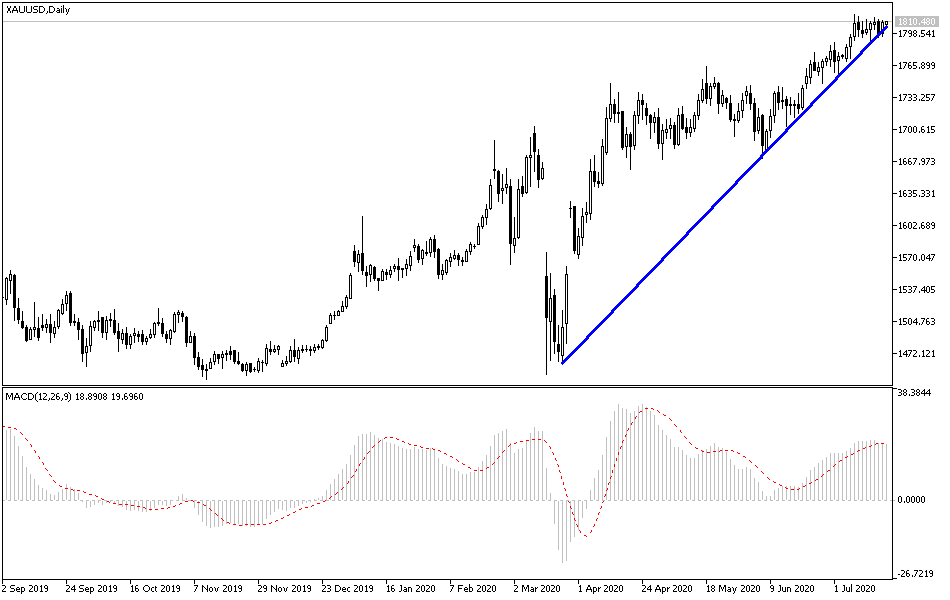

The factors supporting the continuation of gold ounce’s price gains to new highs are still in place, which explains the stability of gold prices above the $1800 psychological resistance, which is near its highest level in nine years. This performance may remain the same for a longer period of time, until the disappearance of the Coronavirus, the calming of tensions between the United States of America and China, solving the Brexit problems and the and European economic stimulus, and all this may take months. Gold price is stable at around $1810 at the time of writing. Investors rushed to the metal as a safe haven amid uncertainty over the pace of economic recovery from the slowdown caused by Covid-19, and in the hope that global central banks will come out with a new incentive to boost economic growth.

Ongoing concerns about tensions between the United States and China and the weakening USD also contributed significantly to the rise in gold for the sixth straight week.

As for other minerals. Silver futures advanced about 1% to $19.764 an ounce, recording gains of about 3.75% for the past week. Copper futures settled in September at $2.9045 a pound, recording 0.2% gains last week.

In economic news, a report from the University of Michigan showed an unexpected deterioration in US consumer sentiment in July. The preliminary report said that the consumer confidence index fell to 73.2 in July after jumping to 78.1 in June. The downturn surprised economists who expected the index to rise to 79.0. A report by the Commerce Department showed that US housing starts rose 17.3% to an annual rate of 1.186 million in June after jumping 8.2% to the 1.011 million in May. Economists had expected housing starts to rise by 20% to 1.169 million from 974,000 reported in the previous month.

The report also said that US building permits increased 2.1% to an annual rate of 1.241 million in June, after rising 14.1% to a dropping rate of 1.216 million in May. Building permits, an indicator of future housing demand, were expected to jump 5.7% to the rate of 1.290 million from the 1.220 million that were originally reported for the previous month.

According to the technical analysis of gold: The general trend remains bullish and holding on to stability around and above the $1800 resistance is still a motivation for bulls’ control over performance for a longer period, and the factors that we mentioned at the beginning of the analysis will remain a catalyst for gold in testing higher levels, with the closest ones currently are 1815, 1827 and 1840 dollars, respectively, reaching these levels means all technical indicators reaching overbought areas, which means that the profit taking sell-offs will be strong. And there will not be even a limited opportunity for the bears to control performance without breaching support levels at 1790, 1775 and 1760, respectively.

There are no significant economic releases affecting the price of gold today.