During last week's trading, the GBP/USD pair managed to take advantage of the decline in the USD and rebounded higher with gains reaching the 1.2529 resistance. Gains stopped at this point with a positive US job numbers for the month of June being better being than expectation alongside pessimism after the conclusion of a new round of negotiations between the two sides of Brexit without reaching an agreement. The performance last Friday was boring in the shadow of an American holiday to mark Independence Day. The pound rose 1.2% during last week's trading, its first increase since the opening week in June, but fell slightly by Friday after Prime Minister Boris Johnson indicated for the third time in a week that he was open to an Australian-style business relationship with the EU. This will be subject to the terms of the World Trade Organization and this is what some people intend to say when they use the term "No-deal Brexit".

Johnson reportedly told LBC Radio that this outcome of the trade talks would be a "very good option". The comments came after Chancellor Angela Merkel said last Wednesday that Europe needs to be prepared for the possibility of not reaching an agreement. Commenting on the latest performance, John Hardy, chief foreign exchange strategist at Saxo Bank, says: “The British pound may have the greatest potential to move if the Brexit negotiations see significant breakthroughs next week” and “Forex traders find it difficult to find performance stimulus out of the reflexive reaction to developments in risk appetite and avoiding it"

Johnson's comments may have been sufficient in the past to leave the pound groggy, but what strongly added to the pressure on the pound was the unexpected early termination of the negotiating round, confirming to the market the extent of faltered understanding between the two sides. For his part, British negotiator David Frost said, "We have completed our discussion ... and the negotiations were comprehensive and beneficial, but they also emphasized the important differences that remain between us on a number of important issues. We remain committed to working hard. To find an early understanding of the principles upon which the agreement is based. ” He stated that he had heard familiar complaints from the European side.

On the American side, the strength of the second Corona epidemic wave affects investor sentiment. For several days in a row, new cases of the disease increased, so the total number of COVID-19 infection increased to nearly 2.9 million last Thursday, and it may exceed 3 million cases early this week. The force of the second wave forced some US states to re-impose restrictions on activities while others delayed attempts to reopen, all with European countries continuing to reopen and believe their economies were enjoying a temporary recovery.

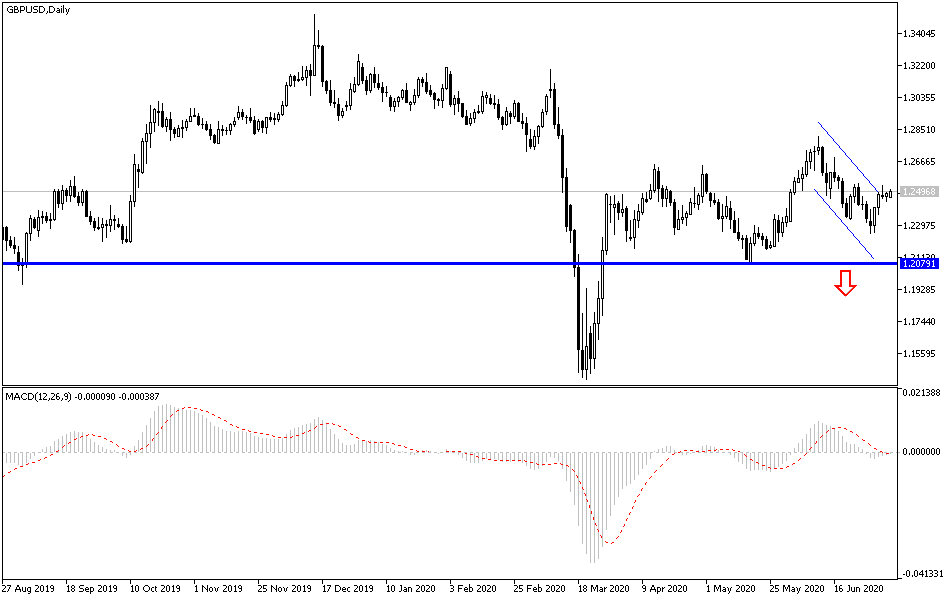

According to the technical analysis of the pair: On the daily chart below, the GBP/USD pair was unable to exit from its declining channel, and a breach of that channel may occur if the pair succeeds in moving towards the resistance levels of 1.2645 and 1.2800, respectively. On the other hand, the bears’ targeting, the 1.2320 support will remain the strongest to return to controlling the performance as is the case in the long term. In general, I still prefer to sell the pair from every ascending level, as the U.S economic performance is better compared to the British economy in the Coronavirus era, and with the Brexit file still faceing many obstacles.

As for the economic calendar data today: From Britain the construction sector PMI will be announced. From the United States the ISM services PMI will be announced.