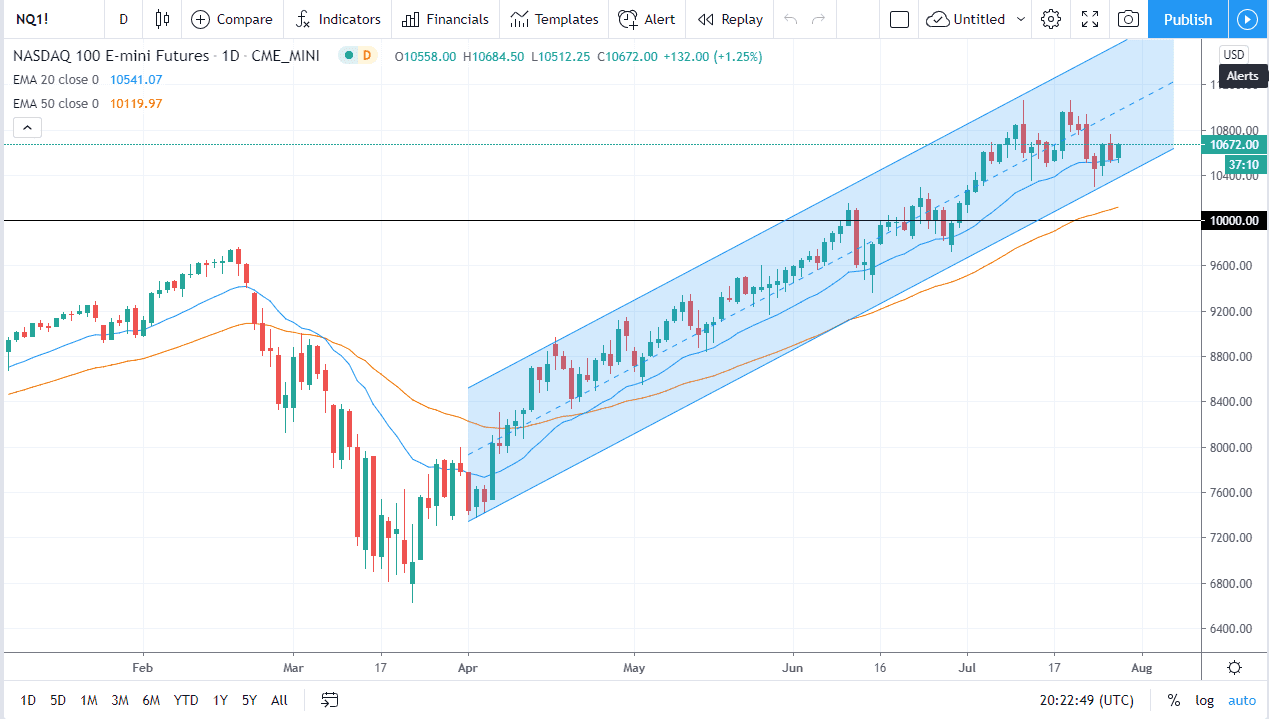

The NASDAQ 100 has shown itself to be resilient over the longer term, and as we pulled back a bit during the trading session on Wednesday, it offered enough value near the 20 day EMA to attract traders to the long side. I think at this point we are likely to continue in the up trending channel now that the FOMC meeting is out of the way, and the Federal Reserve continues to promise to support Wall Street over the longer term. I think at this point is all but impossible to short stocks, as liquidity is the name of the game.

Even if we were to break down below the 20 day EMA, the 10,400 level could offer support, just as the 50 day EMA could which is sitting just above the 10,000 level. I think the “floor” in the market overall is at the 10,000 level, so it is likely that the buyers will be waiting down there as well. If we were to break down below that level it could lead to something a little bit more significant, but quite frankly in this fundamental environment is difficult to imagine where the NASDAQ 100 drops significantly, as there is plenty of reason to think that the Federal Reserve will step in and pick it up if it falls. After all, they have shown their desire to do that before, despite what they may say. It is a matter of watching what someone does as opposed to what they say.

Over the longer term, I think that we will continue to see liquidity measures push the indices higher and we are almost certainly getting ready to see this market try to break out above the recent all-time highs. Once we do, then 11,500 would be my target. To the downside, if we were to break down below the 10,000 level then I would simply stand to the side and wait for some type of signal off of a daily candlestick to start buying again. At this point, the only way that I am looking to short the NASDAQ 100 is if there is something catastrophic with the economy, or if the Federal Reserve is looking to get out of the game of forcing liquidity down the throats of everyone. It is difficult to see how this changes anytime soon.