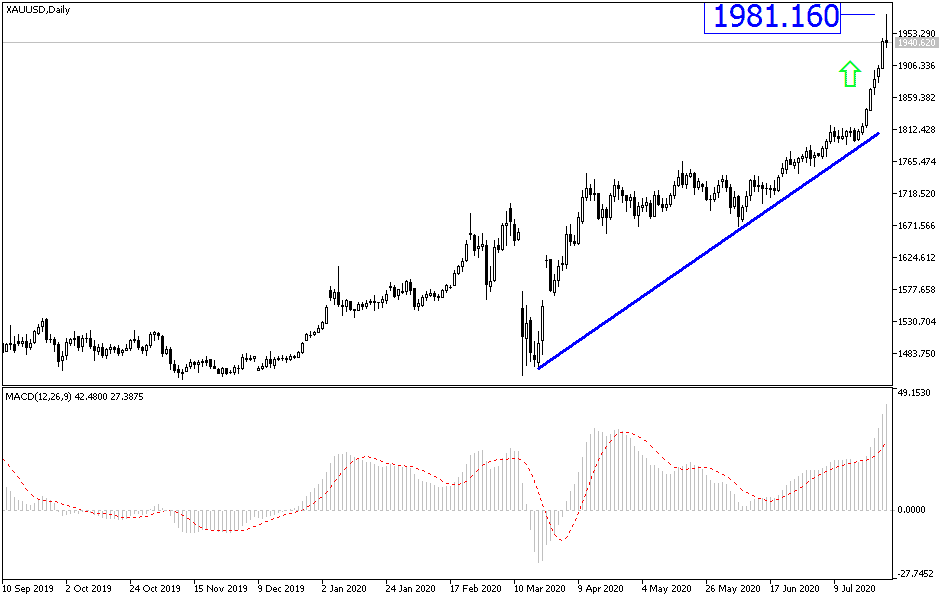

Non-stop gains distinguishes the gold performance in the last period on Tuesday morning, the price of an ounce of gold reached $1981, the highest ever, before settling around the $1936 an ounce. Contributing to those gains was the dollar's drop to a two-year low amid escalating tensions between the United States and China and optimism about more stimulus from the Federal Reserve. The Fed will announce its latest monetary policy decision on Wednesday.

As for Coronavirus news, the global Covid-19 virus cases exceeded 16 million during the weekend, with more than 644,000 deaths. China recorded the largest number of cases in three months after the epidemic hit three separate regions. For its part, the UK government announced a 14-day quarantine for travelers from Spain. In Spain itself, more than 900 new cases were reported on Friday.

On geopolitical news, tensions between the United States and China have escalated amid issues ranging from vaccine development companies and Huawei's communications equipment to China's territorial claims in the South China Sea and Hong Kong. Many observers are pessimistic about the deterioration of US-China relations after the closure of the consulates in Houston and Chengdu.

All doubts about the global economy, the pandemic, and how long interest rates remain at almost zero have helped push gold price higher, making it the best-performing investment for 2020. Recently, the US dollar weakness and concerns over escalating tensions between the United States and China gave gold an additional boost towards its highest level in history. Both countries have already suffered heavy losses in the tariff war that broke out between them in 2018 due to Beijing's technological ambitions and trade surplus. And if talks on ending the conflict fail, the world may face downward pressure one trade at a time when the global economy is already suffering from the deadly virus pandemic.

On the economic side. After a major pickup in new US durable goods orders that were reported for the previous month, the US Department of Commerce released a report showing that durable goods orders continued to rise sharply in June. The ministry announced that durable goods orders rose 7.3 percent in June, after jumping 15.1 percent in May. The continuous increase comes after the observed drop in March and April.

Economists had expected US durable goods orders to jump 7.2 percent, compared to the 15.7 percent jump reported in the previous month. Transportation equipment orders helped lead the way again, rising 20.0 percent in June after rising 78.9 percent in May. The report also said that orders for cars and spare parts increased by 85.7 percent, more than offsetting a sharp decline in aircraft and parts orders.

Excluding the large increase in transportation equipment orders, durable goods orders were still up 3.3 percent in June after rising 3.6 percent in May. Previous transportation orders were expected to rise 3.5%. Orders for manufactured metal products, primary metals and machinery increased significantly, which contributed to the significant rise in previous transportation orders.

According to the technical analysis of gold: There is no change in my technical view. The general trend of gold is still bullish. We are awaiting correction by profit taking selling. The technical indicators have all reached the peak of overbought area, and it seems that the correction came quickly this morning with the stability of the price around $1935 after the price reached the highest level in history at $1981 this morning. News of a major development for the vaccine that eliminates the epidemic was a valid reason for rapid retreat taking into account that retreat would be an opportunity to form the starting base again. Therefore, the closest support levels for the gold price are now 1930, 1910 and 1875, respectively. Today's economic calendar focuses solely on the announcement of American consumer confidence.