Gold prices rose sharply and gold futures settled at their highest level in almost 9 years, supported by the European Union's announcement of a Eurozone recovery fund, and optimism about the new stimulus in the United States. The sharp decline in the US dollar also contributed to the noticeable rise of the metal, pushing the price to $1866 an ounce, and settling around the $1857 at the time of writing. In the same performance, September silver futures rose $1.365, or about 6.8%, to $21,557 an ounce, the highest contract settlement since March 2014. Meanwhile, copper futures settled in September at $2.9580 a pound. The gains in the metal markets came despite optimism in the markets, but the weakness of the US dollar was the strongest catalyst for achieving these record gains.

Yesterday, after a long wait, European Union leaders agreed to a package of 1.8 trillion Euros of measures to address the exceptional nature of the economic and social situation posed by the Covid-19 pandemic. After four days of marathon talks in Brussels, European Union leaders approved the package, worth 750 billion Euros. Accordingly, the bloc will jointly issue the debt, which will be provided to the member states most affected by Covid-19.

Of the 750 billion Euro recovery plan, 390 billion Euros will be in grants and 360 billion Euros in low-interest loans. Now the deal must be approved by the parliament of 27 member states. According to the original plan, 500 billion Euros were allocated for grants and 250 billion Euros in loans.

Before recent gains, Citibank expected that the new gold price record would be achieved and that it was only a "matter of time." Gold price continues to rise as investors continue to accumulate hard assets amid a torrent of easy money in the global financial markets and expectations of a long period of extremely low-interest rates. The price of gold has now risen by 19.7%, or $300 an ounce so far this year. The last time gold traded above $1,800 an ounce was in September 2011, but it ended that year at $1,565 an ounce.

According to Bloomberg, and based on commodity expectations in the third quarter from Citigroup, the gold price “is expected to rise to an all-time high in the next six to nine months, and there is a 30% chance that it will exceed $2000 an ounce in the next three to five months. ”

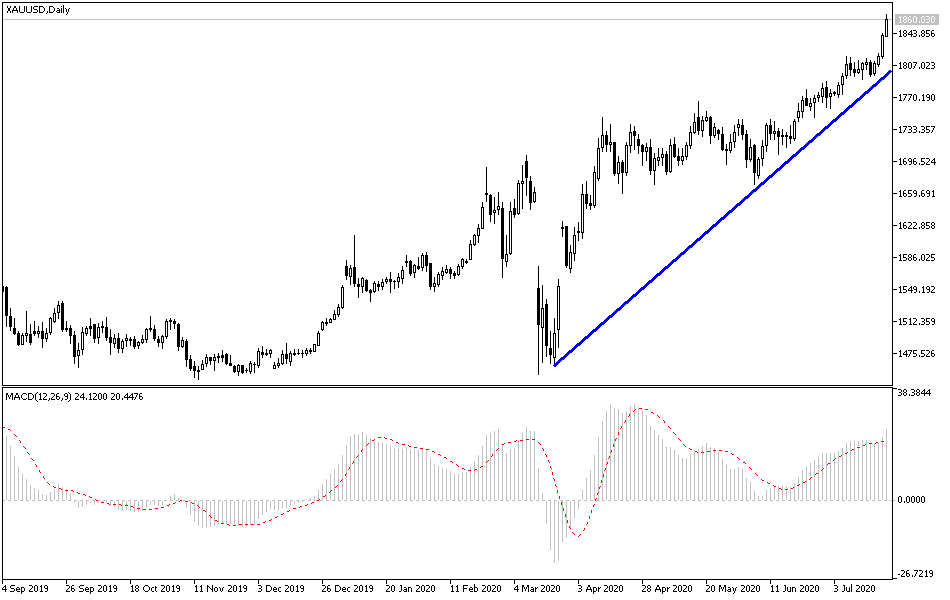

According to the technical analysis of gold: On the daily chart of the gold price, the technical indicators have reached sharp overbought areas, and are waiting for profit-taking sales at any time. The closest resistance levels for gold are currently at 1860, 1872, and 1890, respectively. I do not currently recommend buying gold after the recent win marathon. There will be no chance for the bears to take control without breaking through the 1800 level. The yellow metal will continue to react to the performance of the US dollar and the extent of investor risk appetite amid developments of the COVID-19 virus.