The GBP/USD gains that pushed it towards the 1.2636 resistance level may be temporary, as the British pound rose to a multi-week high against the US dollar. British Chancellor Rishi Sonak revealed a budget of 30 billion pounds in Parliament to protect the British economy from the severe downturn in the era of COVID-19. In his summary statement, Sonak announced a reduction in stamp duty in England and Wales for this fiscal year. Homebuyers will be exempt from paying the stamp duty for purchases less than £500,000 as of March 31. He said the government will reduce the value-added tax on hospitality and entertainment companies to 5 percent from 20 percent until next January.

Sunak announced a new job retention policy, with employers receiving £1,000 per employee on leave, and continuing until January. With unemployment avoided and taken into account, Sunak announced a £2 fund to create six-month employment jobs for unemployed people between 16 and 24 years old. Commenting on those decisions, Samuel Toms, chief economist for the United Kingdom at Pantheon Macro Economics, says: “It's not enough to support the V-shaped recovery.”, “In total, the financial package could lead to a cash injection of 30 billion pounds, or about 1.5% of annual GDP, although much of its success will depend on the number of companies that rehire workers”.

The pound's gains were halted after German Chancellor Angela Merkel warned that the European Union should prepare for the prospect of a no-deal Brexit, and more Covid-19 cases in some parts of the world. Merkel said in a speech to European Parliament legislators in Brussels that progress in the Brexit negotiations was weak despite the accelerated efforts from both sides. "I will continue to push for a good solution, but we must also prepare for the possibility of a no-deal scenario," Merkel added.

Positive sentiments receded after the outbreak of the coronavirus in the United States exceeded the dark millstone of more than 3 million confirmed cases, and the World Health Organization recognized that there is an "emerging evidence" that the virus could be transmitted through the air. This could quickly return fear to markets, and thus buy the US currency as a safe haven.

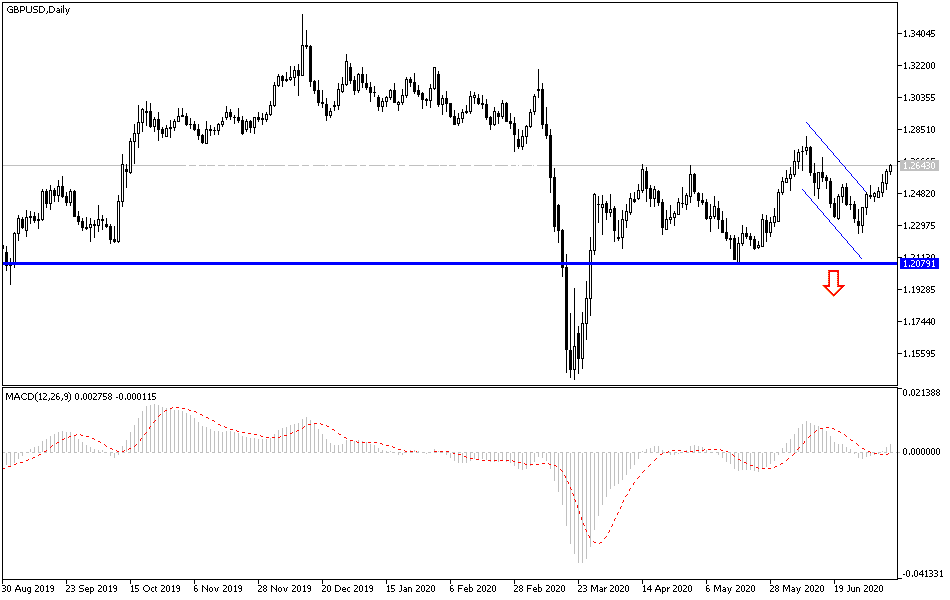

According to the technical analysis of the pair: On the daily GBP/USD chart, there is a clear break of the bearish channel, but we still warn that Pound gains are subject to a rapid collapse if the round of negotiations between the two sides of the Brexit this week, which takes place in London, fails. Therefore, the most appropriate resistance levels for selling might be 1.2675, 1.2760 and 1.2820, respectively. On the downside, there will be no return to move within the bearish channel, which remains standing on the long run, without the pair moving towards the 1.2330 support again.

The pair is not expecting any important British economic data releases today. From the United States, weekly jobless claims numbers will be released.