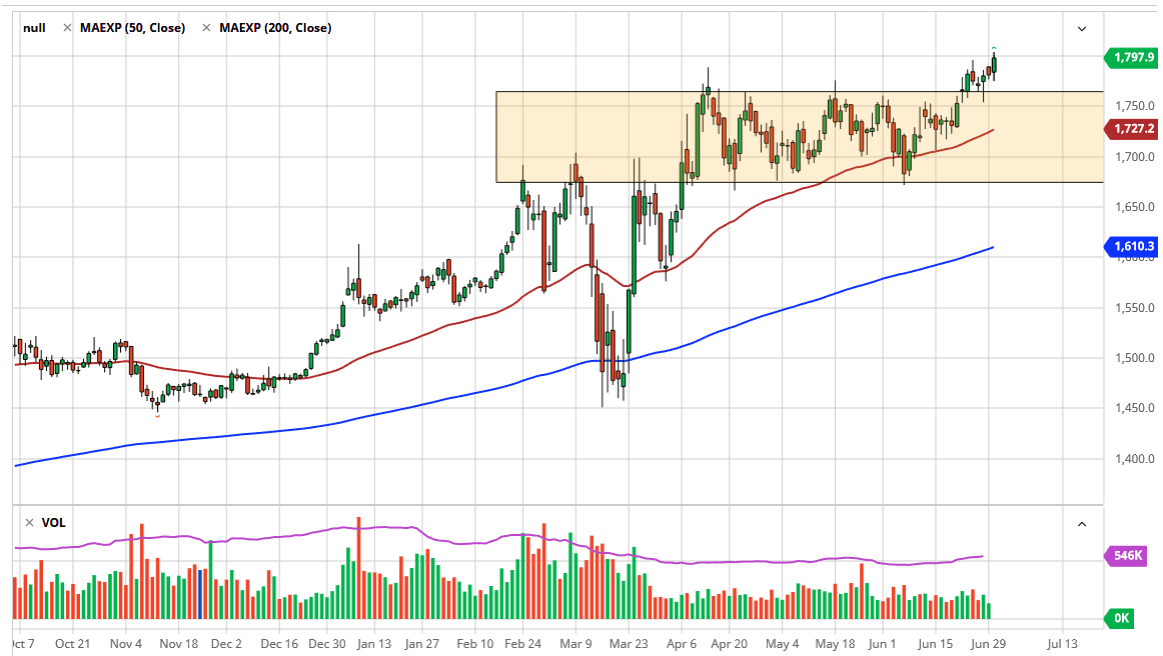

Gold markets initially pulled back a bit during the trading session on Tuesday but then turned around to show signs of strength again. The $1800 level was tested and even pierced that one point, but we could not stay above there for long. Because of this, the market looks like it is trying to finally break out to the upside, but it is obvious that we are going to continue to see a lot of noise. I do think that eventually, we continue to go higher and take off for a bigger move. The short-term pullback should continue to be buying opportunities, and as a result, it looks like the $1750 level should be supported based upon the recent price action.

If we were to break down below there, I am still not going to be bearish of gold, as the 50 day EMA sits closer to the $1727 level. I think there are plenty of buyers between these two levels, and even if we were to break down below there, we still have plenty of support near the $1700 level. In other words, there are a ton of areas where buyers might return to the market on any type of pullback.

When you look at the chart, you can see that we are quite positive over the longer term, and the last couple of days have shown the resiliency of the market, which wants to go higher. I think given enough time we will, as breaking above the $1800 level, albeit short-lived, is a strong sign. Ultimately, this is greatly influenced by the central bank liquidation moves by the ECB, and most importantly the Federal Reserve. Gold has broken out against other currencies, so it is only a matter of time before it does the same against the greenback.

Unless there is some type of major change in the overall attitude of central banks, I find it exceedingly difficult to imagine the idea of shorting gold. Yes, we could pull back a bit but again, I think it is only a matter of time until finding a pullback that show signs of resiliency and strength that we can take advantage of and go long yet again. I believe that if we can continue the upward momentum, the market is likely to go towards the $2000 level. Obviously, that is a longer-term call, but I do think that is where we are going over the next several months.