The silver markets have gone back and forth during the trading session on Wednesday as the FOMC has spoken, reiterated and the fact that they are willing to flood the markets with US dollars. Silver has had a massive boost because of this, and at one point over the last couple of days we had gained as much as 7%! That is far too much impulsivity to hang on to in the short term, but I do think that given enough time we will find buyers underneath to take advantage of cheaper prices.

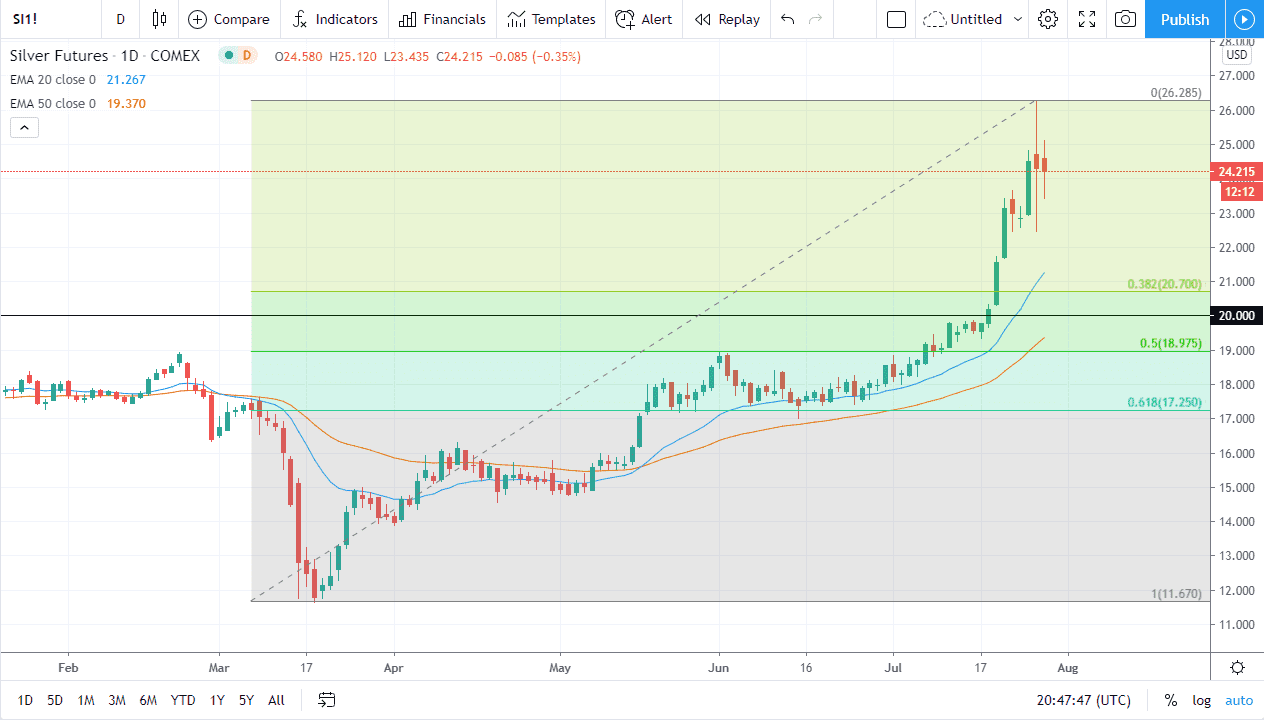

There are a multitude of areas where I can see buyers getting involved, with the $23 level being a possibility. After that, we have the $22 level, and then the $21 level. We even could go as low as $20 and still find buyers, because by the time we get down there it is very likely that the 50 day EMA will be crossing at the same area. Ultimately, you can also look at the Fibonacci retracement toll that I have laid out on the chart, as the market has been so strong for so long. Pullbacks at this point should offer plenty of value and I think it is only a matter of time before traders will see it as such. In general, I recognize that the market has gotten ahead of itself, but it still has plenty of fundamental reasons to rally.

The idea of liquidity pushing it higher makes quite a bit of sense, but beyond that the possibility of some type of economic recovery would also drive the idea of usage higher. In general, though, it is likely that we will continue to see buyers on dips so even if we knew that it was going to break down over the next couple of days, it would be foolish to try to short this market. Simply waiting for value is the only way to go. If we break above the huge candlestick from the Tuesday candlestick, then it is going to become even more dangerous to get long of this market. We desperately need a pullback in order to get long again, because quite frankly the silver market is extraordinarily volatile, and you can get seriously hurt if you pay too much for it. Be patient, look for value, and look to buy silver.