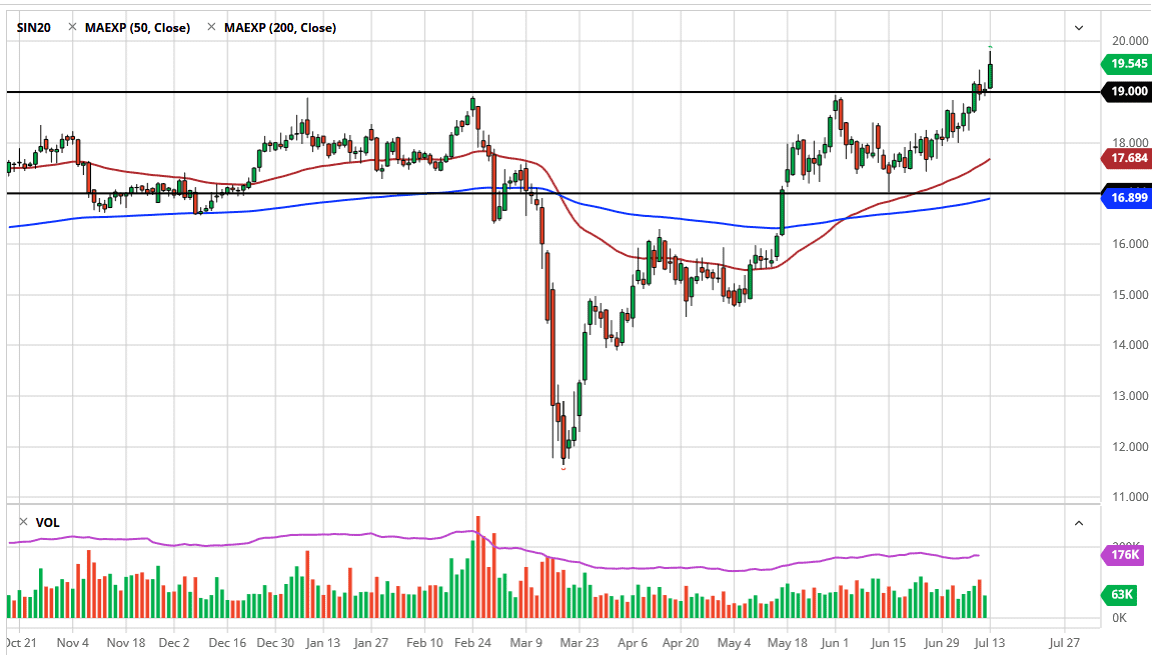

Silver markets have rallied again during the trading session on Monday to kick off the week but gave back quite a bit of the gains late in the day as the US dollar suddenly surged in value. As the day wore on, we got word that California was shutting a lot of things back down, and that had people jumping into the treasury markets in the US dollar for safety in general. With that in mind, people will then begin to question whether or not there will be a demand for silver, which is not only a precious metal, but it is also a significant industrial one. If the industry is not working at full tilt, it obviously does not need much in the way of commodities like silver. If that is going to be the case, then it is likely we will drop towards the $19 level underneath. That is an area that should cause a certain amount of support.

To the upside, the $20 level will be a significant barrier, but I do think that it is the ultimate target for the silver market. With all that in mind, I believe that we are more than likely going to continue to see an uptrend, but it is going to be choppy and messy all the way to the top. If we continue to see a lot of concerns out there it would make sense that the silver markets could pay the price for being a precious metal and an industrial one at the same time. As long as there is a serious lack of demand, obviously there will be a serious lack of demand for the contract as well. That being said though, I do think that eventually the buyers come back based upon the fact that silver has been so strong.

To the upside, if we get above the $20 level it is likely we will go looking towards the $50 level again, which is the long-term target for those who believe that we are heading back into a scenario like the Great Financial Crisis. Obviously, it would take quite some time to get there but alas that we broke above $20 with any sustainability, that is exactly what happened. I have no interest in shorting this market right now, as long as the Federal Reserve is out there printing.