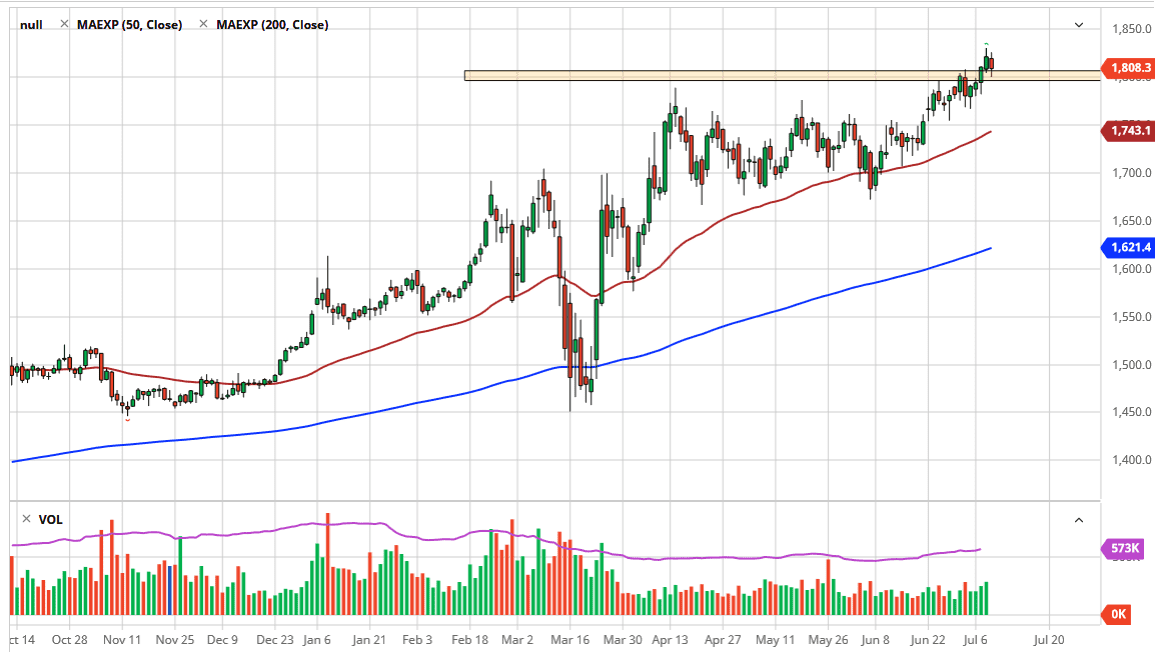

The gold market has pulled back a bit during the trading session on Thursday as we reached towards the $1800 level. We did find buyers there as you would anticipate though, and I did point out previously that this was an area I thought would keep the market somewhat afloat. Now that it has, I believe that we are more than likely going to find value hunters in this region. If it does not work out that way, then the $1775 level should be supportive, so ultimately this is simply going to be an opportunity to go long based upon “cheap gold.”

If we turn around and simply break above the top of the candlestick that is also a buying opportunity as well, because gold markets have been so bullish as of late it is difficult to imagine a scenario where we would be selling. Yes, the US dollar could very well find itself strengthening and that could weigh upon the gold market in the short term, but I think this will only be looked at as a potential opportunity for those who wish to buy gold for the longer-term move. I believe that the $1750 level will be supportive, especially as the 50 day EMA is starting to approach. In fact, at this point I do not have a scenario in which I am willing to sell gold as central banks around the world continue to dump liquidity into the marketplace, thereby devaluing currencies overall. Yes, there will be the occasional pullback, but that is just a value opportunity.

To the upside, the market looking towards the $2000 level will continue to have people bullish longer term but that does not necessarily mean that we simply go straight up in the air. I think looking for little bits and pieces of value along the way is probably the best way to go, and that of course will be demonstrated by short-term pullbacks. It is not until we see a major change in the attitude of central banks that we can start to think about selling gold. I anticipate that what we are going to see is a move to the upside, perhaps even a parabolic one eventually, and then an opportunity to sell gold for a longer-term move. Obviously, that is quite some time away, but if you look at the Great Financial Crisis, that might be a bit of a template for what it is about to happen.