The NASDAQ 100 is very volatile to say the least, especially considering that after hours on Thursday there will be a slew of announcements when it comes to the earnings season, as four of the world’s largest technology companies are reporting after the bell. At the end of the day this is about liquidity so if we see some type of selloff after Google, Netflix, Facebook, or any of the others, it is likely that we will see plenty of buyers anyway due to the fact that the Federal Reserve is going to continue to throw money at people.

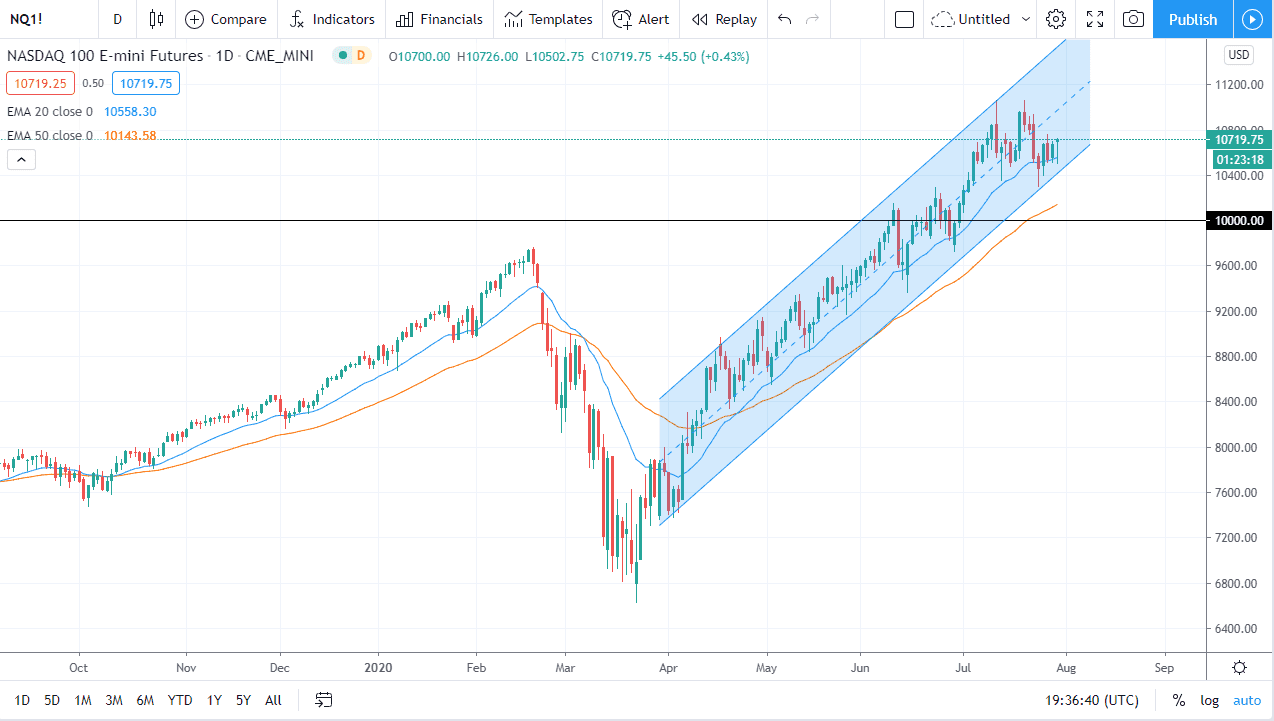

The 20 day EMA continues offer a bit of support and of course we have the bottom of the channel that I have drawn on the chart, although to be honest it is more about the Federal Reserve than technicals at this point. The market will likely go looking towards the highs again, although it is a Friday, we are heading into so that could cause some issues. Nonetheless, you cannot sell the NASDAQ 100, nor can you sell any other stock index at this point as central banks continue to liquefy everything.

I know it sounds curt and a bit simplistic, but that has been the argument for 12 years. Yes, occasionally we get some type of massive selloff but at the end of the day it is short-lived. It seems like a whole lifetime ago that we had the massive selloff in the stock markets, but you can see that we have recovered rapidly, and I think that is going to be the name of the game here: do what the Fed allows. The Federal Reserve currently allows buying risky assets as they continue to flood the markets with money, devaluing the US dollar.

Another thing that is worth paying attention to is the fact that some of the world’s biggest technology companies are doing quite well, and as a result that will drive the NASDAQ 100 higher also. Obviously, the earnings call can cause a bit of chaos, but I think it would be short-lived at best. After all, there is a certain amount of “groupthink” when it comes to Wall Street, and therefore it is only a matter of time before somebody causes others to buy the same handful of stocks, based upon some type of mental gymnastics. I have been watching this for 12 years, so I continues to be the case.