As expected, gold prices continued to achieve gains, and reached the resistance at $1797 an ounce, the highest level in nine years, and closer than ever to the $1,800 psychological resistance. Gold gains came as the US dollar weakened, and investors rushed to the yellow metal amid uncertainty over the pace of the economic recovery, as well as rising numbers of Covid-19 cases in many US states and other parts of the world, raising concerns about the possibility of another shutdown, and thus a setback for the global economic growth.

Silver futures have risen to $18.699 an ounce and the white metal has exploded in recent months, rising 22% since mid-April. Silver prices have also increased 4% so far this year after falling for most of 2020. Meanwhile, copper futures rose to settle at $2.7970 a pound.

Many analysts warn that the latest upbeat data could be reversed in July as the return of cases in some states will lead to another business shutdown. For his part, Anthony S. Fossey, director of the National Institute of Allergy and Infectious Diseases, said the United States has reported record increases in new cases of Covid-19 in the first five days of July, according to Reuters statistics.

Florida is once again closing its restaurants for indoor dining, gyms and other indoor places just weeks after it reopens. On the other hand, the US Federal Reserve official, Rafael Postic, told the Financial Times in an interview that there are signs that the US recovery is "stabilizing."

Precious metals primarily benefit from concerns about the re-emergence of COVID-19 in more than a dozen US states, as USA has reported a significant increase in confirmed cases, which has led to fears that this will affect the economic recovery. The increase in cases led to increased concerns from companies that the government might have to re-impose strict closure measures again, which would inevitably paralyze smaller companies and cause a stock market crash.

The United States of America officially has more than three million people infected with coronavirus and 133,000 deaths. Unlike other major countries, the United States did not level the curve, and instead saw a major boom. Most of the American cases are in the northeast; Florida, Texas, California and Illinois

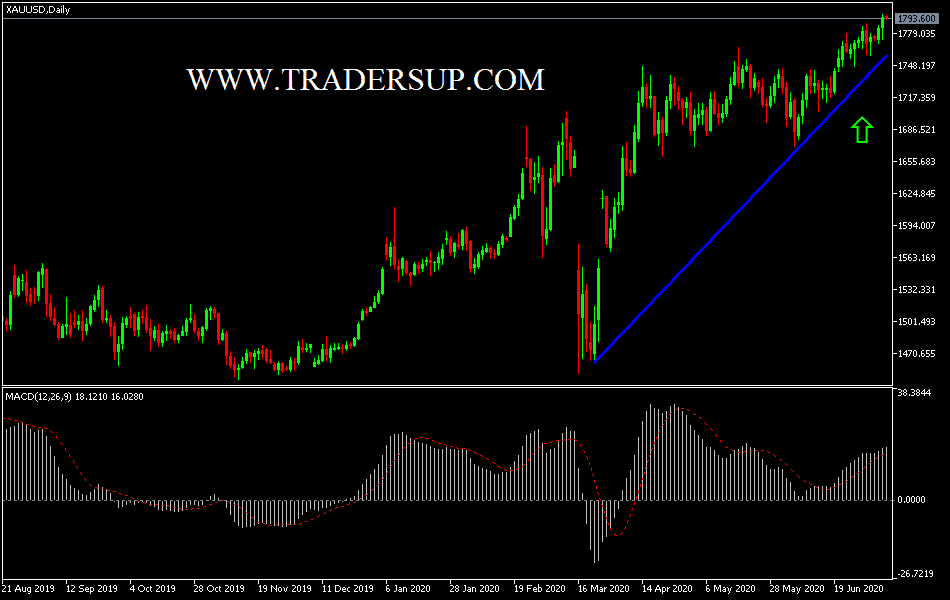

According to the gold technical analysis: Bulls control of gold prices is still the strongest, but it must be taken into account the emergence of strong signals of technical indicators reaching overbought areas, which may be followed by profit taking sell-offs at any time. The psychological resistance level at $1800 is still a legitimate target for bulls, and the closest resistance levels now are 1812 and 1820. On the other hand, sell-offs expected to push prices towards 1784, 1772 and 1760 levels, respectively.