Renewed global geopolitical and trade tensions, along with continued concern about the renewed outbreak of the COVID-19 pandemic, were important factors in the return of gold price stability around and above $1,800 an ounce, which is an important resistance level. During yesterday's trading session, gold fell to the $1791 support, but events were quick, and investors returned to buy the yellow metal as a safe haven, pushing gold towards $1811 an ounce at the time of writing, near its highest level in nine years. Prices are still likely to achieve more gains if investor anxiety increases about the future of reopening global economic activity in light of the increasing pandemic cases around the world, in addition to increasing tensions in particular between the United and China.

Yesterday, the Japanese government announced that China is pressing hard to make territorial claims in regional seas and even to use the coronavirus pandemic to expand its influence and obtain strategic superiority, which poses a greater threat to Japan and the region. The report, which highlights the government's defense priorities by Prime Minister Shinzo Abe government, was adopted less than a day after the Trump administration almost completely rejected all of Beijing's important maritime claims in the South China Sea in a statement likely to deepen the rift between the United States and China.

The defense white paper issued by the Abe government highlights potential threats to China and North Korea as Japan tries to increase its defense capability. Under Abe, Japan steadily increased its budget and defense capabilities and bought expensive American arsenals. Japanese Defense Minister Taro Kono recently canceled the deployment of a pair of expensive American missile interception systems due to technical problems, and Abe quickly announced his intention to review Japan's defense guidelines, which could allow Japan to bypass its traditional defense role only under the Japan-US security alliance, including discussing the possibility of gaining a preemptive strike ability.

The white paper accused China of using propaganda, including spreading misleading information about the spread of coronavirus. The report also indicated that North Korea continues to develop its nuclear and other weapons programs. According to the report, North Korea "is relentlessly pursuing increasingly complex and diverse attack methods, and it is constantly enhancing and improving its offensive capabilities." It said that since May 2019, North Korea has launched three types of new short-range ballistic missiles that use solid fuels and fly at lower altitudes than conventional missiles that could penetrate the Japanese missile defense system.

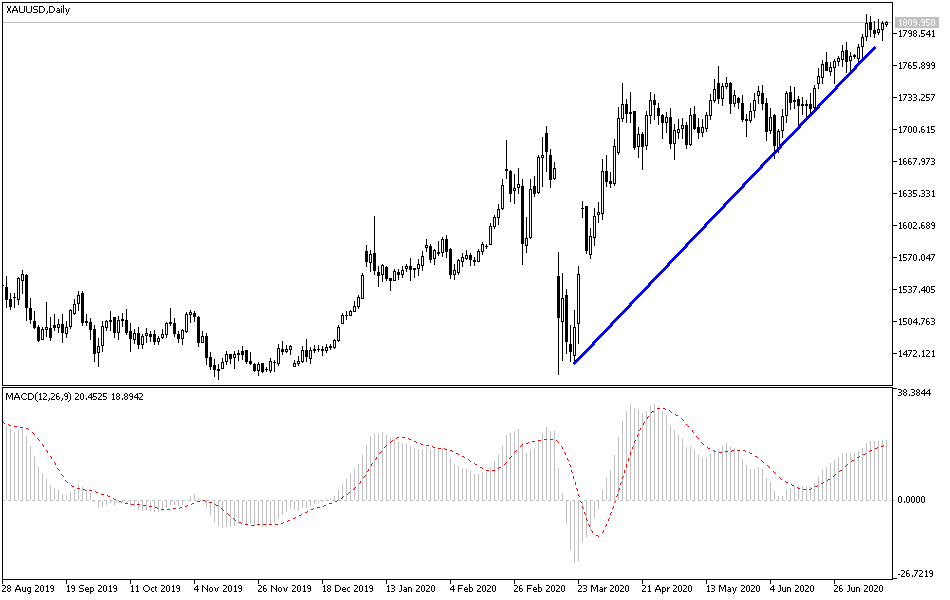

According to the technical analysis of gold: Based on the above, it is clear that the price of gold is set to achieve further record gains, especially with stability above the $1800 psychological resistance. Investors cautiously monitor government measures for global economies now to face a new outbreak of the COVID-19 pandemic and US/Chinese relations to determine the path of their financial positions and may be interested in buying safe havens led by gold for a longer period. Accordingly, the closest resistance levels for gold are currently 1818, 1827, and 1840, respectively. Bulls’ dominance of performance is still the strongest. On the other hand, the profit-taking sell-offs at any time may collide with support levels at 1789, 1775, and 1760, respectively. In general, I still prefer to buy gold from every lower level.

As for the economic agenda data: Investors will interact with the announcement of monetary policy for both the Japanese central bank and the Bank of Canada, in addition to the announcement of the UK inflation figures and the US industrial production rate data.