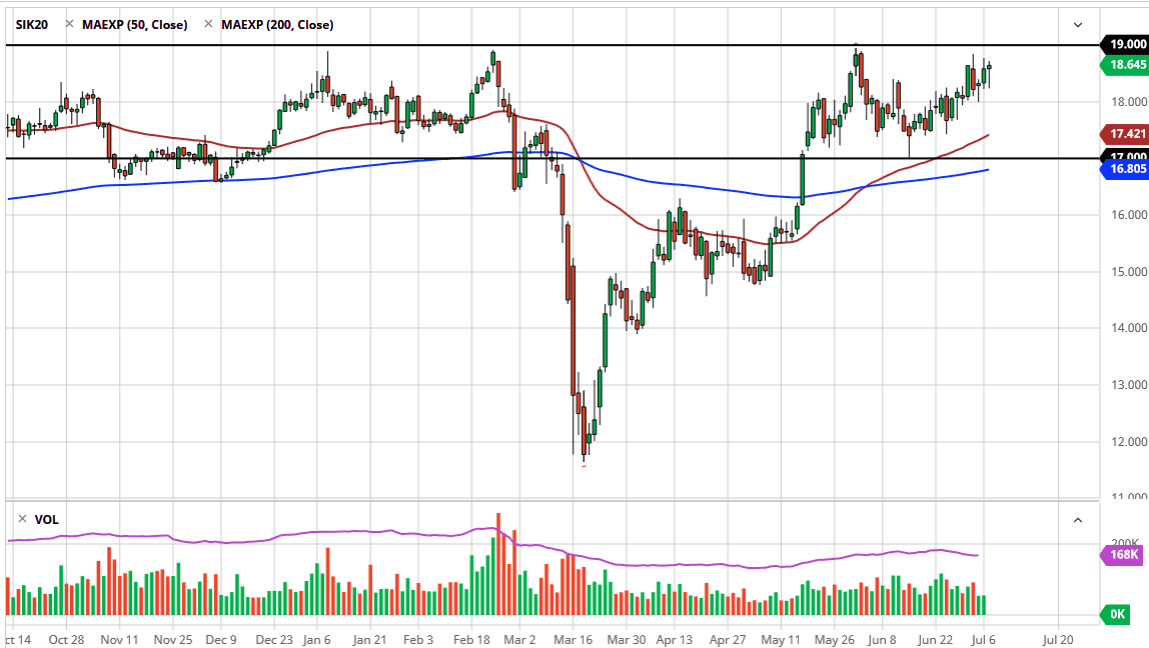

Silver markets have initially pulled back during the trading session on Tuesday but found plenty of buyers underneath the turnaround and shows signs of life. By doing so, we ended up forming a bit of a hammer during the day and it is showing that there is a significant amount of support looking to push this market to the upside. Keep in mind that the $19 level above has been massive resistance and has been tested multiple times. Every time we get closer to that area, the more likely we are to see some type of break out. With that in mind, if we can break above the $19 level, I believe that this market will probably take off to the upside. At that point, it would free the buyers to go looking towards the crucial $20 handle which will attract a lot of attention.

Looking at the silver market, it has been lagging the gold market in the sense that gold has already broken out to the upside, while silver has just threatened to do so. That makes a lot of sense though because gold is the first place traders will go looking to for safety and to get away from the US dollar. However, silver is also a precious metal so eventually, get a bit of help from that move as well.

Unfortunately, silver is also considered to be an industrial metal, so that does come into play as well. There is a somewhat serious concern when it comes to industrial demand, so this will continue to make silver a bit sluggish in comparison to gold. However, over the longer term the two markets do tend to move in the same direction so that is something worth paying attention to. To the downside, I think that the market continues to see a lot of volatility underneath, with the $18 level offering support, just as the 50 day EMA will and the $17 level will. Just below the $17 level, there is also the 200 day EMA which comes into play. Because of this, the market is likely to see more noise than anything else but eventually I do anticipate that we will be knocking on the door $20. If you are patient enough and use little in the way of leverage, you should be able to ride out volatility and take advantage of this move.