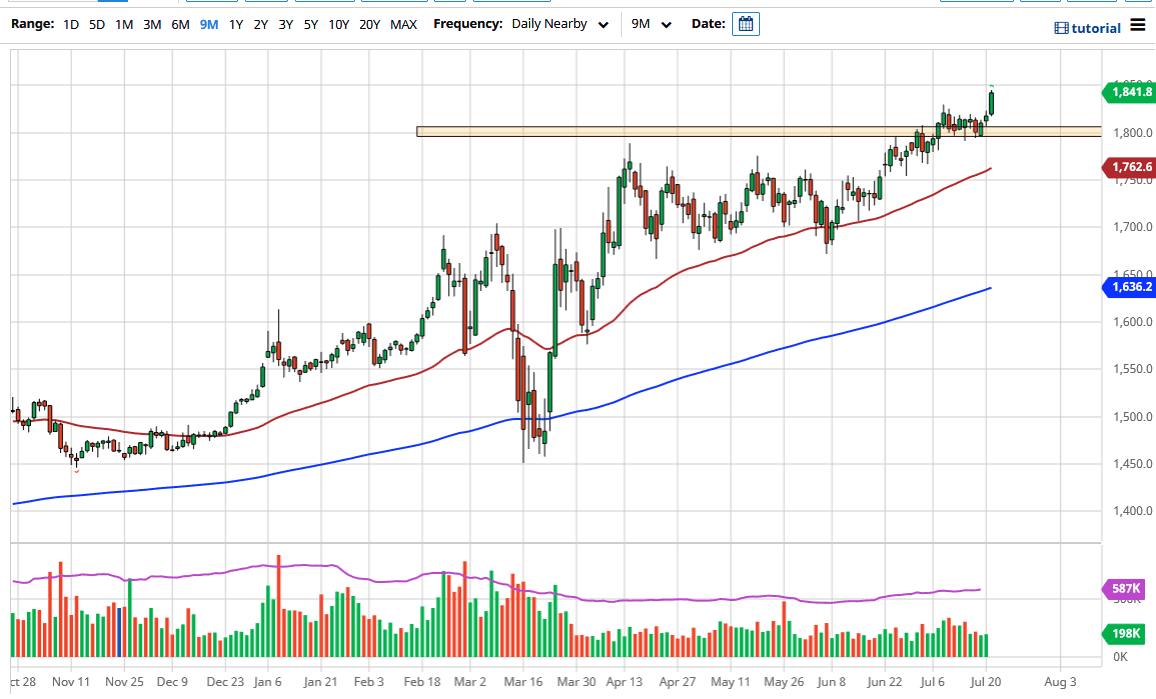

The gold markets rallied significantly during the trading session on Tuesday as we are reaching towards the $1850 level. At this point in time it is likely that pullbacks will continue to offer buying opportunities as gold is obviously going to benefit from the softening US dollar. The US dollar has been absolutely hammered during the trading session on Tuesday and I think that will continue to be the case going forward. The most widely followed currency pairs involving the US dollar are all breaking away from the US dollar, as the Euro has broken above the 1.15 handle, and then the Australian dollar broke above the crucial 0.71 handle.

At this point in time, I think that the $1800 level underneath will be a massive support level, as it was massive resistance. It is also a large, round, psychologically significant figure, so therefore I think that the market is probably going to continue to see that level as crucial. Furthermore, the 50 day EMA is starting to reach towards the $1800 level, which has broken above the $1750 level over the last couple of days. All things being equal, we are in a strong uptrend and therefore there is no reason to fight that. Gold has been one of the best trades the entire year, although we did have a little bit of the sideways move for a couple of months. That is typical for this market, as it would go sideways for a while and then take off again. It is almost as if it needs to build up a bit of momentum.

The size of the candlestick is rather strong, so I think that it is only a matter of time before plenty of people would be looking to take advantage of this. Quite frankly, the US dollar is extraordinarily strong from a historical standpoint, so it does make sense that the US dollar drops, and that should help gold longer-term. I think at this point we are starting to see people move away from the greenback, and that will send more money into gold as it will take more of those greenbacks to buy it. I do not believe there is an opportunity to sell this market, and I do not even see a scenario where gold starts to lose its luster, pun intended.