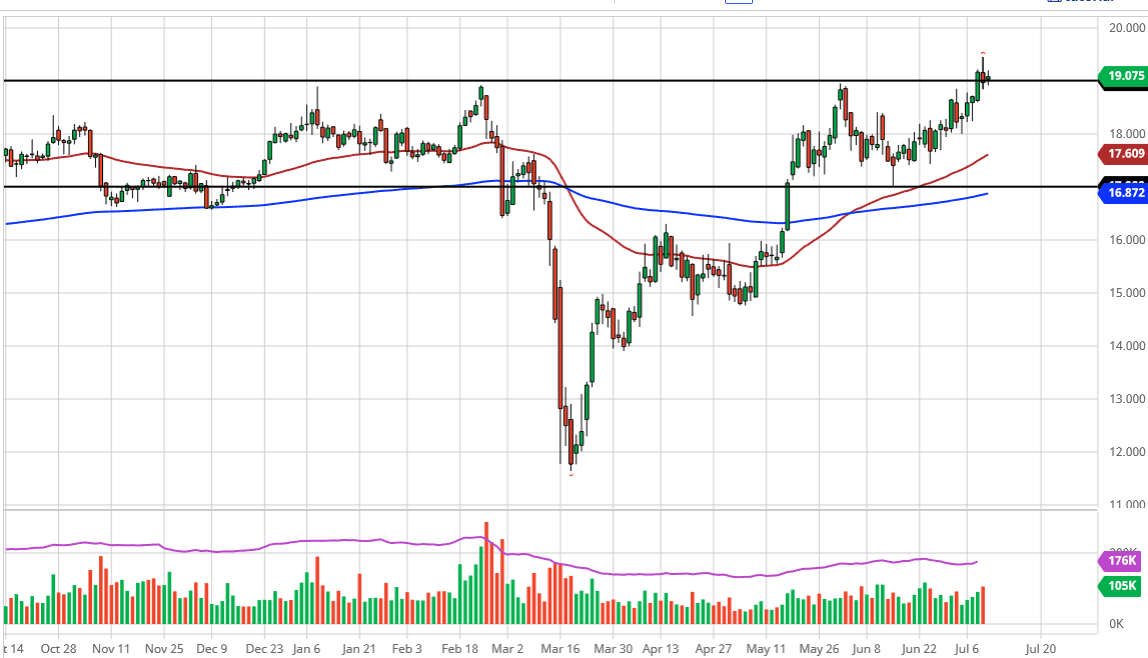

Silver markets went back and forth during the trading session on Friday, showing signs of exhaustion but have broken above the $19 level, which is an area that has been difficult to deal with for some time. Signs of exhaustion would be expected here because there was so much in the way of selling pressure and therefore it makes sense that we would give back some of the gains. At this point, I think a pullback is only going to be looked at as an opportunity for value hunters, as silver has clearly shifted into a very bullish attitude.

This makes quite a bit of sense, considering that the central banks around the world continue to show the proclivity to loosen monetary policy, giving fiat currency a bit of a beat down as traders will start to look for hard assets in order to keep wealth preserved. At this point, the $18 level underneath would be massive support, just as the $18.50 level would be. The 50 day EMA is below there as well, reaching towards the $18 level, so I think it is only a matter of time before the buyers return.

On the other hand, we could break above the top of the candlestick for the Friday session and then look towards the highs of the Thursday session which formed a bit of a shooting star. Breaking above the top of the shooting star would be a very bullish sign, allowing the market to go even higher. This makes sense considering with all of the loose monetary policy out there we would see money flow in, but you should also keep in mind that silver has a bit of an industrial component built into it as well, so we need to pay attention to that as well. If the global growth continues and monetary policy continues to be very loose, it is likely that silver will go looking towards the $20 level. It is at the $20 level that we should see a massive amount of resistance and a lot of headline risk. Breaking above that level would of course be big news, and people will continue to try to pick it up. In the present central bank regime, I have no interest in trying to short this market as it has such a bullish run over the last several months.