During last week's trading, the GBP/USD pair increased by 1.1%, with gains pushing it to the 1.2529 resistance, and soon, the pair gave up the gains with the failure of the negotiations round between the two sides of the Brexit last week, and better than expected results for the US employment numbers for the second month in a row. Accordingly, it fell to the 1.2437 support and succeeded in achieving its first weekly gains within a month. This week’s trading started with stability around the 1.2470 level. On the economic side, the British economy contracted in the second quarter by - 2.2 percent. This was a downward revision of the initial estimate of 2.0%. This was the worst quarterly decline since 1979, as the coronavirus had a major negative impact on economic activity.

In the manufacturing sector, the final PMI came in at 50.1, close to the initial estimate of 50.2 points. The final services PMI came at 47.1, slightly higher than the initial estimate of 47.0. This still indicates a contraction, but it was a very improved figure compared to the previous reading of 29.0 points.

From the United States, the manufacturing sector improved sharply, as the ISM Manufacturing PMI rose from a reading of 39.8 to 49.6 points. Expectations were at 50.0, the level that separates contraction from growth. The US durable goods orders were sparkling in May, as the main figure increased by 4.0%, and retreated after a decrease of - 7.4%. Core Durable Goods Orders increased by 15.8%, rebounding from a previously -17.2% reading. The US consumer confidence index jumped from a reading of 85.9 to a reading of 98.1 and was better than expectation of a reading of 91.6 points. The most important was the increase in US jobs in the non-agricultural sector during the month of June by adding 4.8 million jobs, and during the month of May, 2.509 million jobs were added. Unemployment claims decreased from 1.48 million to 1.42 million claims.

The most important economic data and events that will affect the Sterling for this week:

Starting on Monday with the announcement of the U.K construction PMI reading. Building activity was close to the bottom in April, with an absurd reading of - 8.2 points. The PMI improved to a reading of 28.9 in May, and is expected to rise to a reading of 46.0 in the upcoming release. According to the data from the index, the 50 level separates growth and contraction. On Tuesday, the reading of the Halifax House Price Survey will be announced. The housing price index has recorded no gains since February. The index fell -0.2% in May and expectations are to continue the drop to a -0.6% reading for June.

On Wednesday, the RICS reading for house prices will be announced. The survey conducted by the Royal Institute of Chartered Surveyors in June showed that 32% of surveyors reported a decrease in prices compared to those that reported an increase. This indicates weak conditions in the housing market. June is expected to be a little better, with 25% of surveyors reporting a drop in prices.

The most important economic data and events that will affect the performance of the US dollar for this week:

Data this week will not be as important as the US economic releases in the past week. In general, the beginning will be with the announcement of the ISM PMI reading for US services on Monday, with expectations for a reading of 50.00 after the sector shrank in the previous release with a reading of 45.4 and there is no doubt that the reopening of the US economy contributed strongly to improving the economic data in the recent period.

On Thursday, the number of weekly US jobless claims will be announced. On Friday, the producer price index readings will be announced, which is one of the US inflation measurement data, and it is expected that it will not change from the previous 0.4% reading.

With the scarcity of important US economic data for this week, the USD will react strongly to the numbers of new coronavirus cases in the US. This virus, which was first detected in Wuhan, China in December 2019, had infected 1,090,682 people globally including 2,732,639 people in the U.S. alone as of Friday. It has killed at least 522,112 people worldwide, including 128,873 in the United States, according to Johns Hopkins University.

New York saw the largest number of deaths due to COVID-19 in the United States, followed by New Jersey and Massachusetts.

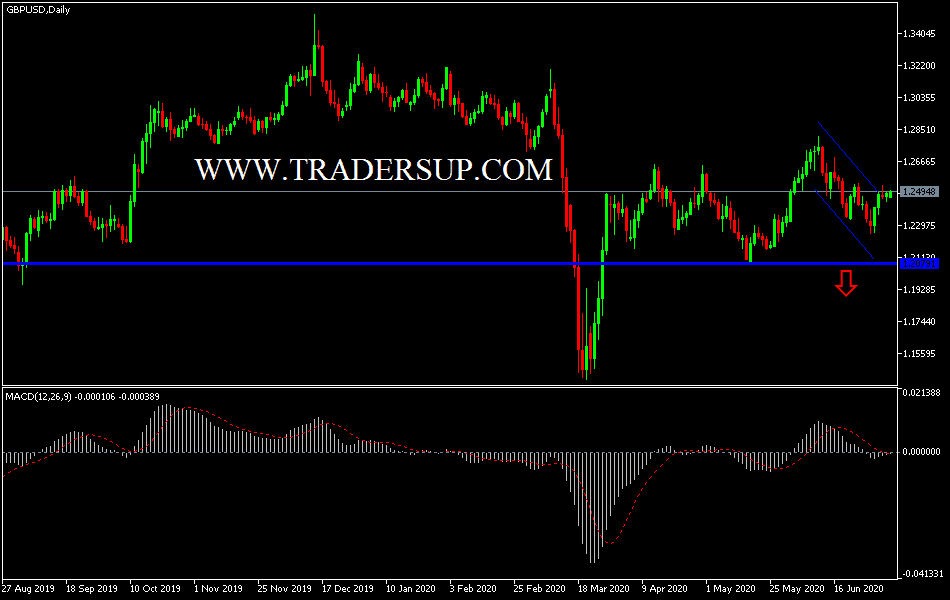

GBP/USD technical expectations this week:

The general long term trend for the GBP/USD is still downward, as the British economy continues to combat the devastating effects of the Covid-19 epidemic, coupled with the lack of clarity about Brexit progress, which will make investors reluctant to hold onto the pound for a longer period.

The most important support levels for the GBP/USD this week are: 1.2360, 1.2200 and 1.2000, respectively.

The most important resistance levels for the GBP/USD this week are: 1.2540, 1.2620 and 1.2870, respectively.