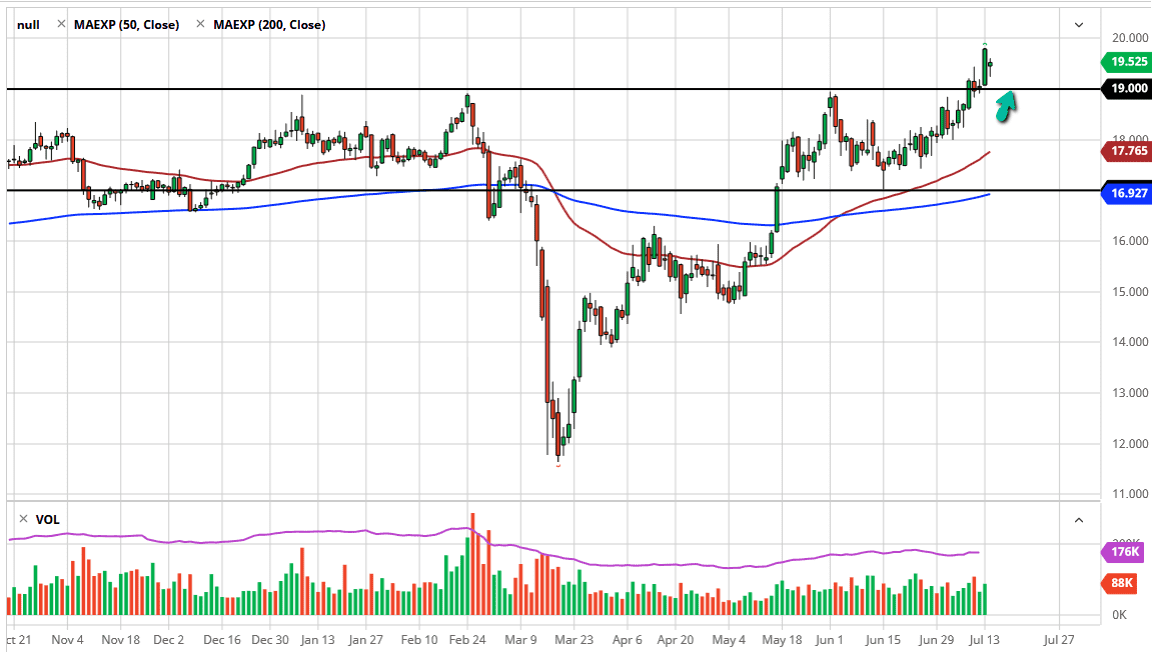

The silver markets did gap a bit lower during the open on Tuesday which was a negative sign and then fell to reach down towards the $19.25 level, for turning around and showing signs of life again. The candlestick for the day is forming a bit of a hammer and that is a bullish sign. At this point, I think it makes sense that the market eventually tries to get through the $20 level, as it is an area that will cause a significant amount of resistance but is also a large, round, psychologically significant number, something that markets tend to be attracted to. I do believe that we will get to the $20 level, but it may take quite a bit of momentum. Pay attention to the US dollar, it can have a major effect on what happens next.

However, the biggest problem that the silver market deals with right now is the fact that there are a lot of concerns with whether or not there is a significant amount of demand or not. The demand is dented by the fact that the global economy is simply stuttering. Silver has an industrial component to it, so if you are trying to play the precious metals trade, gold will continue to outperform but silver is lagging a bit.

Looking at this chart, the $19 level underneath should be supported quite nicely, due to the fact that the area has significant resistance and there is a large, round, psychologically significant figure. Even if we break down below there, the 50 day EMA is starting to reach towards the $18 level, an area that had been important more than once. We are a bit of her stretched here though, so I think it is likely that we are going to see a certain amount of value hunting underneath. I like the idea of buying dips, especially if we can get like a $1.00 drop. If we were to somehow break above the $20 level, then the market is likely to continue running for a much longer amount of time, sending silver towards the $50 level eventually. Don’t get me wrong, I don’t think it happens overnight or anything, but it is most certainly an area that the market has tested the last couple of financial crises, so why would not it do it now?