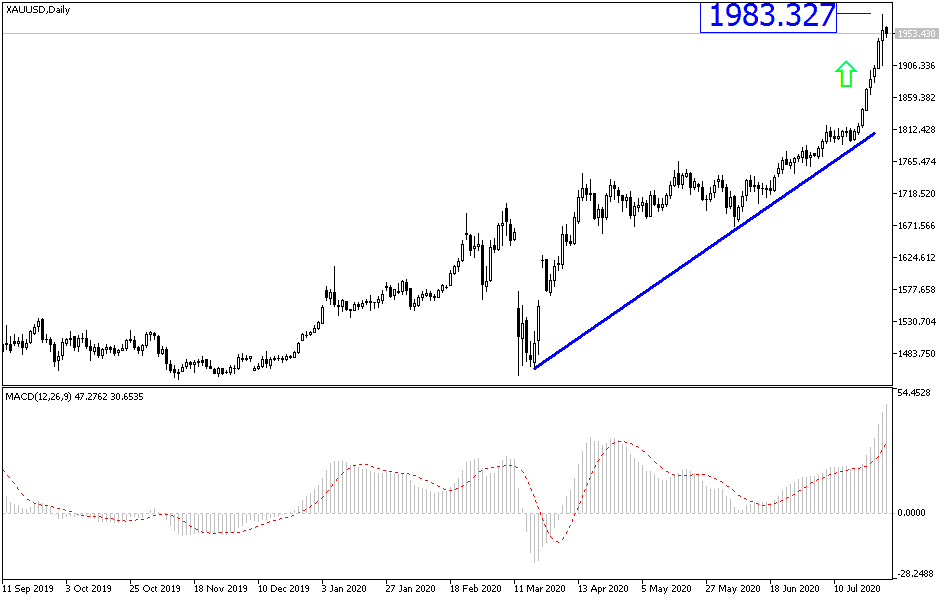

At the beginning of yesterday's trading, gold's price jumped to $1981, the highest in history. Immediately after the announcement of expanded experiments on vaccines to counter the pandemic of COVID-19, markets found the opportunity to have profit-taking sales that pushed prices towards $1906, and with optimism evaporating quickly, the price returned to rise towards the $1964 an ounce at the time of writing, preferring to wait for the US Federal Reserve to announce its monetary policy decisions later today, Wednesday. The reaction will be strong on the US dollar performance and, accordingly, on the price of gold. The recent collapse of the US dollar, coupled with the uncertainty about the health of the global economy, was a strong driver of the yellow metal, although US growth forecasts may be more important to the metal forecasts when updated by the US central bank.

Investors flocked to gold this year, especially since May, although gains increased in the past week, with the price of the yellow metal rose more than 7% to maintain a 10% increase for July and a gain of 28.5% in 2020 until now.

The July rally coincided with a significant depreciation of the dollar relative to other major currencies and strong gains for stock markets, although it also coincided with a surge in the outbreak of the COVID-19 virus in the world's largest economy as the United States tops global pandemic cases and deaths. Gold looked better when the virus shut down the economies of Europe and North America, prompting unprecedented government actions and reinventing global central bank instruments to combat crises.

The result has been new lows of bond yields and significant increases in the supply of major paper currencies. The most prominent in this regard was in the United States where the Federal Reserve launched an unlimited quantitative easing program and printed new money to purchase not only federal and local government bonds but also co-debt. "The yellow metal has a tendency to rise when real interest rates fall because it reduces the opportunity cost of its contract," says Matthew Arseno, deputy chief economist at the National Bank of Canada Financial Markets. At yesterday's close, the 10-year TIPS yield was at -0.90%, which basically corresponds to the record low recorded in December 2012, and “is there a risk of a sharp reversal in real rates in the coming months as we saw in 2013? We don't think so”. He added.

The increase in government spending, which came amid the unprecedented needs of the US economy, saw the Federal Reserve balance sheet increase from $4.2 trillion to more than $7 trillion in early June even as bond yields fell to new lows amid increasing demand from the lender. This affected the dollar and saw "real returns" - coupon payments that are expressed as a percentage of return but adjusted as per inflation - and returned to previous historical lows.

Monetary policymakers around the world are following the same path, but its release from the world's largest central bank has pushed up the price of gold, which is negatively correlated to both the falling US dollar and bond yields once adjusted for inflation.

According to the technical analysis of gold: The general trend of the gold price is still bullish and strongly so, and the price does not care that technical indicators reached the overbought areas, as factors of its gains remain the strength of the COVID-19 virus in paralyzing the global economy, US/Chinese tensions, more stimulus to revive the US and global economy and a strong drop for the US dollar. The latest performance will support expectations of the opportunity for the price of gold to reach the next psychological resistance at $2000 an ounce. From there and above, we prefer selling in anticipation of a sharp profit-taking sell-offs. The first opportunity for bears to control performance may be if the price moves towards the support level at $1880.