For eight consecutive trading sessions, the GBP/USD pair was in an upward correction range, taking advantage of the decline in the US dollar. Gains were crowned by testing the 1.2952 resistance, the highest level in four months, before settling around the 1.2922 at the time of writing, and before announcing the decisions of the U.S central bank meeting led by Jerome Powell. The Pound may need fresh momentum through progress in the Brexit negotiations as Brexit negotiators hold informal talks this week before the next round of formal talks that will begin on August 17. This and a possible reworking of the UK's position in the main economic periodic table could help a fresh breakout for the GBP/USD.

This was after UK PMI results pulled out its Eurozone and U.S counterpart in July, challenging the popular perception that the British economy was lagging behind the rest of other global economies. If this dynamic is confirmed by other data, the pound might be ready for stronger gains, although many economists doubt that PMI surveys may be unreliable at the moment.

Analysts noted that, in May, the Composite PMI - which groups the manufacturing and services sectors together - in the UK was 30, indicating a possible sharp monthly drop in GDP. But official GDP data finally showed that the British economy recorded one of the largest monthly growth. Meanwhile, UK production and retail sales data indicated a turning point was reached in May, but the rise in the same month significantly exceeded the size of the GDP rebound.

At the moment, the sterling will react against other major currencies, as the UK economic recovery is proceeding at a rapid pace, and therefore the country will not necessarily lag behind its European neighbors, a scenario that has become a very common assumption among analysts. It is also comparable to the recovery in the United States of America, where the appearance of coronavirus cases has hindered recovery. On the other hand, the possibilities of a trade deal after Britain’s exit from the European Union continues to rise, even if the official line is that the two sides are still far apart.

On the economic front, the CBI Distribution Trade Survey confirmed that one of the key elements of the economy - the retail sector - has finally recovered from the recession caused by the COVID-19. In this regard, Joe Manimbo, chief market analyst at Western Union, says: “The pound has found Support also after the UK's consumer spending measure rose unexpectedly in July, providing evidence of a third-quarter recovery. Where the CBI monthly retail sales balance increased to +4 from -37 in June, the highest level since April 2019 and confirmed retail sales have now recovered to pre-COVID-19 levels”.

Meanwhile, CBI expects sales to remain close to seasonal standards next month.

The data confirm that the British economy is back in its feet and should calm fears that the UK was at risk of economically falling behind its peers in the Eurozone, a scenario that may have contributed to the recent Euro rally against sterling, according to some analysts. The Pound got a significant boost this week with a press report that confirmed that the European Union's chief negotiator, Michel Barnier, told the European Union ambassadors that he was confident that a trade agreement would be reached after Brexit.

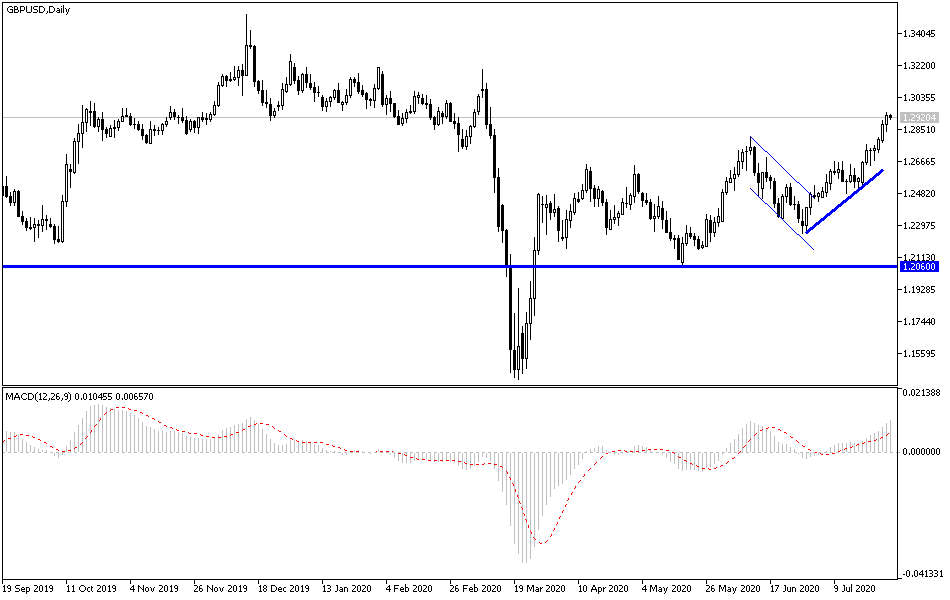

According to the technical analysis of the pair: On the daily chart, there is GBP/USD stability in the range of the last bullish channel and in the event of a breach of the 1.3000 psychological resistance, this will be important for stronger bulls control on performance for a longer period, but at the same time it will motivate investors to think about Profit-taking sales, with technical indicators heading towards overbought areas and with fears of a vague future for the post-Brexit future to date, so the closest resistance levels to the pair may now be 1.2985, 1.3065, and 1.3130, respectively. I still prefer to sell the pair from every upper level. On the other hand, there will be no stronger bear control over the performance without the pair moving below the 1.2500 support.

As for the economic calendar data today: From Britain, the money supply, net lending to individuals, mortgage approvals and the trade balance of goods will be announced. From the United States of America, the pending home sales figures and monetary policy decisions of the Federal Reserve will be announced, followed by the statements of its Governor Jerome Powell.