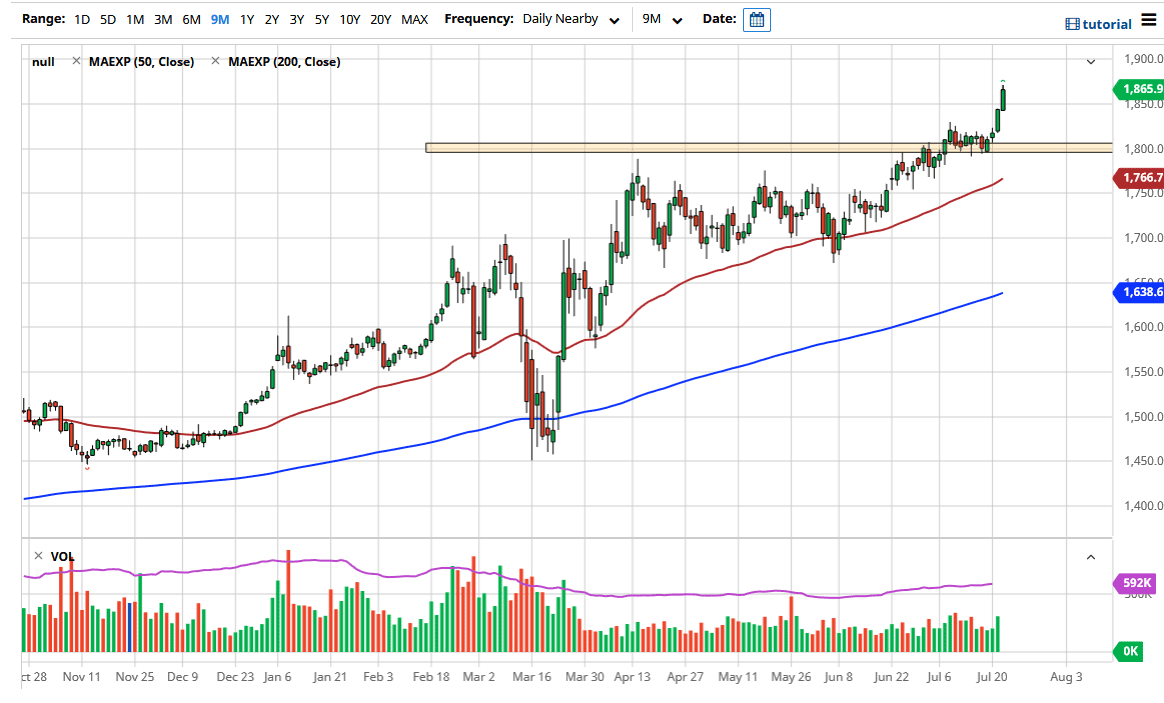

Gold markets have rallied during the trading session on Wednesday as we have broken above the $1850 level. At this point, the market is likely to see a lot of buyers on dips, as we have most certainly broken out. The US dollar has been getting pummeled, so that has made gold attractive for most traders, as we have been in a longer-term uptrend. To the downside, the $1800 level was significant resistance, and now it should be significant support. Beyond that, it is also a psychologically important figure so a lot of traders will be paying attention to it. Furthermore, the 50 day EMA sits below the $1800 level and will offer a significant amount of support as well, perhaps even offer a defining marker for the trend.

To the downside, if we were to break down below the 50 day EMA we will probably have to “reset” the overall trend, giving us an opportunity to perhaps buy the gold market at a cheaper level, as it would be “on sale.” Having said that, I do not really see a scenario where that is going to happen anytime soon so ultimately, I think this is a market that will offer dips occasionally, but it is going to be a while before we see the 50 day EMA.

The US dollar getting pummeled is something that you should be paying attention to, so if you have the ability to track the US Dollar Index, or perhaps the EUR/USD pair at the very least, it can give you a bit of a “heads up” as to where this market could go. That being said, I do expect a little bit of a pullback as we may have gotten ahead of ourselves and will probably have to go lower to pick up more order flow. There is no scenario where I am willing to sell gold, but I do recognize that pullbacks are likely to come. With that being the case, I am looking to find value as I go along and take advantage of it. At the very least, we need to retrace the Wednesday candlestick in order to find a bit of value. If we break out above the top of the Wednesday candlestick before pulling back, I know it is hard to watch, but it is something you need to stay out of as it could cause issues and you certainly would be “chasing the trade.”