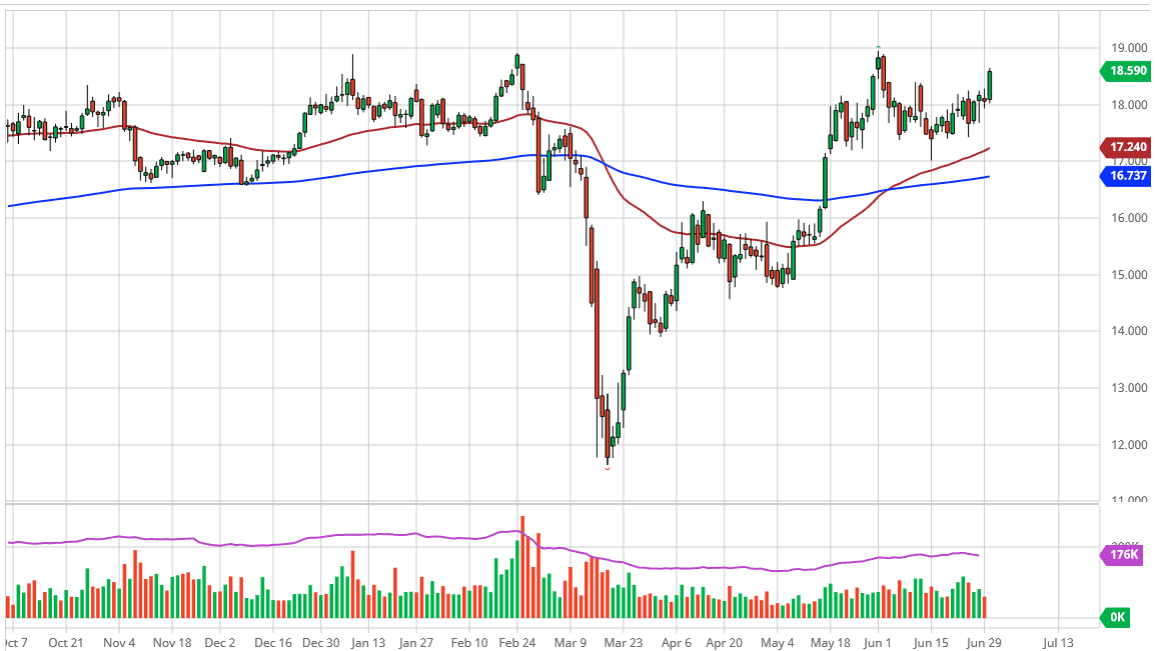

The silver market shot straight up in the air after the initial struggle early in the trading day. The $18 level looks to be offering a bit of support, and now it appears that we are ready to go looking towards the $19 level. By breaking above the $18.50 level, this has made a bit of a statement, as there are a few short-term selling ranges that have been broken. Remember, silver has been a bit of a laggard when it comes to precious metals trading in general, as gold had broken out. That should drag silver right along with it.

At this point, short-term pullbacks are likely and should be thought of as opportunities in a very bullish market. The $18 level underneath should offer significant support going forward, and therefore I like the idea of buying these pullbacks in order to take advantage of “cheap silver.” Eventually, we will break above the $19 level, which could open up the door to a potential move towards the $20 handle. That is an area that is crucial and will attract a lot of attention. Remember, it was during the Great Financial Crisis that silver broke above the $20 level and then shot straight up in the air towards the $50 level. I do not necessarily think that we are going to do that again, but it certainly is an area that could cause quite a bit of buying pressure.

Even if we were to break down below the $18 level, I think there are plenty of support levels underneath there anyway. With silver, it is going to be a simple matter of when you are buying, not whether or not you buy or sell. If we were to break down below the $18 level, then it is likely that we will see the $17.50 level as an opportunity to pick up a bit of value. Underneath there, the market is likely to see support at the 50 day EMA as well, and the $17 level will be even more supportive as we not only have the large, round, psychologically significant figure, but we also have the 200 day EMA. At this point, I believe that buying on the dips continues to be the best way to handle this market, so this continues to be the play that I use off of short-term markets.