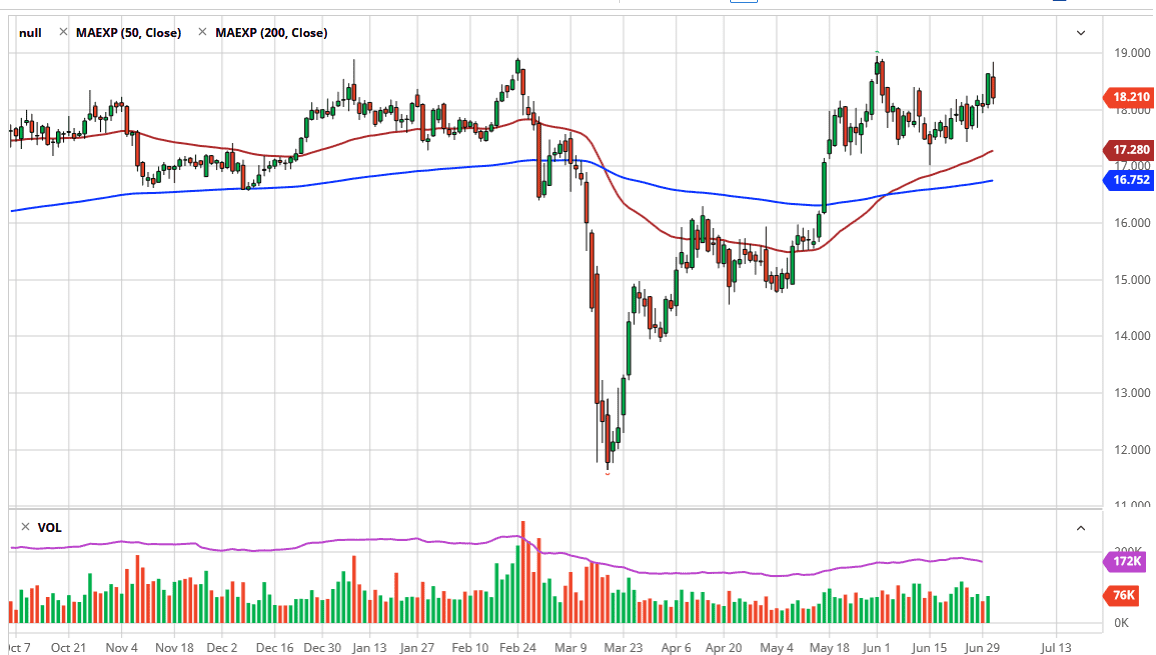

Silver markets initially tried to rally during the trading session on Wednesday as we reached towards the $19 level. The $19 level of course is a scenario where we have seen a lot of resistance, and as a result, it is likely that we have sellers based upon the larger round figure and the fact that we have seen a lot of selling pressure in that area previously. That being said, we ended up finding a bit of support at the $18 level, which of course is a large, round, psychologically significant figure.

Looking at this chart, the 50 day EMA is starting to reach higher, and it is near the $17.25 level and I think we are going to continue to go higher. The slope of the 50 day EMA is strong and at roughly 45°, so it is likely that we will see plenty of value hunters looking to pick up silver “on the cheap.” I like the idea of buying silver after drops like this because central banks around the world will continue to destroy their own currencies in the idea of stimulating their economies. With that being the case, I think that we will see not only silver but all metals and hard assets rise over the longer term.

The $17 level for me is a major support level, as we are looking at the 50 day EMA crossing above it, and the 200 day EMA reaching towards it. There is a lot of support between those two moving averages typically, so I think it is only a matter of time before as value hunters would appear there as well. The alternate scenario of course is that we break above the $19 level. If we do, then the market is free to go looking towards the $20 level given enough time. Looking at this chart, the breaking of the $19 level to the upside would be a very bullish sign and it could allow the market to go looking towards the $20 level. The $20 level is also significant, and as a result, there will be resistance there as well. That being said, the $20 level is the gateway to much higher levels as we had seen during the Great Financial Crisis. With this being the case, I continue to buy dips and preferred those over by the breakout but would do either.