For the third consecutive day, gold ounce price was not able to overcome the $1981 resistance barrier, the highest in the history of the yellow metal, which confirms how overbought gold is after the recent price jumps. Markets await the spark of the green giant comeback to activate the profit-taking sales on the price of gold today, tomorrow, or at any time. Gold price settled around $1956 an ounce at the time of writing. Gold price continues to rise sharply for the ninth session in a row, thanks to the continued demand for safe havens amid the relentless boom in COVID-19 cases worldwide. In addition to that, what supports gains of the metal is the increased tensions between the United States and China to unprecedented levels and the endless stimulus by the global central banks and governments to revive the global economy in the face of the epidemic effects.

After ending the session at a new record closing level, gold futures gained more in electronic trading after the US Federal Reserve Board said it plans to keep interest rates near zero until the economy improves.

Prior to their decision, a report issued by the National Association of Realtors said that pending home sales in the United States of America showed a significant increase in June. NAR said the Pending Home Sales Index rose 16.6% to 116.1 in June, after jumping 44.3% to 99.6 in May. Economists had expected pending home sales to jump 15%.

In a widely expected move, the Federal Reserve announced yesterday that interest rates will remain at levels close to zero amid the economic hardship posed by the Corona pandemic. Accordingly, they decided to keep the US interest rates between zero to 0.25%, and this statement indicated that economic activity and employment have recovered somewhat in recent months after sharp declines, but are still well below their levels at the beginning of the year.

In part, the US central bank attributes this recent improvement in public finances to policy measures to support the economy and the flow of credit to American households and companies. They also reiterated that they remains committed to using a full set of tools to support the US economy in this difficult time. In addition to maintaining interest rates at current levels until they are confident that the economy has surpassed recent events, the Fed said it will also continue to increase its holdings of Treasury bonds and residential and commercial mortgage-backed securities at least at the current pace.

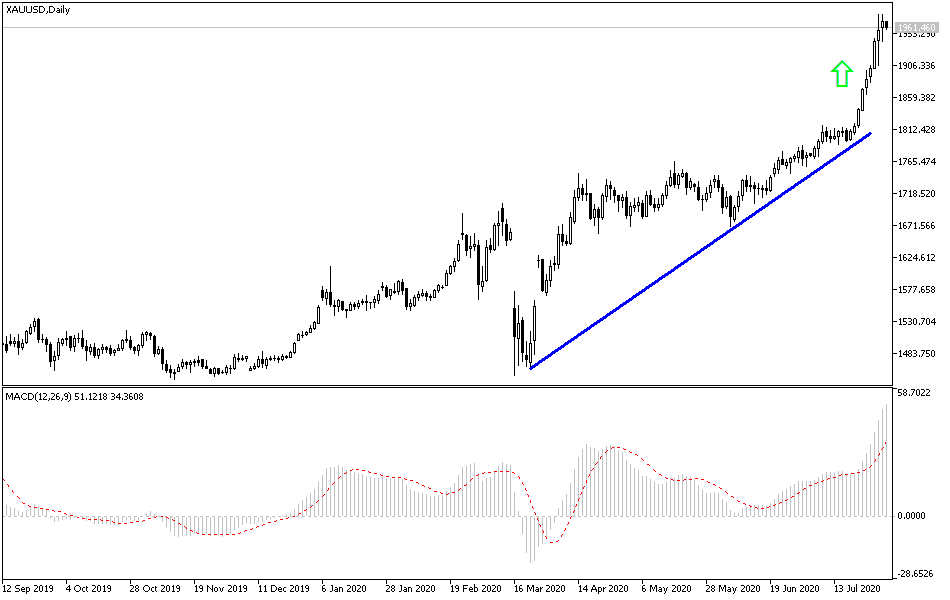

According to the technical analysis of gold: Gold prices is settled in the neck of the current bullish channel and all technical indicators confirm that the price has reached sharp overbought areas awaiting just the right moment to activate the profit-taking operations. Resistance levels 1978, 1990 and 2015 may be the most appropriate right now to determine the expected selling deals. On the downside, there will be no downward trend without the yellow metal breaching the $1885 support. Gold will react today to the announcement of the US economic data; the gross domestic product growth and weekly jobless claims.